The European Central Bank raised its key interest rate by 25 bps during its May meeting, signalling a slowing pace of policy tightening. Nevertheless, borrowing costs have now reached their highest level since July 2008 after 7 consecutive rate hikes as the ECB seeks to combat high inflation, despite ongoing recession risks.

The central bank also announced plans to stop reinvesting cash from maturing bonds purchased under the €3.2 trillion APP from July. The latest economic data revealed that the inflation rate in the Euro Area rose to 7% in April, with the core rate remaining near March’s all-time high of 5.6%. Interest rates on major refinancing operations, as well as rates on marginal lending facilities and deposit facilities, increased to 3.75%, 4.00%, and 3.25% respectively. Meanwhile, President Lagarde said in her press conference that the ECB has more to discuss and will not stop the rate hike cycle anytime soon.

Meanwhile, the Swiss Franc cross pair strengthened against the Euro after the ECB interest rate policy decision. The EURCHF currency pair is still showing marked weakness, as the banking chaos in the US has favoured the Swiss Franc as a hedge against uncertainty.

The SNB in this case is likely to keep a close eye on the strengthening Swiss franc, as a rising Swiss franc would weaken the economy, which is heavily dependent on exports. This week’s data reaffirmed that the Swiss economy is showing some signs of strain. Consumer confidence fell to -13 in the second quarter, down from -9 in Q1. Manufacturing PMI continued to decline, slowing from 47.0 to 45.3 in April. CPI for April on Friday is expected to rise to 0.5% m/m from 0.2% in March.

Technical Review

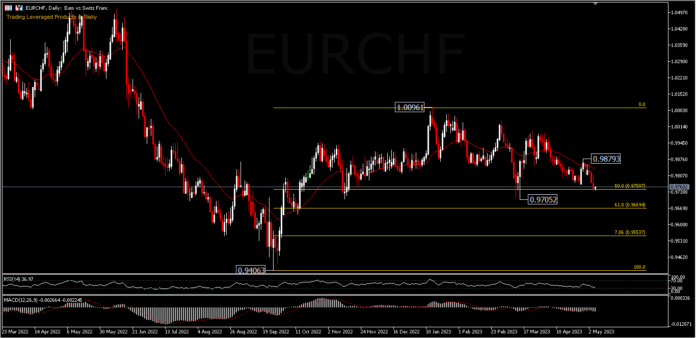

EURCHF fell -0.23% on Thursday to close at 0.9753. This decline was an extension of the January 2023 peak, after the 0.9406 rebound failed to continue the rally and stalled slightly above the parity level.

Intraday bias is tilted to the upside currently, breaching 0.9848. On the upside, the nearest resistance is seen at 0.9879, and a move above this level would open the opportunity to retest the 1.0000 and 1.0096 parity levels. In the short term, bear pressure still seems to hold at 0.9850. This is reflected by the technical indicators that validate it, with the price below the 50-day EMA, RSI at 35.8 and MACD in the sell zone.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.