BOJ keeps YCC policy unchanged, Kuroda “will not hesitate to increase easing if necessary”. DOVISH !! – Downgraded economic forecasts – Growth 2023 – 1.7% vs. 1.9% & 2024 1.1% vs. 1.5%. Inflation forecast raised to 1.8% vs. 1.6%. YEN tanked (USDJPY +2.6% at one point). Bonds rallied, the 10-yr JGB dropped to 0.36% from 0.52% yesterday. US Stock markets were mixed (DOW -1.14%, Nasdaq +0.14%) as Goldman Sachs Earnings disappointed. Asia markets and European FUTS also mixed. UK CPI confirmed at 10.5% (CORE CPI 6.3%)down from 10.7% in November but still at 40-year highs.

- The USD Index recovered from under 102.00 at 101.70, to 102.60 following BoJ, back to 102.10 now.

- EUR – holds back over 1.0800, following 1.0760 lows earlier and a rejection of this weeks high at 1.0870.

- JPY – Lows on Monday were 127.20 as speculation peaked, the Dovish “no change” outlook from Kuroda took the pair to 131.60 highs today. Back to 130.25 now.

- GBP – Sterling has breached 1.2300, following the CPI data and currently trades at 1.2325, a 23-day high.

- Stocks – The US markets were weak into close (-1.14% to +0.14%). Mixed news from Banks – GS -6.44%, MS +5.91%, TSLA +7.43%, RBLX +11.77% US500 FUTS trade at 4017.

- USOil – rallied again to test $81.00 following inventories and 2023 outlook upgrades.

- Gold – declined from $1930 highs on Monday to test $1900 today as USD lifts.

- BTC – Continues to hold over $20k this week and over $21k again today.

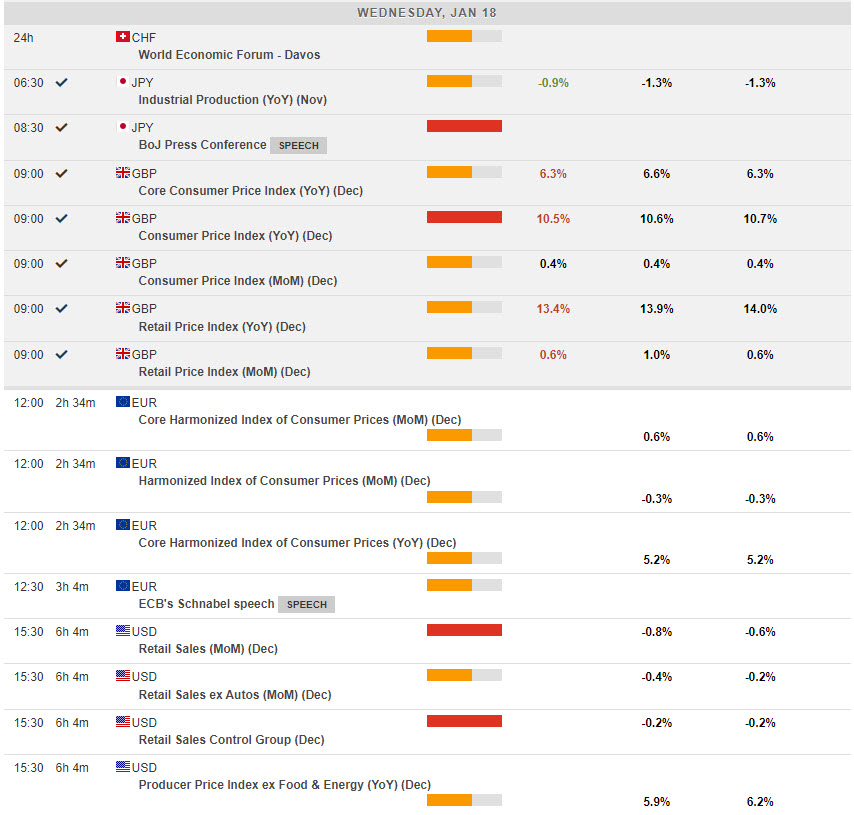

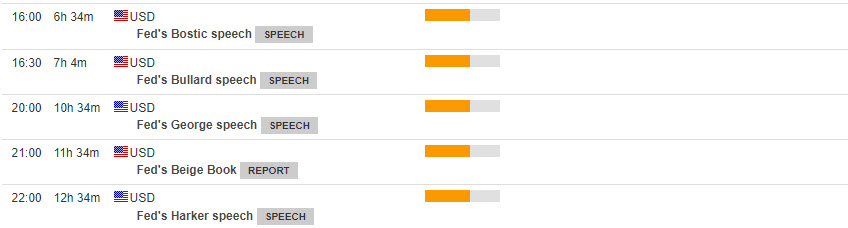

Today – US Retail Sales, PPI & Industrial Production, Speeches from Fed’s Bostic, Bullard, Harker & Logan,. Earnings – Charles Schwab, Prologis & Kinder Morgan.

Biggest FX Mover @ (07:30 GMT) NZDJPY (+2.71%). Bounced from a test of 81.00 zone on Friday and adds to gains today at 84.80 highs. Following the Dovish BOJ. MAs aligned higher, MACD histogram & signal line positive & rising. RSI 75.36, OB & rising, H1 ATR 0.354, Daily ATR 1.301.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.