Sterling has seen sharp falls in most pairs, some with runs of over 1000 pips from their highs and some with 800 pips today alone. This is in the wake of the mini-budget reported on Friday, which is casting doubt on the UK’s economic future and causing investors to question the decisions of its new government and the BoE.

Today, the country’s largest mortgage lenders have suspended and withdrawn new mortgage deals thanks to rising costs for lenders due to the new tax cut announced last week by the new finance minister, Kwasi Kwarteng, which in turn pushed bond yields higher.

This is in addition to several disappointing economic data which you can read in this previously published article.

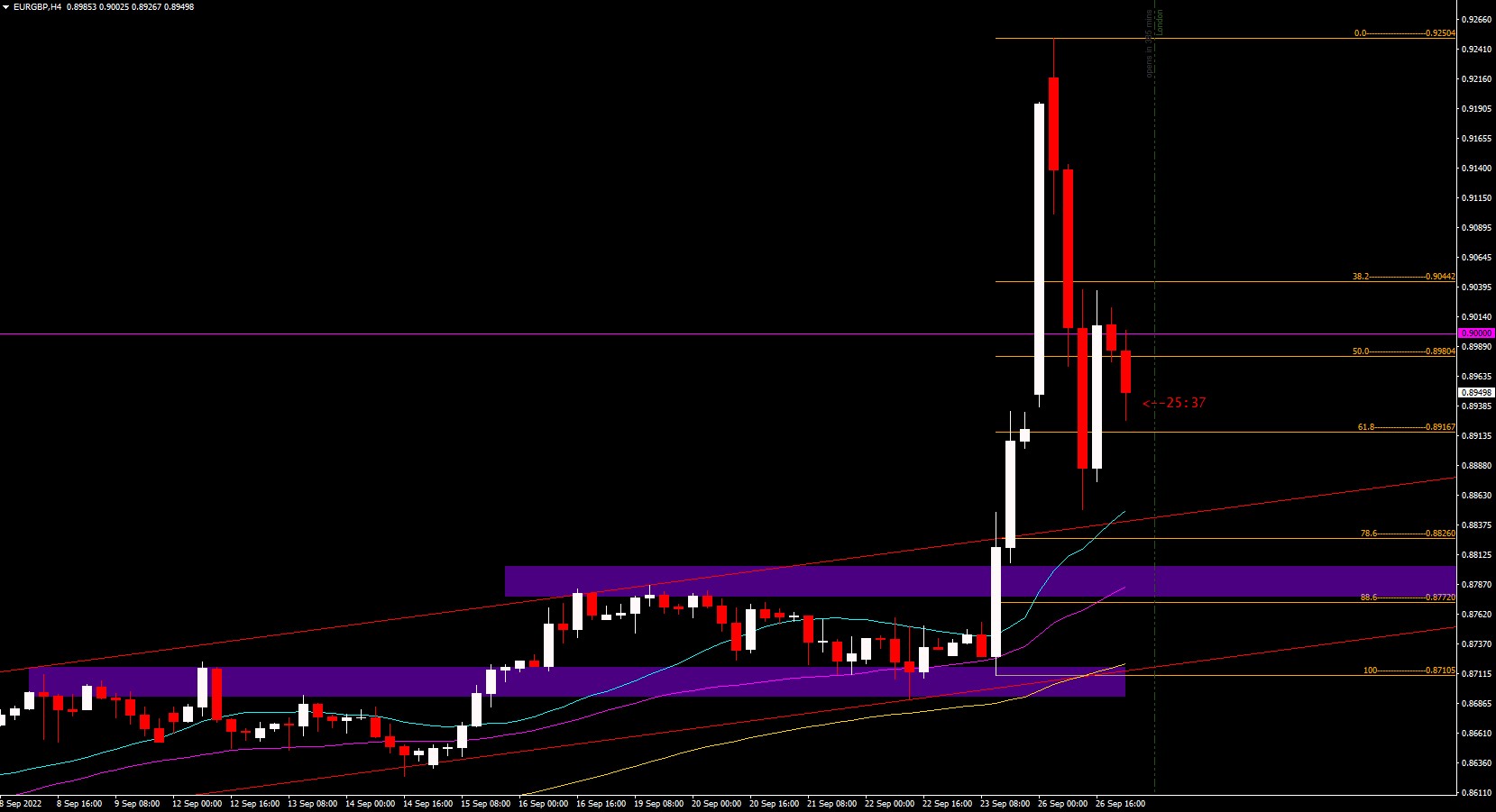

EURGBP – $0.8944

The EURGBP price has soared from the lows of 0.8686; after being range bound for several days in a bullish channel, it rose more than 500 pips and the price made a high of 0.9254, testing the Sep 2020 highs. The price has trimmed gains testing the 61.8% Fibo level at 0.8906 but closing just below the psychological level of 0.9000 which will act as a buy or sell signal.

The next highs are the March 2020 highs at 0.9496 followed by the October 2016 highs. Supports are at the 20-period SMA (H4) at 0.8850 along with the broken channel guideline, followed by the 88.6-78.6 range at 0.8753-0.8809 along with the 50-period SMA (H4) at 0.8785. Lows at 0.8689. 200-period SMA (H4) is at 0.8602. RSI at 55.76 after reaching 89.23.

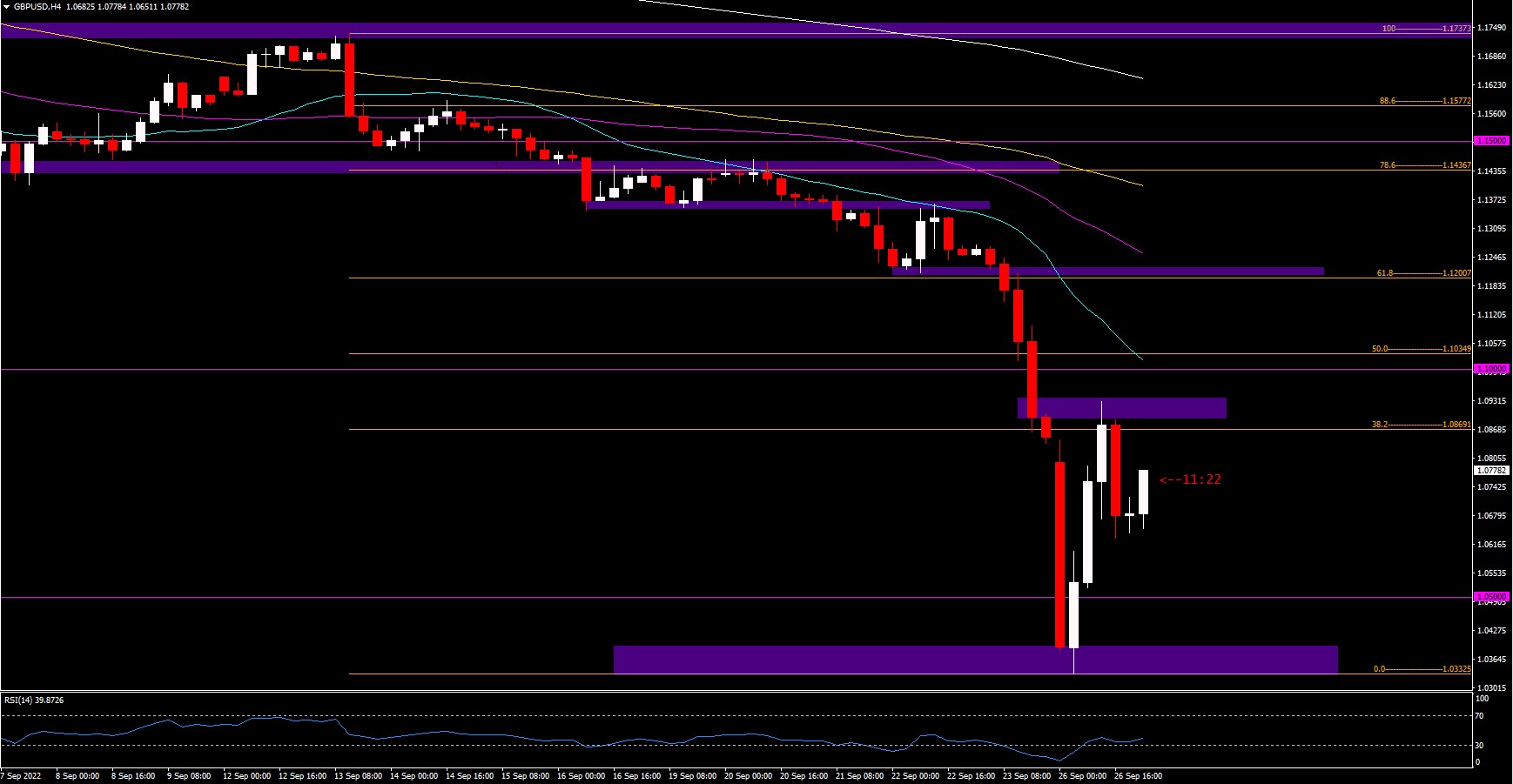

GBPUSD – $1.0773

The GBPUSD price has accelerated its fall from the highs of 1.1737, dropping over 1400 pips and breaking the modern day lows of February 1985 at 1.0520, and trading at levels not seen since the Bretton Woods monetary system was abandoned in February 1972, making new all time lows at 1.0333.

Resistance is at the 38.2% Fibo level at 1.0869, followed by a range from the 20-period H4 SMA which crossed the 1.10 level to the 50% Fib. at 1.1035 and then the 61.8% Fibo along with the psychological level at 1.1201 and the 50-period SMA at 1.1239. Regarding supports, there is only the current historical low which is likely to be broken and the psychological levels up to parity at 1.00 which is the key level in focus. RSI at 39.87 after being oversold.

GBPAUD – $1.6610

The GBPAUD price fell sharply lower after ranging from 1.7100-1.6895, retracing more than 1000 pips lower and making lows at 1.5915, prices not seen since March 2017.

Current resistances are at the 61.8% Fibo level at 1.6650, the 20-period SMA at 1.6746, followed by the 88.6% Fibo level at 1.6968 near the base of the range and the psychological level of 1.7000. Support levels after the current range of 1.5915-1.6000 are at 2016 lows at 1.5361, 2013 lows at 1.4379, 1985 lows at 1.3606 and historical lows are at 1.2781 from 1976. RSI at 44.40 flat after recovering oversold.

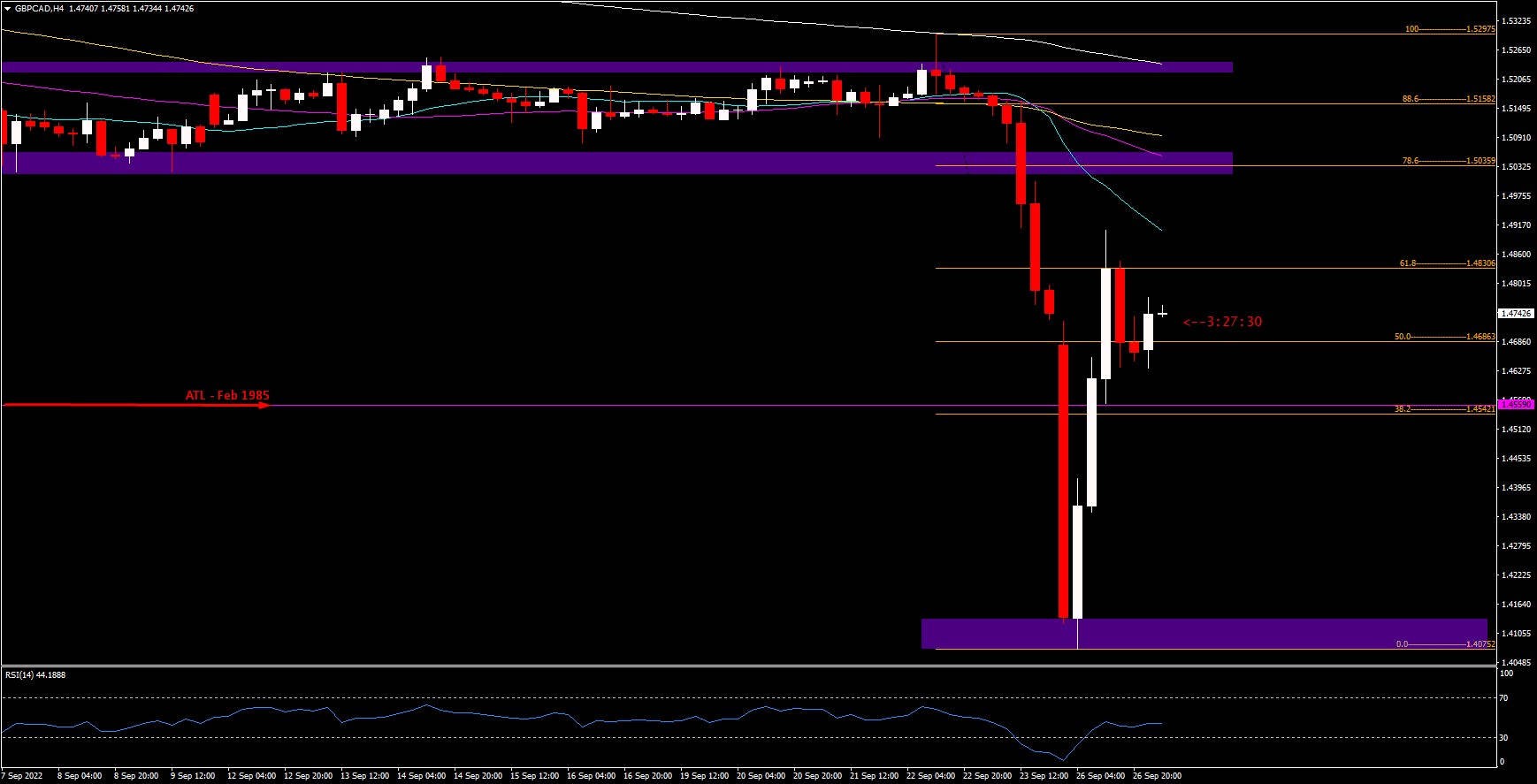

GBPCAD – $1.4742

The GBPCAD price made new all time lows at 1.4075 after falling more than 1200 pips from multi-day range highs at 1.5297, breaking past all time lows at 1.4559 of February 1985. The price has recovered the historical lows of 1985 and has resistance at the 61.8% Fibo at 1.4831. The 20-period SMA is at 1.4905, the base of the range at the 78.6% Fibo is at 1.5000-1.5036.

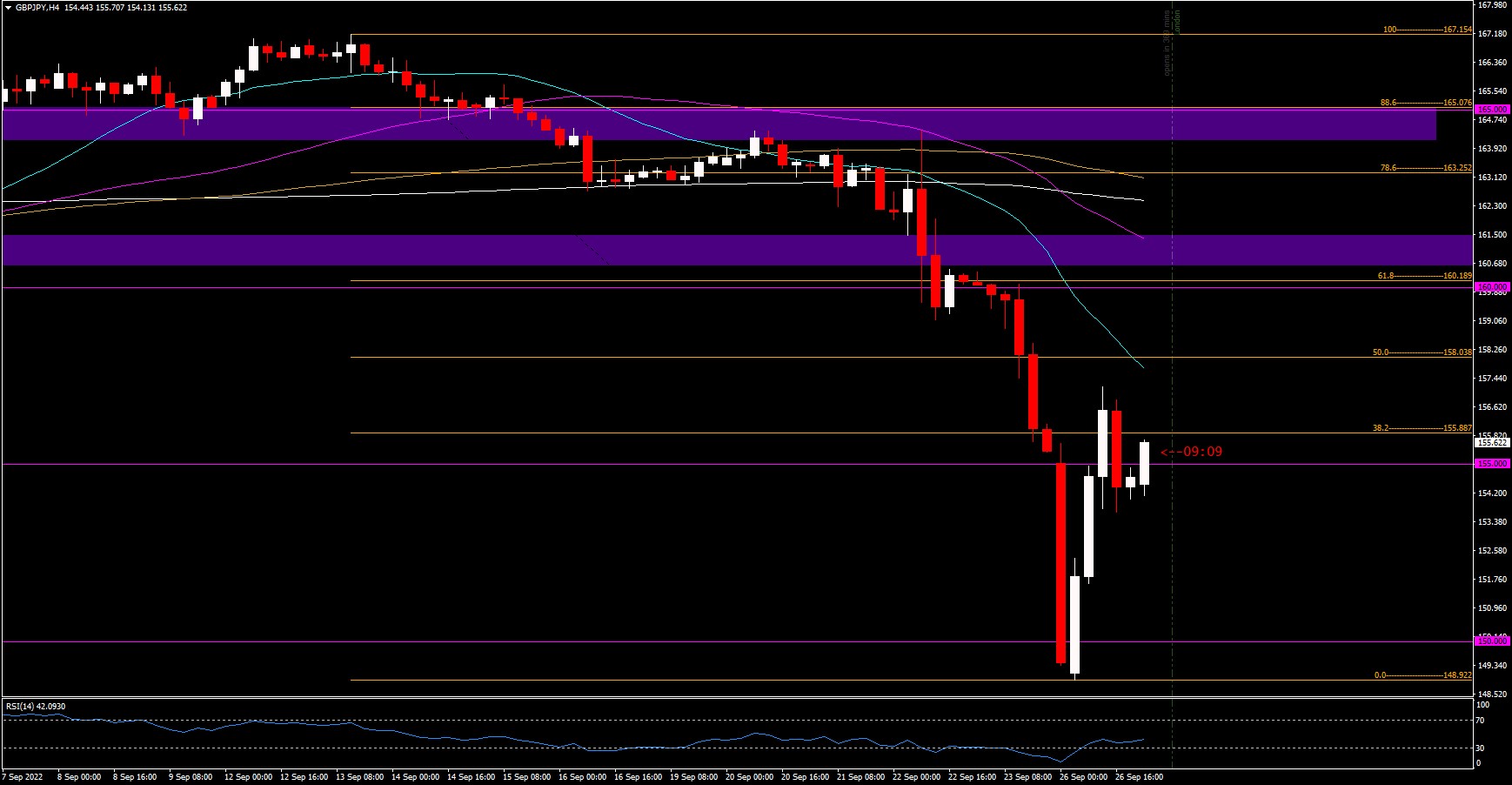

GBPJPY – $155.574

The GBPJPY price accelerated its fall from 167.15 highs to 148.92 lows, a price not seen since July 2021. The price has recovered from the 150.00-155.00 level and remains below the 38.2% Fibo at 155.88. Resistance is at the 20-period SMA at 157.36, the 50% Fibo at 158.03, and the psychological level of 160.00. Support is at 148.92-150.00 area. RSI flat at 41.91 after recovering oversold.

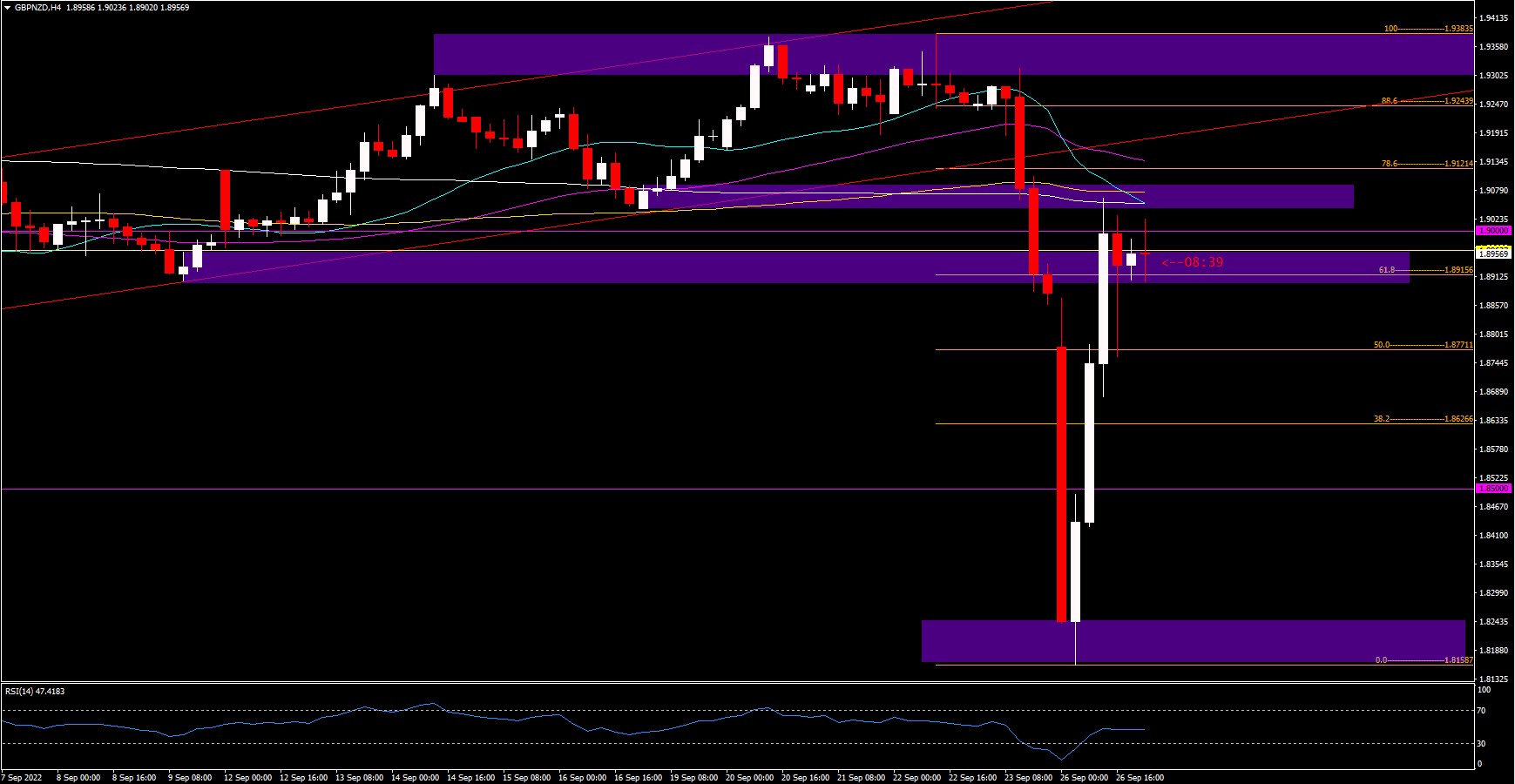

GBPNZD – $1.8960

The GBPNZD price was in a bullish channel since early September where it made a high at 1.9380 but failed to hold the level and fell sharply over 1200 pips to a low at 1.8158 (2018 lows), but trimmed losses at the close of today’s session. Resistances are at the psychological level of 1.9000 which can be used as a watershed between buys and sells, followed by the 20-, 100- and 200-period SMA.

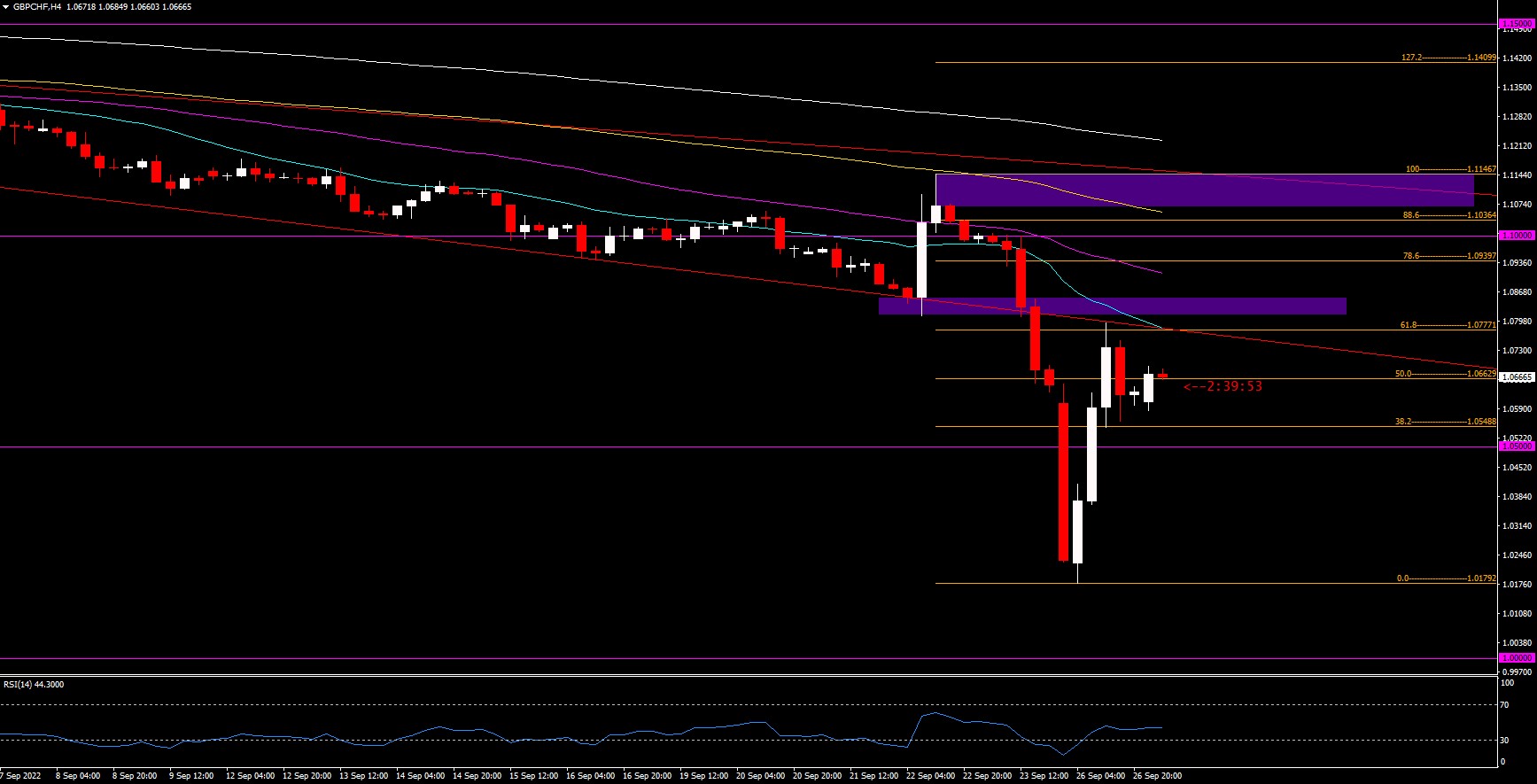

GBPCHF – $1.0667

The GBPCHF price accelerated its downtrend for the year and fell over 900 pips breaking last year’s lows at 1.1118 and making new lows at 1.0179, prices not seen since November 1976.

Resistance is at the 61.8% Fibo and 20-period SMA at 1.0777, followed by the 50-period SMA and 78.6 Fib. at 1.09110-1.093397 and the psychological 1.1000 level. The break of the latter leaves no support apart from today’s new low and the 1.0500 level.

Click here to access our Economic Calendar

Aldo Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.