China’s Caixin services PMI unexpectedly outperformed expectations in May, rebounding to 57.1 from 56.4. The composite PMI followed suit, rising to 55.6 from 53.6. overall, and the services and composite PMIs expanded for the fifth consecutive month, with the former growing at the second-fastest pace since November 2020 and the latter at the fastest pace since December 2020.

Earlier, the Caixin Manufacturing PMI rose from 49.5 to an expansionary level of 50.9, but concerns about overseas uncertainty lingered, with “lack of domestic momentum in economic growth” and “low confidence among market participants” leading to a seven-month low in investor sentiment. Investor sentiment is at a seven-month low. In contrast, the services sector was more positive, including output growth at a faster rate than manufacturing. On the employment front, the services sector climbed for the fourth consecutive month, while the manufacturing declined at its fastest pace since February 2020, offsetting the former.

In the US, Markit and ISM also released their services PMI and non-manufacturing PMI respectively, both of which underperformed, with the former falling from 55.1 to 54.9 (after four consecutive months of expansion) and the latter falling from 51.9 to 50.3 (after five consecutive months of expansion, but the slowest rate of growth in the series.) ISM reported that the declining readings were driven by several factors, including a slowdown in business activity, new orders as well as new export orders, and a contraction in employment. The S&P Global Services PMI for the US was revised down slightly to 54.9 from an initial reading of 55.1. In response, Anthony Nieves, Chairman of the ISM Services Survey Committee, said: “Business Conditions are stable, but concerns about an economic slowdown remain“.

Fedwatch showed that the market’s probability of the Fed keeping the benchmark interest rate unchanged next week rose to 76.0% from 74.7% a week ago. This is a big difference from 35.8% a week ago.

Technical analysis:

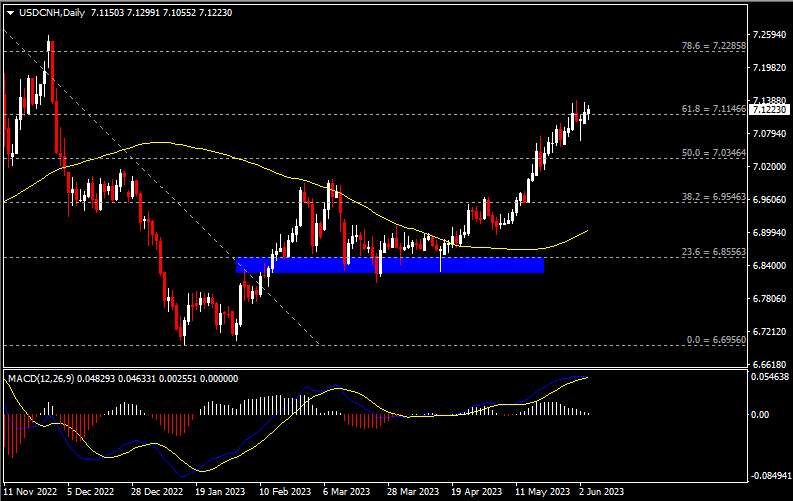

USDCNH, daily chart: The pair maintained a range-bound oscillation in the first half of the year, before breaking above the first quarter high (6.9953) in mid-May to start a new uptrend. Resistance is currently being tested at 7.1150 (FR 61.8% from last October’s all-time high to this January’s low).

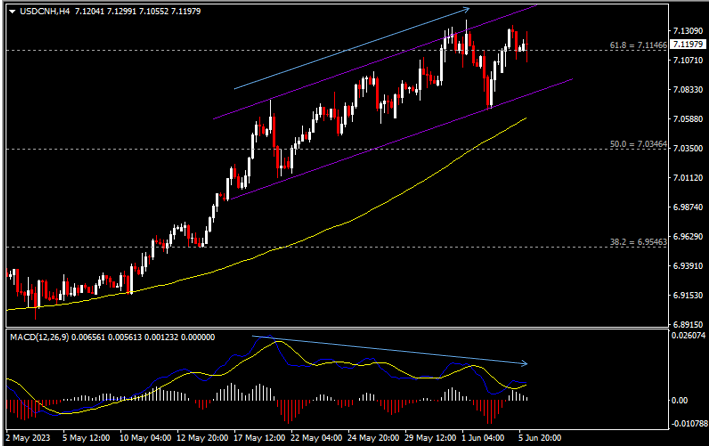

USDCNH, 4-hour chart: The smaller time frame shows that the pair is in an upward channel. The MACD indicator shows that the upper (daily) double line is looking to form a dead cross, while the lower (4-hour) chart is forming a negative divergence from the currency pair. In addition, the MACD white histogram is gradually narrowing in both time frames, which may reflect diminishing upside momentum.

On a macro level, if the Fed keeps interest rates unchanged as expected by the market, this could contribute to a further decline in the attractiveness of the Dollar and is expected to increase selling pressure on the pair. The bottom line of the uptrend channel is currently the nearest support, followed by dynamic support at SMA 100.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.