Last Tuesday (March 28), Alibaba Group announced “the most important organizational change in 24 years” with the purpose of achieving “agile organization”, that is, the “1+6+N” organization. This means that Alibaba’s six major business groups (Taobao Tmall Business, Alibaba Cloud Intelligence, Local Life, Cainiao, International Digital Commerce, and Big Entertainment) and multiple business companies (Ali Health, Sun Art Retail, Yintai Commercial, Quark, etc.) will be independently responsible for and operate their respective departments. Except for Taobao Tmall Business Group, the other business groups have the possibility of independent financing and seeking a separate listing.

This is comparable to the largest organizational structure adjustment in history. Its main purpose is to “promote various businesses to become more agile, shorten the decision-making chain, respond to market changes faster, and further develop the business by seizing their respective market and industry opportunities, thus unlocking the value of Alibaba Group’s various businesses.” This decision may also, to some extent, improve the shortcomings of large organizations with multi businesses, namely “unclear positioning of customers, rigid organizational formation, vague strategic goals, lack of business strategies, corporate bureaucracy and culture”.

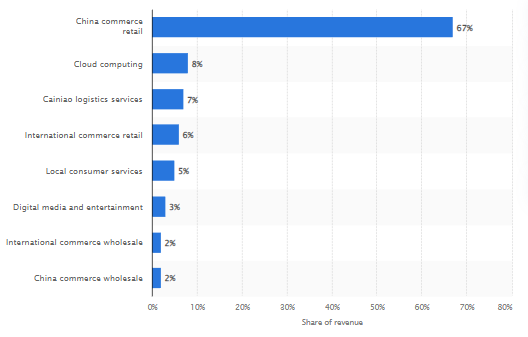

Alibaba’s Revenue Distribution in Q4 2022. Source:Statista

Alibaba’s Revenue Distribution in Q4 2022. Source:Statista

The spin-off of Alibaba’s division is a positive thing for shareholders, as the faster-growing business unit will be given a higher valuation by the market. Among them, the cloud business’ revenue ranked second among other divisions, and it is also the fastest growing and most sustainable department. Although its losses increased from FY2018 to FY2021, they narrowed sharply in 2022, reflecting strong resilience. After all, the cloud business is gradually replacing e-commerce since last fiscal year, and has provided computing services in 28 regions and 86 availability zones around the world. According to the above description, it definitely has the potential to be listed independently in the future.

The sales growth of Cainiao is no less than that of the cloud business. In Q4 last year, its revenue increased by 17% year-on-year. In any case, the biggest problem currently facing the Cainiao Group is still the stiff competition in the local express delivery industry. In addition, its international business includes AliExpress, Lazada, Alibaba.com, Trendyol, Daraz, etc. Alibaba is still facing many obstacles in this regard, including pressure from competitors, logistics issues, geopolitical conflicts, changes in overseas value-added tax policies, transaction data privacy, etc. In addition, the local life service sector is also facing severe challenges in its subdivisions. However, as the Covid situation stabilizes and travel demand picks up, the company’s “AutoNavi” and “Fliggy” businesses are expected to recover gradually, while improvement in the business efficiency of “Ele.me” shall also continue to narrow losses. Alibaba’s digital media and entertainment business includes Alibaba Pictures, Youku, etc. Ali Pictures has been listed on the Hong Kong stock market (market value is about 13.7 billion Hong Kong dollars). The division has narrowed its losses since fiscal 2019. On the other hand, in the December quarter, the average daily paying user scale of Youku also increased by 2% year-on-year, indicating there is still a lot of room for improvement.

Technical Analysis:

Shares of #Alibaba (BABA.s) opened higher after the announcement and last quoted at $102.08 following market close on Friday. The company’s shares have risen more than 28% since the rebound last month. Near-term resistance is seen in the $105.20 to $106.25 area. A successful breakout means the bulls are on track to test $112.20, and this year’s peak at $121.15. Conversely, $100.30 serves as near-term support. Should the selling pressure increase and break this level, the stock could test the $95.40 to $97.05 area, as well as the dynamic support of the 100-day SMA.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.