- USDIndex – Slumps as YEN & EUR spike. A brief rally back to 110.00, faded following ECB’s hawkish 75bp hike and similarly Hawkish comments from both Lagarde and Powell. Trades at 108.90. Comments from Japanese officials lift the YEN and weak Chinese inflation data exposes demand weakness.

- EUR – ECB moved by 75bp and suggested more significant hikes to come. EUR rallied back to through Parity and trades at 1.0065 now.

- JPY having rejected 145.00, combined comments from Suzuki, Matsuno & Kuroda lifts the YEN and the pair trades at 142.90.

- GBP 1.1500 support held yesterday and a follow through move today takes Cable to 1.1600 resistance.

- Stocks US stocks moved higher again as Dollar & Yields cooled (S&P500 4006) FUTS trade at 4011. Asian stock markets have rallied, and European FUTS are little changed, the FTSE100 up 0.3%.

- USOil recovered from $81.40 lows to $83.50 now on chatter of more supply issues. 20-day moving average sits at $90.00.

- Gold – also rallied to $1725 and holds the key $1700 at $1721 now.

- BTC – rallied higher as the ETH merge (offering a 99.9% reduction in power consumption!!). Spiked from $18.5k on Wednesday to $20.6k now.

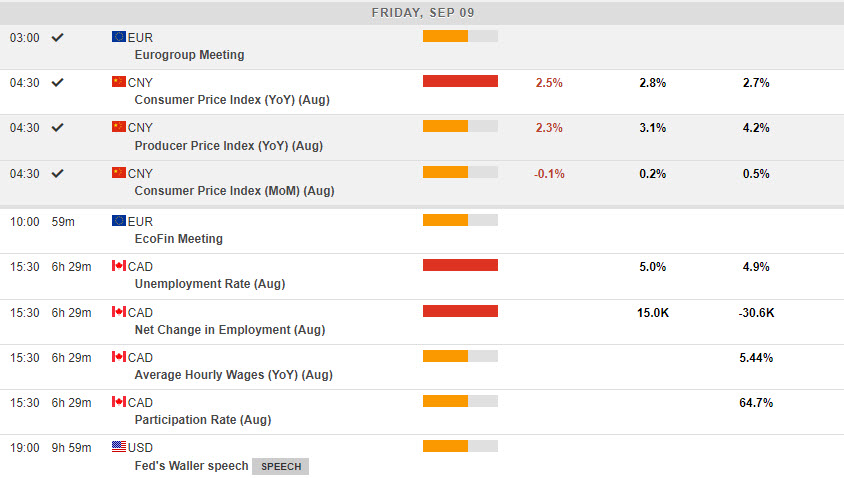

Overnight & Today – Canadian jobs report, EU energy meeting, Speeches from ECB’s Lagarde, Fed’s Evans, Waller & George.

Biggest FX Mover @ (06:30 GMT) AUDUSD (+1.31%). Continues to rally from a test of 0.6700 on Wednesday, trades at 0.6850 now. MAs aligning higher, MACD histogram negative & signal line positive & rising, RSI 79.22 & OB, H1 ATR 0.00142, Daily ATR 0.00850.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.