UK markets in turmoil as fiscal concerns mount. The new PM’s plan to revive spirits by launching a major round of tax cuts hasn’t really worked. Indeed, in the current situation, where growth constraints mainly lie with the supply side, last week’s mini-budget put the government on course for unsustainable finances and a standoff with the BoE and the result is that bonds and Sterling slid to the trough of 1985, in free fall.

UK assets are under pressure as investors continue to react to Friday’s mini-budget. The focus on tax cuts raised concern of ever more aggressive central bank action and a spike in inflation and fueled concern that government finances will increasingly become unsustainable. That the measures will be able to lift growth in the current situation seems unlikely, as the main challenges not just in the UK lie on the supply side. The FTSE 100 is currently down -0.8%, underperforming versus the DAX, which is down -0.1%, after a weaker than expected round of Ifo confidence readings. The 2-year rate jumped 52 bp to 4.4% this morning, the 10-year is still up 34 bp at 4.16%, with the inversion of the curve flagging recession risks. Cable saw a record low of 1.035 early in the session, but has since managed to move up to a still dismal 1.08. EURGBP is at 0.8993, after touching a session high of 0.93953 – a level last seen early in 2020.

The BOE raised interest rates by 50bp, while a new economic plan failed to ease concerns over the threat of a recession. GBPUSD lost around 3.5% on Friday, hitting a low of 1.0838. Usually, Sterling’s weakness supports the UK market, but this time the buyers gave up with more than 2.2% losses on the UK100. The index fell below 7000 for the first time in three months and closed at 7021. The sell-off was exacerbated by the GfK consumer confidence indicator which fell from -41 to -49, breaking the historical record since 1974. The CBI retail activity indicator fell from 37 in August to – 20 in September. Further decline of economic activity was faster than expected; the composite PMI fell from 49.6 to 48.4 against expectations of 49.0 after the Services index fell from 50.9 to 49.2.

This week will tell whether the UK is already in recession as the final reading of second quarter GDP is due. The latest reading was -0.1% so a small positive revision could be enough to halt a technical recession, but it hasn’t changed the market’s skepticism.

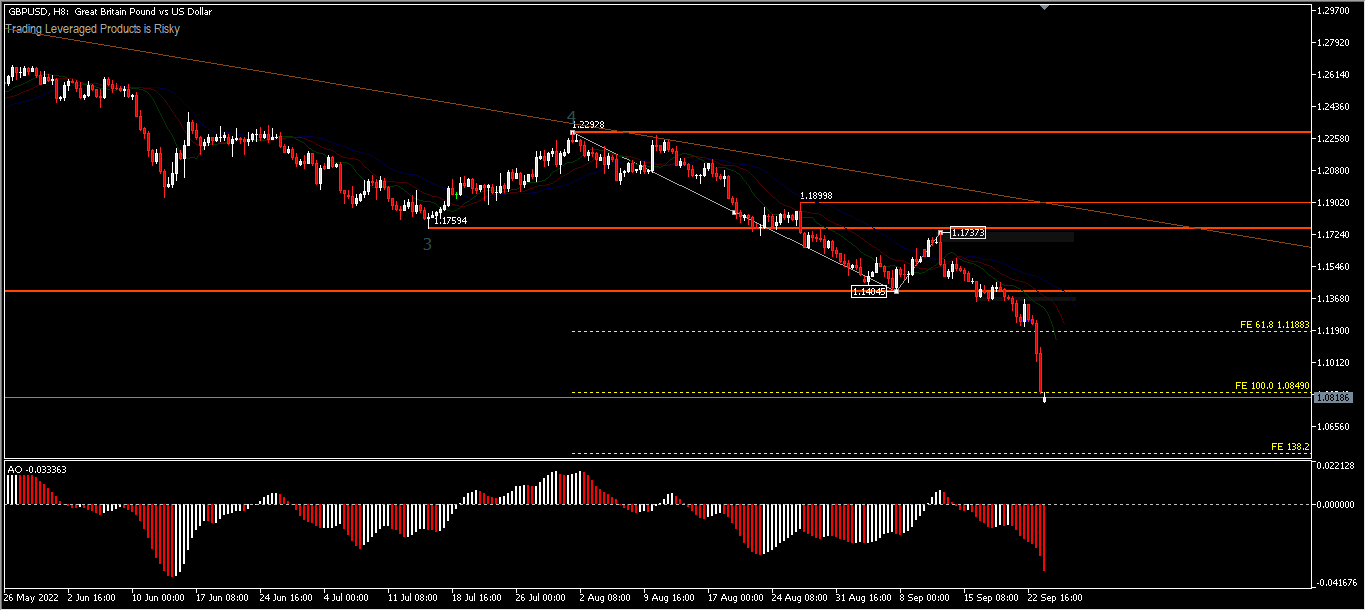

Technical Overview

GBPUSD – Downtrend hit a low of 1.0838 last week and in today’s open shifted again to the downside. In the near future there is no sign of a low point. Long term continued declines still leave key 37-year support at 1.0520 (Feb 1985). However, if projected with Fibonacci Expansion, from the draw 1.2292-1.1404 and 1.1737 the next possible target is at the FE1 38.2% level around 1.0500, and FE 161.8% (+/-1.0300) as Friday’s decline has arrived at FE 100% (1.0850).

The movement to the upside will be temporarily limited by the support at 1.1404 which is now resistance before making another decline. However the outlook will remain bearish as long as the resistance at 1.1737 remains intact.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.