Deere & Company, also known as John Deere, is the largest manufacturer of agricultural, forestry and construction machinery in the US and the world. In addition, the company also provides financial services through John Deere Financial. The company has a capitalization of $121.24B and expects to report earnings results for the end of the fiscal quarter ending January 2023 this Friday, February 17 before the market opens.

Zacks positions John Deere Rank #2 (Buy) in the Top 12% position (#31/252) of the Manufacturing – Farm Equipment industry. For this report, EPS of $5.51-5.80 (same for Nasdaq) is expected, which would be an amazing growth of 88.70% YoY compared to the $2.92 reported for the same period, while this quarter has a 5.20% ESP. The size of the global construction equipment and machinery market is expected to continue to grow this year, reaching an estimated $157.06B.

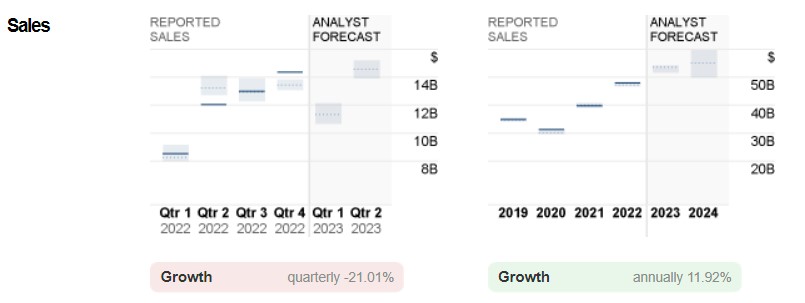

A profit of $11.44B is expected, which would be a year-on-year growth of 34.12% compared to the $8.53B of last year. The company has a P/E ratio of 14.57 and a PEG ratio of 1.22. The estimate has had 2 upward revisions and 0 downward revisions in the last 60 days.

At the beginning of this year, the sale of agricultural machinery saw an increase of 18% in global sales. For its part, DE patented 27 combine harvesters and 168 tractors at the beginning of the year, the leading company in patents for both products this season. In addition, the company has seen a strong rebound in demand for farm equipment in recent quarters, a trend that is likely to continue in the latest quarter and be beneficial to the report.

The company has been beating expectations since November 2019, however it had a negative quarter in August 2022. Last quarter the company reported EPS of $7.44 and revenue of $14.35B, while Deere equipment revenue increased 40% y/y ($14.4M), driven by 59% for production and precision ag, 26% for small farm and turf, and 20% for construction and forestry. The increase in demand is expected to contribute equally to the company’s growth this quarter.

For the full fiscal year 2022, the agriculture and turf equipment segment accounted for 69% of total revenues with $36B, followed by construction and forestry equipment with 24% with $13B and lastly the financial services segment added 7% with $3.6B. The turf and farm equipment segment accounts for a large percentage of revenue and continues to be key to growth this year. This segment is expected to be the fastest growing and largest to add $11B to the top line.

Interestingly, Deere & Co has sought to digitize its revenue; previously, the company presented technology such as autonomous tractors, drones for pest control and smart sprayers. It recently mentioned that it had a closed a deal with a “satellite partner”, in pursuit of the creation of geospatial maps for crop analysis and expanding technology and connectivity that allows exchange of data in the field, remote access and autonomy as an implementation of AI to rural farmers.

The connectivity that Deere is looking for has set a goal of 10% of its revenue being digital, in subscription to its software by 2030, since at the moment it is free on JDLink.

“…still working out the details of what SatCom-enabled connectivity will look like” – Jonny Spendlove, Senior Connectivity Product Manager at John Deere.

Technical Analysis – Deere & Company D1 – $410.15

#JohnDeere price is in retracement mood after breaking previous all-time highs at 445.44 and marking new ones at 448.08.

The price pullback to 401.62, very close to the psychological level of 400.0. However it remains above the bullish trend seen since June 2022, with ADX at 15.60 indicating a very very weak trend, implying that it might be at its end and a new trend lower could begin. In the case of breakout below it, it could retest the 380.16 at the Fibo 38.2%. With further selling pressure below it, it could breach the 61.8% Fibo zone at 346.31 to the September lows.

Click here to access our Economic Calendar

Aldo W. Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.