Crude oil managed to rally slightly yesterday, supported by rumours of production cuts by OPEC+ masking concerns of demand shortages, as China is still implementing COVID-19-related activity restrictions. USOil closed higher in the $78.83 per barrel area, after briefly touching the $79.60 per barrel area and trades above the key $80.00 level today (Wednesday) at $80.20.

A slightly stronger Dollar did not weigh on oil prices as the in-built support from Monday still remained, when OPEC+ delegates said the group could consider deeper crude output supply cuts when they meet later, if needed to balance supply and demand.

Of course, the rise in oil prices was not without support, after China said it would support vaccinations among its senior citizens, a move that would lead to an easing of pandemic restrictions and a faster reopening of the economy.

Concerns over China’s energy demand have continued to weaken crude oil prices in recent times. China reported a record 38,808 new Covid infections on Sunday, which could lead to more pandemic lockdowns curbing economic growth and energy demand. Widespread protests, however, could pressure the government to rethink its Zero-Covid policy.

OPEC+ will meet on 4 December; they have agreed to cut production by 2 million barrels per day throughout 2023.

Technical Overview

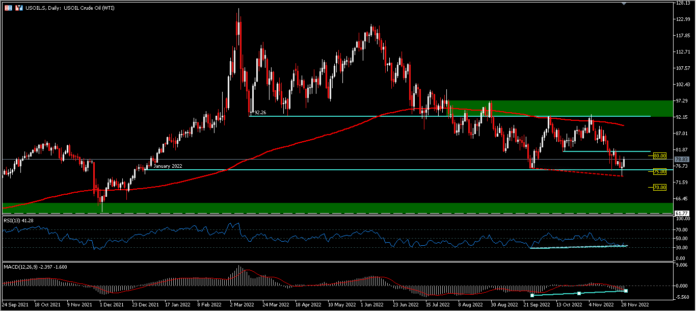

Total oil price gains from January 2022 have been paid, in Monday’s trading. USOil’s January 2022 opening price stands at $75.37, while the second peak $121.29 pullback recorded a low price of $73.61 in Monday’s trading (28/11) which saw a divergence between the low price and the Oscillation indicator. Technically, the price still has the potential to test the 50% FR retracement of the $80.09 and $126.33 pullback lows, if the price remains below the recent neckline at $81.23. Furthermore, the price is seen to be still below the 200-day EMA, although the oversold sign is a technical indicator that could be considered.

Intraday bias looks neutral again, below $80.00, and more in anticipation of the rumours circulating regarding a possible production cut by OPEC+. Trading above the $81.23 neckline could bring oil to test $92.88, conversely a move below the recent low would only confirm concerns that China’s economic growth is still in the red and bring the possibility of prices to test the $70.00 level.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.