Microsoft Corp., an American multinational technology conglomerate currently ranked the second largest company (after Apple Inc.) by market capitalization ($2.556T), which actively engages in the development and support of software, services, devices and solutions, shall release its Q4 2023 financial results on 25th July (Tuesday), after market close.

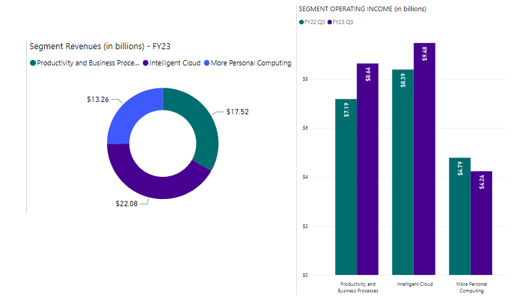

Segment Revenues and Operating Income (in billions) – FY23 Q3. Source: Microsoft

In the previous quarter, the Intelligent Cloud segment contributed the most to the company’s revenue, at $22.08B (+16.3% YoY). Productivity and Business Processes and More Personal Computing drove $17.52B (+11% YoY) and $13.26B (-8.6% YoY) in sales, respectively. The sales of the latter segment dropped due to decreased revenue in Windows OEM and Devices, which offset gains in other sub-segments such as Windows Commercial products and cloud services, Xbox content and services, as well as Search and news advertising (excluding traffic acquisition cost).

Operating income of Intelligent Cloud was up nearly +13% (YoY) to $9.476B, while Productivity and Business Processes was up +20% (YoY) to $8.639B. More Personal Computing was down -11.5% (YoY) to $4.237B. Net income was $18.3B, up +9.6% from the same period last year.

Since its partnership with OpenAI, Microsoft has cumulatively invested $13B (was $1B back in 2019) in the former, leveraging AI supercomputing technology into its Bing Search engine, sales and marketing software, GitHub coding tools, Microsoft 365 productivity bundle and Azure cloud. Wells Fargo analysts estimated that the new technology could add up to over $30B in annual revenue for Microsoft, with roughly 50% generated from Azure, and possibly $100B by 2027.

On the other hand, the US Federal Trade Commission (FTC) paused its trial against the Microsoft-Activision deal worth $69B. Despite the yet-to-be-completed acquisition, Xbox head Phil Spencer remains optimistic, stating that “we will get our acquisition over the finish line”.

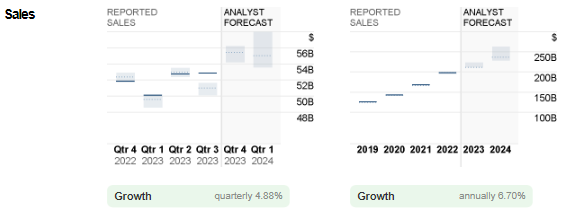

Microsoft: Reported Sales versus Analyst Forecast. Source: CNN Business

In general, prospects remain bright for the tech conglomerate, with consensus estimates for sales in the coming quarter expected to hit $55.4B, up +6.7% from the prior year period. If the reported figure matches expectations, this could lead to overall sales in FY 2023 being recorded at $211.6B (was $198.3B in FY 2022).

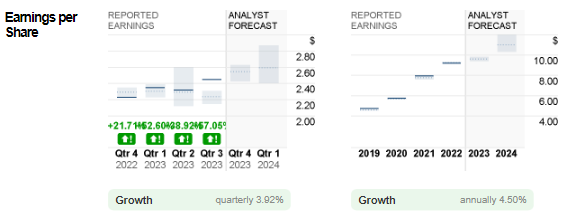

Microsoft: Reported EPS versus Analyst Forecast. Source: CNN Business

EPS is expected to hit $2.55 in the coming announcement, 10 cents higher than the previous quarter, and 32 cents higher than Q4 2022. Consensus estimates for final EPS in FY 2023 stood at $9.62, 41 cents higher than FY 2022.

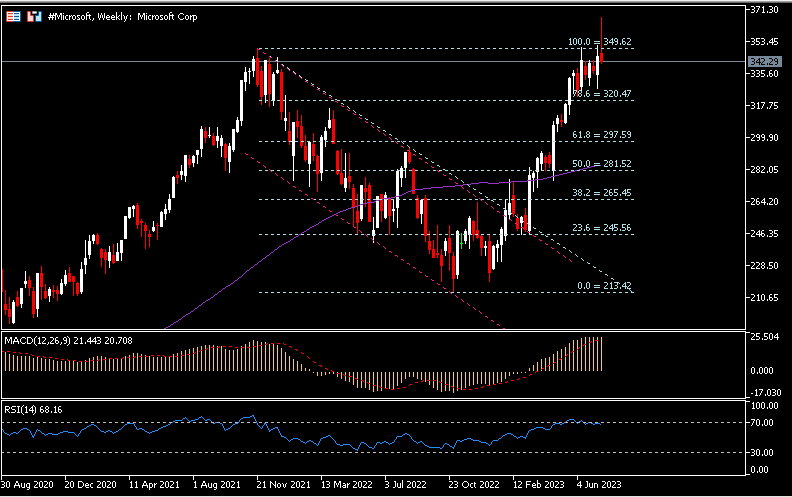

Technical Analysis:

#Microsoft, Weekly: The Microsoft share price hit an ATH on last Tuesday, at $366.73, following announcements regarding its AI-related products. Latest news revealed that Microsoft shall team up with Meta on Llama 2, a new open-source AI model, bringing the technology to more businesses and researchers. Back to the chart, the company’s share price closed with a bearish pin bar, below the highs seen in Nov 2021 ($349.62). These two levels form a strong resistance zone. Once successfully broken, the bulls may continue to test the psychological level $400. On the other hand, $320.50 serves as the nearest support, followed by $298 and $280. MACD indicator remains in positive configuration, while RSI is hovering at the overbought zone.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.