GBPUSD, H1

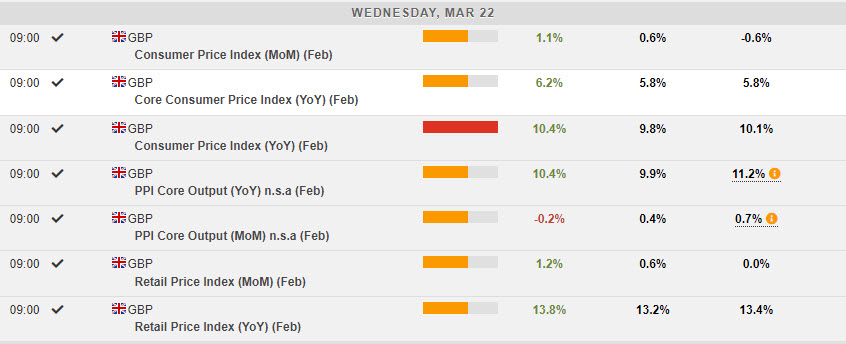

UK inflation surged higher ahead of BoE. The data came in much higher than anticipated, with Headline CPI hitting 10.4% from 10.1% last month, 0.6% higher than the expected decline to 9.8%. Most worrying for policymakers will be the jump in core inflation from 5.8% to 6.2% y/y. The RPI, which is still important for wage negotiations, but also interest payments on inflation linked government bonds, is now a whopping 13.8%.

PPI output price inflation slowed more than anticipated, but at 12.1% remains extremely high and suggests that further price increases are in the pipeline.

The data will likely force the BoE’s hand tomorrow and another rate hike looks much more certain now than before the release. Still, the fact that the BoE has already delivered an impressive run of rate hikes and that financial markets remain nervous backs expectations for a slowdown in pace. Expectations are for a 25bp hike tomorrow, with an even more cautious statement than before the data. PM Sunak will also come under increased pressure as the cost of living crisis in the UK during a mild Winter turns much more frosty as Spring dawns.

The details for February shows a big jump in prices from restaurants and cafes, food, and clothing. This was then partially offset by downward contributions from recreational and cultural goods and services, and particularly motor fuels. From a core standpoint, it is worrying that food price inflation continues to surge higher.

Sterling rallied on the data with Cable touching 1.2270 from 1.2220, EURGBP dipped to 0.8771 from 0.8800 and GBPJPY rallied to a 5-day high at 162.60 from 161.72. Technically the Daily chart for GBPUSD remains bid following a breach and break of the 1.2200 level ahead of both the FED and the BOE this week. Next immediate resistance sits at 1.2285 and 1.2300, further ahead sits the February and January resistance at 1.2400. To the downside if there are any surprises from the central banks or new “banking crisis” rumours then 1.2200, 1.2100 and the key 1.2000 will come into play.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.