European stock markets have moved down from early highs, with the DAX now slightly in the red, after the Ifo institute lowered its growth forecast for the German economy to just 0.6% this year and the Economy Ministry also admitted that growth remains lacklustre in the first quarter of the year. Final February Eurozone CPI, meanwhile, was revised down to 1.5% y/y from 1.6%. Markets initially got a boost from yesterday’s votes in London where MPs voted against a no-deal Brexit scenario, but after German growth concerns and warnings from the EU that it is not sufficient to vote against a no-deal scenario to rule out such an event markets quickly started to move down from highs. As of 11:16GMT the GER30 is down -0.05%, while the UK100 is up 0.44%.

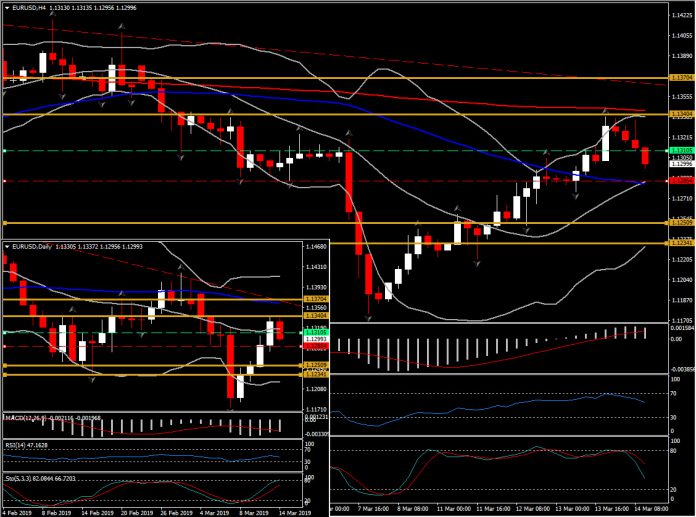

EURUSD has settled in the lower 1.1300s, off yesterday’s nine-day high at 1.1338, which was seen after soft US PPI figures. The PPI data followed benign CPI data for the same month, released the day before, which have maintained the Fed-on-hold view. The Brexit-related surge in the Pound this week has helped buoy the Euro against the Dollar and other currencies.

The overall bearish outlook of EURUSD is still being retained since the September 2018 peak, anticipating the US economy to hold up better than the Eurozone. Last Friday’s US jobs report disappointed a lot at the headline level, but components were much better while the low jobs number can be largely attributed to an outsized weather hit through the BLS survey week, especially in the goods sector overall and construction in particular.

EURUSD broke below the 20-day SMA and is currently retesting the 1.1285 Support level which coincides with the 20- and 50-period SMA intraday. Next Support levels come at 1.1250 (December -February Support) and 1.1220-1.1234 (February low and lower Bollinger Band edge). Resistance remains at yesterday’s peak, at 1.1340 and at 50-day SMA, i.e. 1.1370.

Meanwhile the 20- and 50-period SMA have confirmed a bullish cross in the 4-hour frame, suggesting positive bias in the short-term. This bullish cross along with the flat 200-period SMA suggest that the pair could hold a floor at 20-period SMA or enter a ranging market intraday.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.