Adobe is an American software company founded in December 1982 and is best known for its multimedia and creative software products. It operates through three segments, Digital Media (a creative cloud service that allows members to download and install products such as Adobe Photoshop, Adobe Illustrator, Adobe InDesign, etc.), Digital Experience (providing solutions including analytics, social marketing, targeting, media optimisation, digital experience management, cross-channel campaign management, premium video delivery and monetisation) and publishing and advertising (traditional products and services for e-learning solutions, technical document publishing, web application development and high-end print).

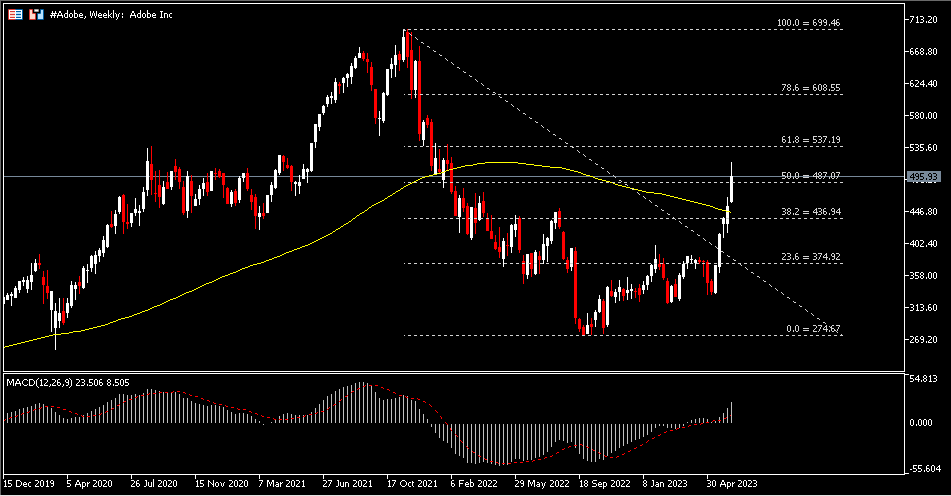

The company’s share price fell sharply from November 2021 to the third quarter of 2022 (from a high of $699.46 to a low of $274.67) as it was weighed down by a sell-off in major technology stocks, an antitrust review of its planned purchase of collaborative design platform Figma, and unfavourable macroeconomic drag. Nevertheless, management’s earlier positive forecast for 2023 did not disappoint investors. In fact, Adobe’s share price has soared by more than 55% this year with news of Adobe’s latest advances in artificial intelligence (AI).

In late March 2023, Adobe.Inc released Firefly, its generative AI tool. in general, this tool has a variety of features, such as generating images from text content (drawing directly what the user wants, or allowing the AI to execute commands during the image editing process), erasing backgrounds or adding drawings to images by generating fills, generating creative text (similar to Microsoft Word art words), etc. The main use of its library, Adobe Stock, is to open up training on licensed content and content whose copyright has expired, allowing users to use it with confidence and without worrying about copyright issues.

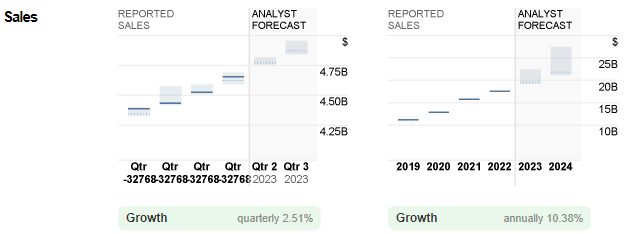

Sales reported by Adobe vs. analysts’ forecasts. Source: CNN Business

Last week, Adobe reported better-than-expected second quarter results. Sales revenue increased +10% (year-on-year) to $4.82 billion, showing strong demand mainly from Creative Cloud (+9% year-on-year), Document Cloud (+11% year-on-year) and Experience Cloud (+12% year-on-year). Its operating income and net income were US$1.62 billion and US$1.30 billion respectively. The next earnings report is due on 19 September.

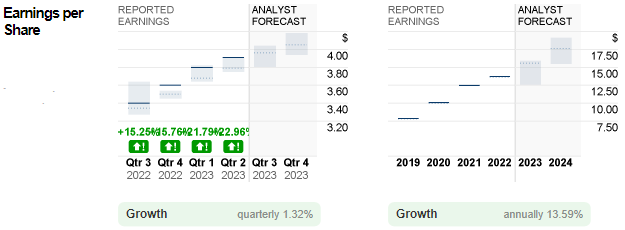

Adobe reported earnings per share vs. analysts’ forecasts. Source: CNN Business

Non-GAAP earnings per share for the quarter reached $3.91, up 17% from the same quarter last year. All in all, management remains optimistic and has provided positive guidance for the third quarter of 2023. The company expects revenue of $4.83 billion to $4.87 billion and adjusted earnings per share in the $3.95 – $4.00 range. Full year earnings per share guidance was raised to $15.65 – $15.75, well above analyst forecasts ($15.57).

Technical Analysis

Adobe (ADBE.s) shares have closed higher for five consecutive weeks and are now above their 100-week SMA and FR 50.0% at $487. If the bullish momentum continues, the next resistance levels to watch are $537 (FR 61.8%) and then $609 (FR 78.6%). Otherwise, a retracement below 50.0% FR could indicate a pause in the bullish rally, with the 100-week SMA and $437 (FR 38.2) being the nearest support, followed by $375 (FR 23.6%). The MACD is still pointing north at 23.506.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.