Sterling tumbled following the early announcement of the new government’s mini-budget. There was speculation that the pound would fall below parity against the Dollar, like the Euro. However, the Pound found its footing against other major currencies as the Bank of England stepped in with an emergency intervention to buy long-term bonds and calmed market sentiment.

Yesterday (October 3), British Chancellor of the Exchequer, Kwarteng, said the government would cancel the 45% cut in the top income tax rate – further supporting the Pound. Under the conditions of the current environment, the large-scale tax cut plan without capital support may do more harm than good, and threats such as rising borrowing costs and deepening fiscal imbalances will damage the credit rating of the UK’s sovereign debt. Rating agency Moody’s is scheduled to reassess the UK government’s credit rating on October 21. Earlier, another rating agency, Standard & Poor, had downgraded the UK’s credit rating from “stable” to “negative”.

Today, the Reserve Bank of Australia announced a 25 basis point increase in interest rates in its interest rate decision to 2.6% (the highest since August 2013), lower than market expectations of 2.85%. This is the central bank’s sixth rate hike in six months. The committee said further rate hikes will continue to “achieve a more sustainable supply-demand balance” for some time to come, and the magnitude and timing of rate hikes will be determined by economic data. The Committee also expects inflation to remain stable over the medium term. In short, the heightened recession risk has prompted the central bank to turn cautious and slow the pace of rate hikes, possibly pausing as future demand weakens and inflation peaks.

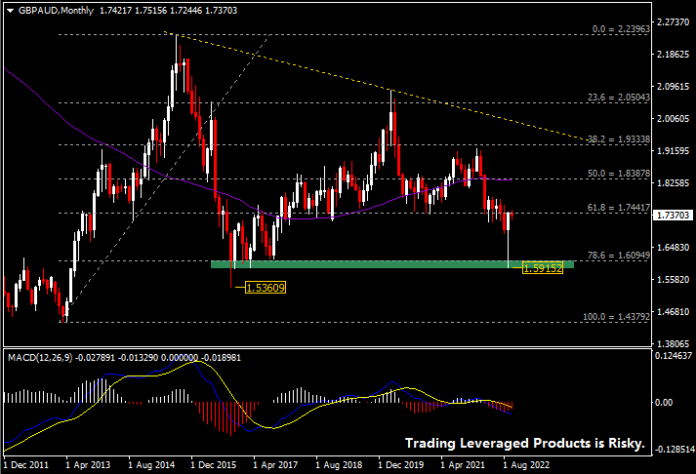

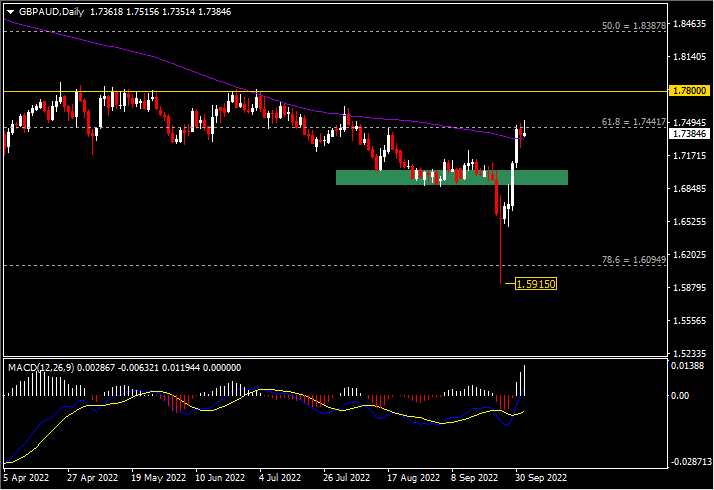

Technical Analysis:

Last month, GBPAUD dipped below 1.6000 for the first time since March 2017 before stabilizing and recovering to settle at 1.7430 . After the RBA interest rate decision, the currency pair continued to test the 1.7500 mark, which is 61.8% of FR extending from the low in March 2013 to the high in August 2015, and it is also a key resistance in the near future. A successful breakout could open the door to further gains for the bulls, with next resistance at 1.7800, 1.8400 (FR 50.0%) and 1.9300 (FR 38.2%). On the other hand, the 100-day SMA is near-term dynamic support. A candle close below this SMA may signal a build-up of bearish power and the pair may push down to the minor support area of 1.6870-1.7030. A break below this area would extend sellers to the next support at 1.6100 and last month’s low of 1.5915.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.