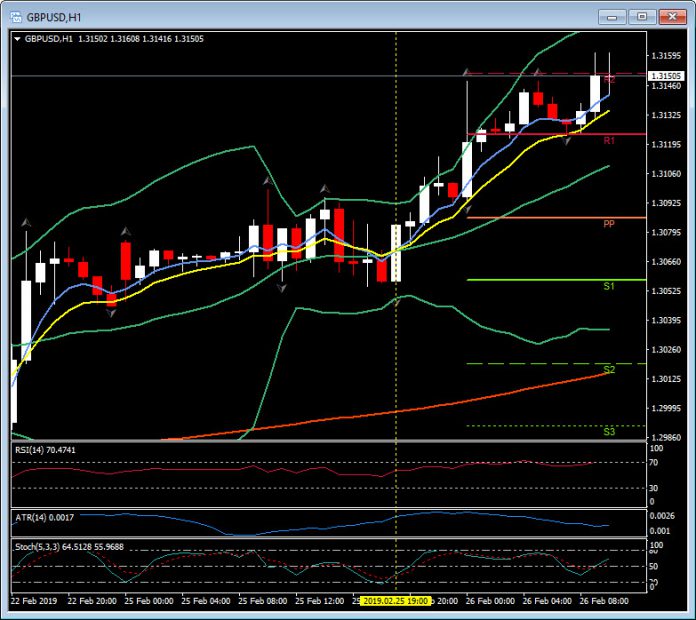

GBPUSD, H1

A little over three years ago, Sunday February 21 2016, Boris Johnson, the then Mayor of London became the figurehead of the Leave Campaign when he announced he would not support Prime Minister David Cameron in campaigning for a Remain vote in the Referendum that was four months away.

It was a political decision that he assumed offered him the best chance of succeeding Cameron and becoming Prime Minister, should the Leave vote prosper in June. He was the natural and charismatic leader to front the Leave campaign.

GBPUSD immediately dropped over 2% on the open the following Monday open and closed the week at 1.3870, down some 3.7% for the week. The Leave vote secured victory, but by July a key Johnson ally and supporter (Michael Gove) withdrew his support, following Cameron’s resignation. Mayor Johnson did not even submit his nomination to follow Cameron. Theresa May filled the void and was elected (unopposed) leader of the Conservative Party and Prime Minister.

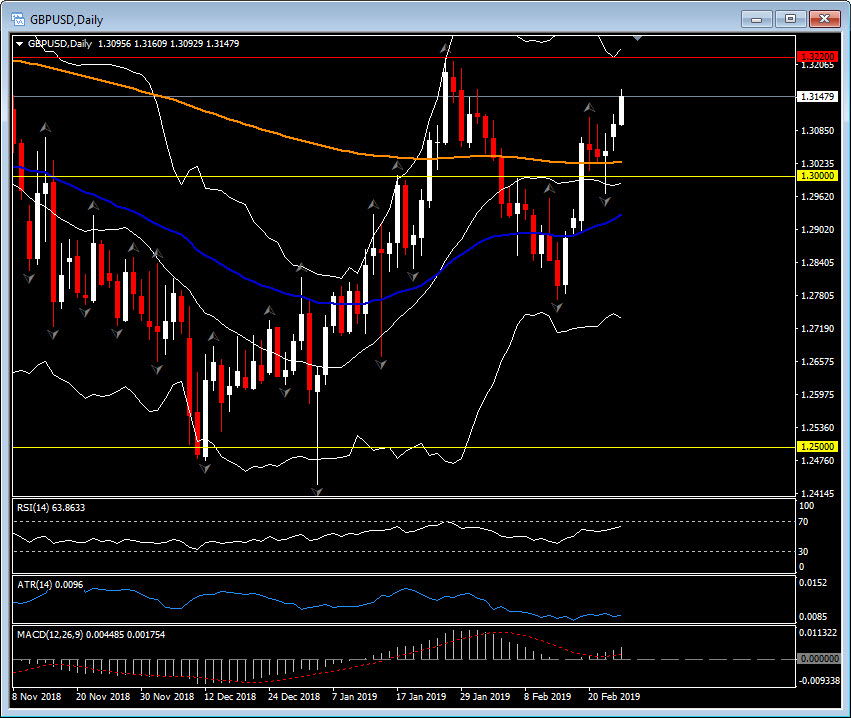

Fast forward 3 years and with less than 5 weeks to the scheduled exit from the EU, UK Prime Minister May has pivoted. She will reportedly now offer members of parliament the chance to delay the Brexit process beyond the March 29 deadline. The BBC reports that about a dozen Europhile ministers have threatened to resign unless this happens. Ministers Richard Harrington, Claire Perry and Margot James, wrote in the Daily Mail today saying that a delay “would be greeted with relief by the vast majority of MPs, businesses and their employees”, adding that the UK risked being “swept over the precipice” in the event of no deal. The government position will be worked out at a cabinet meeting due this morning in London, after which May will make a statement to the Commons. May’s pivot is significant as it greatly reduces the odds for there being a no-deal Brexit scenario. Until now she had been utilizing the threat of no deal as a political persuader while running down the clock to March 29. This is no longer the case. The prime minister’s move follows news that the Labour Party would back calls for a second referendum on EU membership if parliament rejects its alternative Brexit plan. There doesn’t at this time appear to be sufficient support in the House for a new referendum, though this could change quickly in the event that a consensus for a deal fails to materialize. Sterling has rallied on the latest developments, with 1.3220, the 2019 high from January 25, the next key resistance area. The daily pivot sits down at 1.3086, the 200-day EMA at 1.3025 and the 20-day MA & S3 at 1.2985.

Markets will be sharply focused on May’s House address later for confirmation of her shift.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.