Leading indicators come in two types: the first refers to those giving out information on how the economy is doing at the moment, like PMIs and sentiment indices, and the second refers to those giving out hints about the future. The second type, despite its importance, is often overlooked as it usually does not come in ready-made form and requires some additional work.

Despite this, the leading indicator of the second type that we will deal with in this post requires a minimal amount of work. The reason is that it’s already in an easy-to-use format and it can be readily found on the web. This leading indicator is none other than the monthly unemployment rate, which can be easily located on the Federal Reserve Database.

Why should one care?

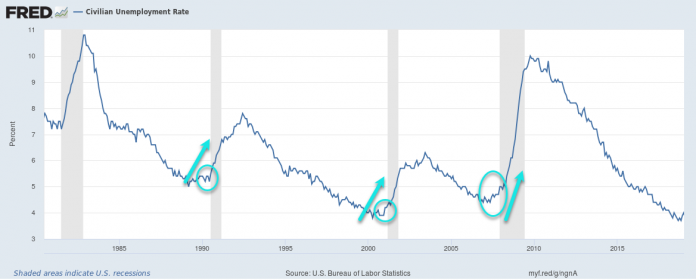

Simply put, the unemployment rate is a good predictor of recessions. Over the last three recessions, the unemployment rate moved higher in the period prior to the downturn, while it moved downwards between recessions. Why do we just focus on the last three recessions when it appears to work for at least one other as the image above suggests? The answer is that in the 1970s and 1980s recessions were not domestically-originated events but were more related to external (oil price) shocks. Thus, the comparison would not be correct.

Note that when extracting a recession signal from the above indicator it does not mean that traders should panic every time the unemployment rate increases a bit. These occasional, one-off events will likely not be correlated with the overall movement but, as the figure shows, they will always be present in the data. Furthermore, it is usually the case that unemployment rises in the aftermath of a crisis, and thus this should not be considered as a sign for further deterioration, but as a signal for a labour market delay in adjustment.

What does the indicator currently suggest?

Simply put, the indicator does not suggest, at the moment, any signs of deterioration in the US economy, as increases appear to have been just one-off events. At the moment, despite the unemployment rate increase to 4% in January, likely the result of the US government shutdown, the rate is at lows, with no signs of moving upwards. Thus, there does not appear to be any recession indication, at least at the moment. Still, given that the rate has been fluctuating in the 3.8%-4% area for a while, perhaps it could be interpreted as a sign of a slowdown.

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.