Following Saudi Arabia’s Energy Ministry announcement, that it will extend its voluntary production cut by one million barrels per day until September, with the prospect of additional cuts and extra extensions, oil futures prices rebounded in Thursday’s trading (03/08). The Saudi production cut keeps its crude output at around 9 million barrels per day, the lowest level in years. Also, OPEC crude production in July fell by -900k bpd to a 1-year low of 27.79m bpd. The OPEC+ Joint Ministerial Monitoring Committee will hold an online review on Friday to gauge the impact of the group’s supply cuts.

In addition, Russia announced that it will reduce oil shipments by 300,000 barrels per day, until September. Previously, Russia pledged to cut its crude oil production by 500,000 barrels per day in August. Meanwhile, the United States experienced a dramatic decline in stocks that caused the overall level of national oil stocks to reach the lowest level since January 2023. US crude oil production was well below the February 2020 record high of 13.1 million barrels per day.

Besides the oil production cut, also contributing to the price increase was the increase in China’s oil imports which was revealed by government trade statistics to have risen +4.6% m/m in June, to 12.72 million barrels per day, the highest in three years.

Technical Review

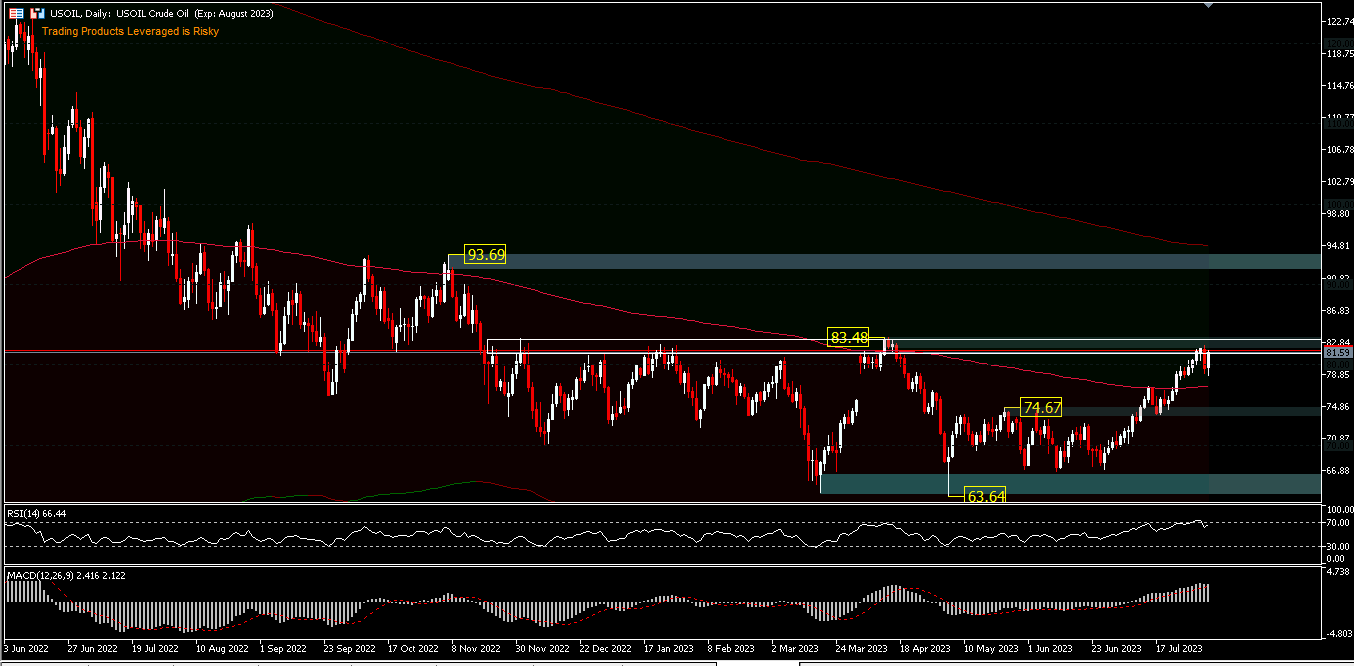

USOIL, D1 rallied over 2% in Thursday’s trading (03/08), after falling on Wednesday. The price is currently still trading above $80.00 with the key resistance being at $83.48 which was the highest price in April. The fact that the extension of production cuts brought prices up to $80.00 does not yet indicate a significant increase, amid falling Indian crude oil imports. In June Indian imports were reported down -1.3% y/y to 19.7 MMT, the lowest in 7 months. While the price is currently sitting above the 200-day EMA, the RSI has shown buying saturation.

MACD is still in the buy zone validating the recent rally. A break of the key resistance of $83.48 could possibly bring an upside to test the resistance of $93.69, but it is likely to be matched by increased demand. Below the 200-day EMA, $74.67 support or at least $75.00 could be the hold that market participants are eyeing.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.