The US stock market closed the week bearish, following Fed Chair Jerome Powell’s testimony (his statement is also supported by some Fed officials) which signaled more rate hikes in the coming months, “the central bank has not reached the end of its tightening cycle”. The return of recession fear ended the winning streak of major US stock indices, with US500 posting weekly losses -1.61%, while US100 down -1.64% and US30 down -1.91%.

Nevertheless, in the technology services sector, Meta.Inc outperformed its peers (such as MSFT, GOOG, NFLX). For the past six months, Meta achieved gains nearly +145%, in contrast to MSFT and NFLX which accumulated gains over +40%, while GOOG at nearly +37% (Source: barchart).

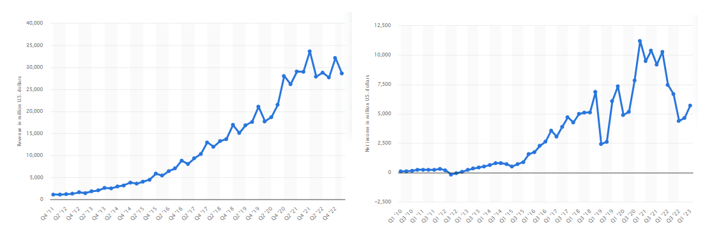

Meta.Inc: Global Revenue and Net Income. Source: Statista

In Q1 2023, Meta Inc. reported sales revenue at $28.6B, down -10.94% from the previous quarter, but up +2.64% from the same period last year. Net income continued to recover to $5.7B. Most of its revenue were generated through advertising. In fact, the company’s net advertising revenues were ranked second highest globally last year, at $112.68B, just after Google ($168.44B). Analysts forecast its advertising revenue to grow over +8% (y/y) to $121.9B in 2023, and then $134.72B in 2024. On the downside, a shift of advertisers from social into retail media (the latter allow advertisers reach consumers “closer to the point of purchase”) could pose a threat, and “Meta has yet to fully confront this threat”.

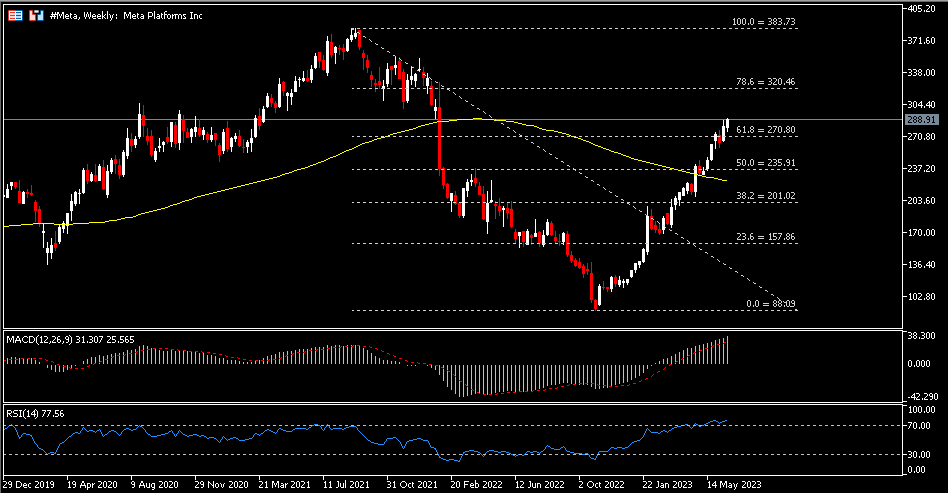

Despite challenging macroeconomic conditions, Meta has been doing well this year. Year-to-date, the company’s share price has rebounded strongly and recovered more than 60% of the decline from Sep 2021 to the end of 2022. Recent surge of the price could be attributed to Meta leveraging on its generative AI tools, to the latest human-like I-JEPA (filling in missing pieces of images via background knowledge about the world) and Voicebox (replicating voices and available in 6 languages – still in controversy that it’s “too risky to release”). It has been a bumpy road for Meta in AI Innovation since a decade ago. During the early stages, there are significant setbacks such as layoffs and a notable exodus of AI researchers (which was due to burnout, lack of confidence and sense of disillusionment with the company’s AI strategy). Today, AI has become a trend. Could Meta’s stock price return to its historical peak or even higher? We will wait and see.

Technical Analysis:

#Meta (META.s) share price rides on a bullish trend since gaining ground in November 2022, at $88.09. It is currently traded above 100-week SMA and FR 61.8% ($270.80). The latter serves as the nearest support. As long as it remains intact, major direction points northward, with resistance at $320.50, followed by ATH $383.73 seen in September 2021. Otherwise, if price breaks below $270.80, there will be downside risk towards $235.90 (FR 50.0%) and the dynamic support 100-week SMA. MACD remains positive, while RSI (14) at overbought zone (77.56).

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.