USDIndex rallied back up through the 107 handle to 107.51, while Yen dropped. Treasuries brushed aside hawkish comments from Bullard (voter) and Kashkari (non-voter), and it seems their commitment to fighting inflation boosted USDIndex, with the latter stating that he is not sure the FOMC can avoid knocking the economy into recession. KC’s George (voter) said she has yet to determine the size of a hike (dissented in June for a more tempered 50 bps hike, though she did go along with the rest of the FOMC and approved a 75 bp increase in July).

US Stocks managed modest gains at the close, Asian shares were left in limbo while European and UK stocks opened in the red after the data. German PPI inflation unexpectedly jumped to 37.2% y/y in July from 32.7% y/y in June. UK100 drifted at the EU open after the UK consumer confidence set at the lowest levels since at least 1974, as prices jump and the country is struggling with a series of strikes that have been hitting public transport. UK retail sales rose 0.3% m/m in July, a tad more than anticipated, but with the June number revised down to -0.2% m/m from -0.1% m/m, the annual rate was slightly lower. Turkey’s central bank cut its benchmark rate by 100 basis points.

- USDIndex rallied to 107.53, currently steady.

- Equities – US500 0.23% higher, while the US100 gained 0.21%, with the US30 up 0.06%. Nikkei & CSI300 flat but steady. Bed Bath & Beyond stock fell 44.6% in extended trading, adding to a loss of nearly 20% during Thursday’s regular trading session, as Cohen completes planned sale.

- Yields – 10-year was down about 2.2 bps to 2.875%. The curve steepened to -33 bps versus -38 bps Wednesday.

- Oil – lifted to $91.40. Current pull back to $89.

- Gold – fell to $1751.76.

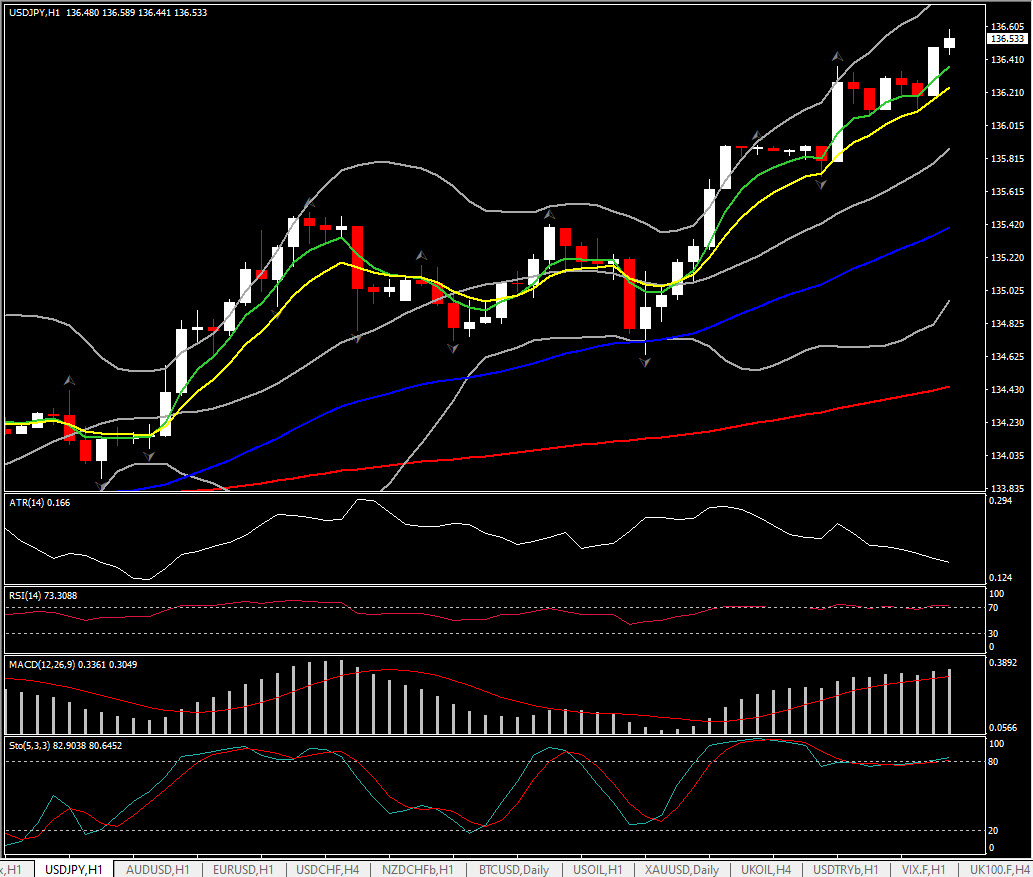

- FX Markets – Yen drops, with USDJPY at 136.45. EURUSD dropped to 1.0074 and Cable slumped to 1.1898.

Today – Canadian Retail Sales.

Biggest FX Mover @ (06:30 GMT) USDJPY (+0.47%) boosted to 136.56. Fast MAs aligning higher, RSI 73.89 & rising, Stochastic and MACD lines also up. H1 ATR 0.166, Daily ATR 1.70.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.