FX News Today

- Asian indices broadly higher amid fresh hopes on the US-Sino trade front.

- BoJ kept policy unchanged as expected, exports seen weighing on outlook.

- Trump-Xi summit pushed back to end of April, USTR cited “major issues”.

- Xinhua news agency reported that Chinese Vice Premier Liu He had a telephone conversation with US Secretary Mnuchin and US Trade Representative Lighthizer and that further substantive progress on trade talks has been made.

- UK lawmakers backed a delay to the Brexit process.

- PM May set to ask for a short term extension if her Brexit deal gets through by March 20, i.e. before the next EU summit, or a long term delay if not.

- European stock futures are moving higher in tandem with US futures.

- WTI future is trading at USD 58.76 per barrel.

- EURUSD softer after posting 9-day high at 1.1341 following soft US PPI

- USDJPY lifted to 1-week highs above 111.70; Yen wary of BoJ dovish tone.

Charts of the Day

Technician’s Corner

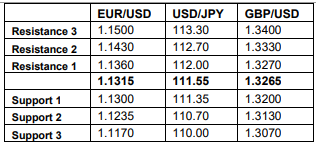

- EURUSD found a floor at 1.1310 after rebounding from 1.1290 and overall remains in an uptrend. The same positive bias held intraday as well, with MAs pointing upwards and RSI sloping above 50.

- GBPUSD is trading in a descending triangle. Support is held at 50-period SMA at 1.3225 and Resistance at 1.3265. A break of these barriers could suggest the near term direction for Pound.

- XAUUSD rebounded from 1297 and broke the 1300 barrier earlier. Upper Bollinger bands are extending higher while the asset has regained more than 60% of the losses seen yesterday, turning the negative near term outlook to a positive one.

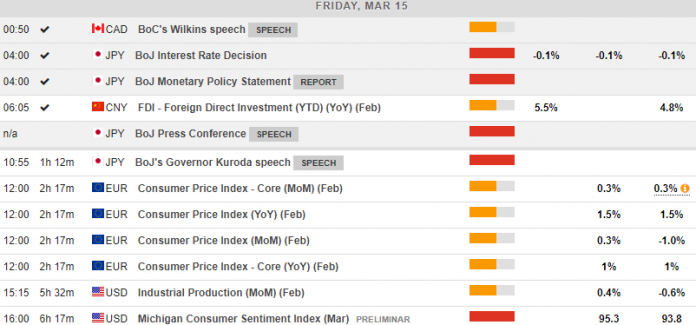

Main Macro Events Today

- BoJ Kuroda Speech – Due to speak at the B20 Tokyo Summit.

- EU Final CPI – The overall Eurozone HICP is anticipated at 1.5% y/y.

- Canadian Manufacturing Sales – the Manufacturing shipment values are expected to edge 0.5% higher in January after the 1.3% drop in December.

- Michigan Sentiment and Industrial Data– Industrial production is projected to rise 0.4% in February, after a 0.6% drop in January, while capacity utilization should rise to 78.4% from 78.2% in January. An early March Michigan Sentiment reading is expected of 96.0 , up from 93.8 in February, but well below the 14-year high of 101.4 last March.

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.