USA500, H1 & Daily

US equities are mildly lower amid a bout of risk aversion that has come amid rising tensions between India and Pakistan after the two nations shot down each other’s jets. The USA30, USA500 and USA100 are all down 0.2% in US pre-market futures trading. European bourses are lower as well, with the Euro Stoxx falling 0.2% and the FTSE 100 contracting 0.7%. Asian shares were mixed, with Japan’s Nikkei 225 climbing 0.5%, but Hong Kong’s Hang Seng marginally lower at -0.05% and China’s CSI 300 slipping 0.2%. In earnings news, Best Buy beat while Lowe’s disappointed somewhat. Results from HP and Rio Tinto are due later. Also there is the second day of Testimony from Governor Powell, Weekly Oil inventories (currently up close to 2% from the Trump tweet fall yesterday), and Pending Home Sales.

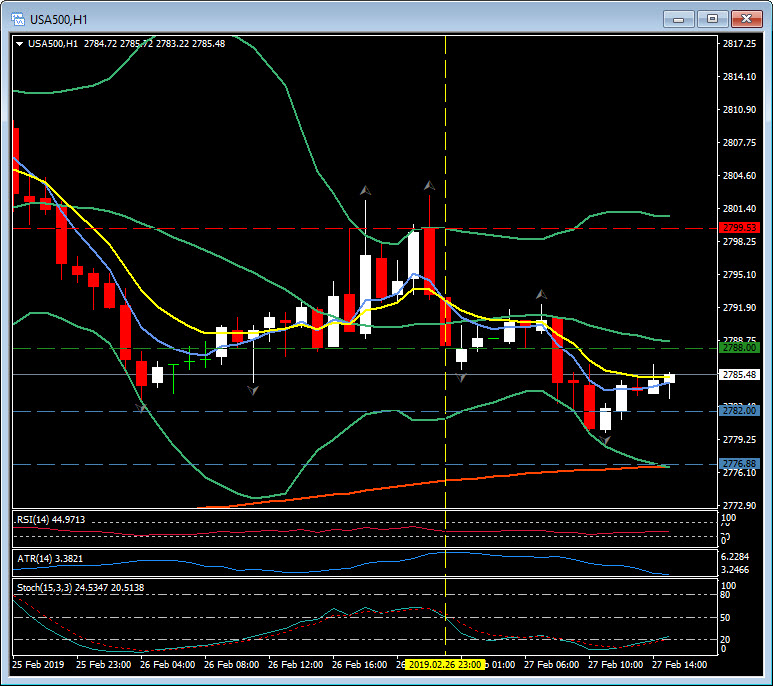

USA500 triggered lower on the close last night on the Crossing EMA strategy, with a high ATR of 6 full points. The strategy produced target 1 at 2782.00 and target 2 at 2776.60, coinciding with the lower Bollinger band area and 200-period EMA. The latest turn in the market was below the key psychological 2800.00 level at 2799.50 where the Stop Loss would have been placed. The higher time frame daily chart shows the strong uptrend in the market from the breach and break of the 20-day moving average (January 7) at 2555.00.

The Daily trend-following strategy with the same ATR-based target levels triggered January 7. T1 was achieved January 17 (76 points) and T2 (192 points) February 13. The daily trend remains intact and robust, above the 200-day EMA and with the 20 MA acting as support. A potential Golden Cross (the 50-day moving average crossing the 200-day moving average from below) is forming on the EMAs. A breach and break of the psychological 2800 level needs to hold for the next leg higher. Beyond S3 at 2820, the next key Resistance levels are 2850, 2900 and the all-time high from September at 2940. A break lower below the 20-day MA and S3 at 2750 would suggest a pause in the uptrend and a possible consolidation phase.

Join our live Webinars every, Tuesday, Wednesday and Thursday to learn how to apply these strategies and many more trading techniques.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.