Due to continued market anxiety, the USA30 has been in a strong downward trend over the past few days. The majority of indices including the VIX Index, put and call options and market momentum are at a very high level of fear.

When the “fear and greed” VIX Index enters the extreme fear zone, the Dow Jones often drops. Investors are worried about economic conditions, the overly strong US Dollar and earnings reports. Thursday’s American inflation report and quarterly earnings will be the main drivers for the USA30.

Despite the fact that petrol prices fell in September, markets expect that the national inflation rate will remain high. At the same time, major financial institutions including Citigroup, JP Morgan and Wells Fargo will this week release their quarterly results.

This year, most of the Dow Jones components have been losing money. Companies such as Intel, Nike, Salesforce, Disney and 3M were among the worst performers. All of these stocks have lost more than 40% in value.

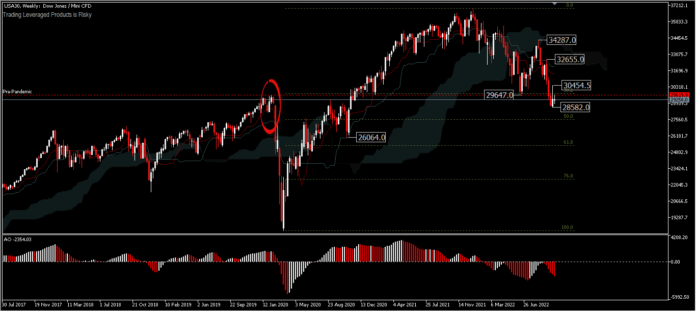

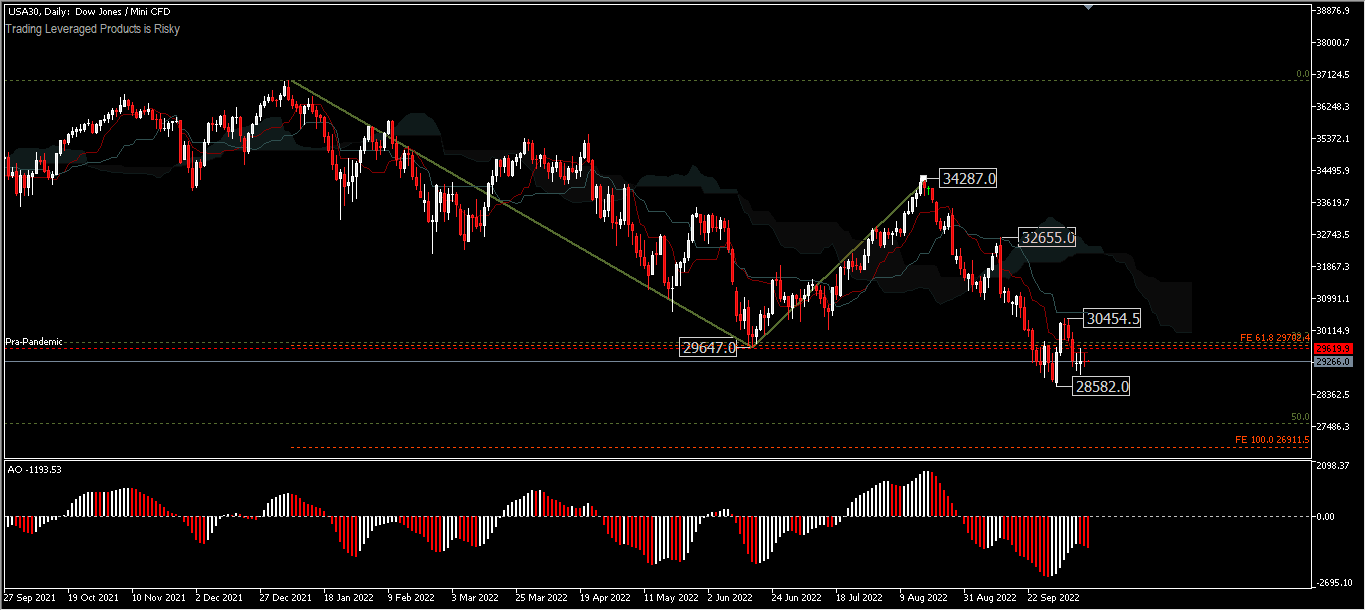

The USA30 has been trading in a tight range all week, below the 29,647 support which is close to the pre-pandemic high of 29,583. The USA30 has lost more than -14% from its August peak and lost more than -20% from its historical peak earlier in the year. Higher inflation reports could pressure the index to test the 50%FR retracement level around 27,560 or about 5% off the current price. Meanwhile, a near-term rebound will have to surpass the minor resistance of 30,454, otherwise the bears’ dominance will remain in place. The technical indicators all validate a downside move.

USA30, Daily

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.