- The USD Index holds at 105.00 from lows on Friday at 104.50, following hot PPI data and strong consumer sentiment. Stocks fell into close on Friday (Dow the weakest -0.9%) and down 2.85-4.0% last week (Nasdaq weakest) threatening the Santa Rally. Yields rallied over 2% on Friday, 10yr closed at 3.567% trades at 3.55% today. Asian markets & European FUTS are also lower as Chinese Covid infections rise as restrictions are eased. BIG week ahead.

Week Ahead – US CPI and the FOMC dominate matters but 10 other Central Banks update markets this week including ECB and BOE. 50 bp hike from the FED now at 77% from Fed Funds Futures, following Friday’s data.

- EUR – tested the 1.0600 zone on Friday – trades down at 1.0530 now.

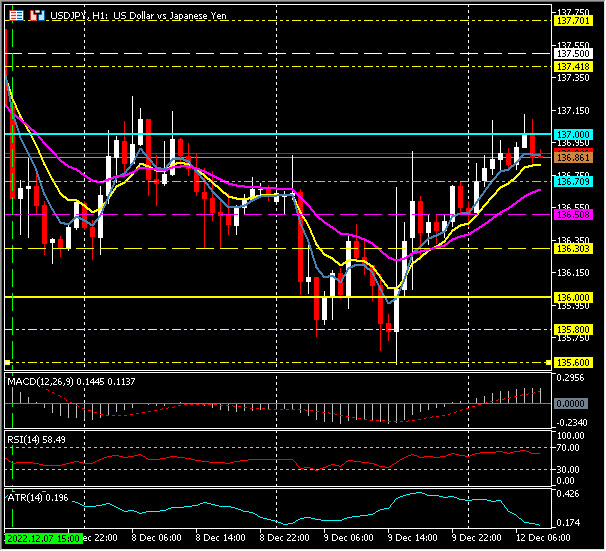

- JPY – rallied from post PPI low at 135.60 on Friday to test 137.00 again today.

- GBP – Sterling rallied again to breach 1.2300, briefly and post 5-month highs on Friday. Trades at 1.2228 now.

- Stocks – Wall Street dived on Friday – US500 -29.13 (-0.73%) 3934, Big movers included LULU -12.85%, COIN -6.00%, & TSLA +3.23%, NFLX +3.14%. FUTS trades at 3933 now too.

- USOil – Slipped to new 12-month+ lows at $70.05 on Friday on a weak global outlook, trades at $71.40 now.

- Gold – Rallied to and broke the key $1800 again, but could not hold it. Trades at $1788 support now.

- BTC – Sentiment woes continue, rallied to $17.3k on Friday but trades below 17k today at 16.9K

Today – UK GDP (m/m) beats (0.5% vs. 0.4%) & better Production data. UK NIESR – Speech from BOC’s Macklem.

Biggest FX Mover @ (07:30 GMT) USDJPY (+0.47%) rallied from post PPI low at 135.60 on Friday to test 137.00 again today. MAs aligning higher, MACD histogram & signal line positive but falling, RSI 58.50 & rising, H1 ATR 0.196, Daily ATR 1.783.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.