FX News Today

- US bond yields recovered in the Asian session, recovering some of the losses seen in the wake of softer US inflation data yesterday, which underpinned expectations of a patient Fed.

- However, Asian bond markets rallied and yields headed south, led by a -7.1 bp drop in Australia’s 10-year rate after weak consumer confidence data.

- Asian stock markets headed south after a narrowly mixed close in the US, as disappointing machinery orders out of Japan and the renewed defeat of May’s Brexit deal in London weighed on confidence.

- Topix and Nikkei closed with losses of -0.84% and -0.99% respectively, and the ASX lost -0.22%. The Hang Seng is currently down -0.49%, the CSI blue-chip index down -0.43% and Shanghai and Shenzhen Comps down -0.58% and -1.52% respectively.

- US futures are also in the red, with the Dow Jones mini down 0.2%.

- The front end WTI future is trading at USD 57.18 per barrel.

Charts of the Day

Technician’s Corner

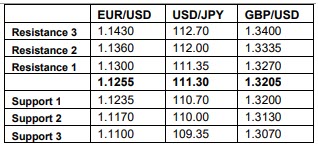

- EURUSD has continued its rise after the weaker than expected US inflation data and despite the rejection of the Brexit agreement. The pair has immediate Resistance at 1.2922, the point of the 200HMA, with another Resistance point at 1.13, far from the next 1.1256 Support level.

- GBPUSD has remained relatively flat, despite the Brexit agreement rejection, trading around 1.308, but remaining above the 1.3067 Support, with the MACD and Stochastics indicators giving mixed signals. Immediate Resistance is at 1.3132.

- XAUUSD gained significantly after global uncertainties rose crossing the 1300 mark and pushing above the 200HMA yesterday. The MACD and Stochastics indicators are both showing negative signals.

- USDJPY continues to move slightly upwards, albeit at a slower pace with immediate Resistance at the 200HMA level at 111.57, while Stochastics and the MACD are not providing clear guidance.

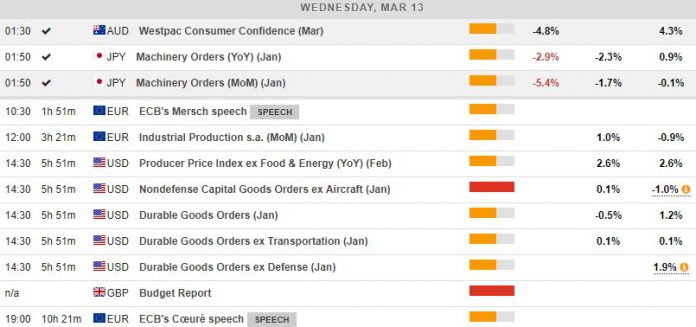

Main Macro Events Today

- Industrial Production (EUR, GMT 10:00) – Industrial Production is expected to have increased by 1% m/m in January, compared to a reduction of 0.9% in December.

- Producer Price Inflation (USD, GMT 12:30) – US PPI is expected to have stood at 2.6% m/m, the same level as in January.

- Durable Goods ex Transportation (USD, GMT 12:30) – Durable Goods Orders growth is expected to have stood at 0.1% in January, the same level as in December.

- Brexit Vote (EUR, GBP, N/A) – The UK Parliament will vote on whether a no-deal Brexit can be taken off the table, even though the possibility of a no-deal cannot be ruled out if no other agreement is reached.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.