On Monday night Moody’s cut the credit rating of a bunch of small and mid-sized banks while placing several big Wall Street names under review. Among these latter ones there is BNY, US Bancorp, State Street and Trust Financial.

The rating agency cited the continuous interest rate and asset-liability management risks with implications for liquidity and capital ‘’as the wind-down of unconventional monetary policy drains systemwide deposits and higher interest rates depress the value of fixed-rate assets”. Banks’ Q2 results also showed growing profitability pressures that are reducing their capacity to generate internal capital. While the last Stress Test results showed fairly comfortable capital ratios among the biggest players of the sector, Moody’s is warning that substantial unrealized losses may be not captured by those regulatory capital ratios and sudden losses of market or consumer confidence in a high interest rate environment will leave weaker banks struggling with a worsening quality of their assets. The agency is expecting rates to stay higher for longer and a mild recession in early 2024.

Technical Analysis – Bank of New York Mellon (BNY)

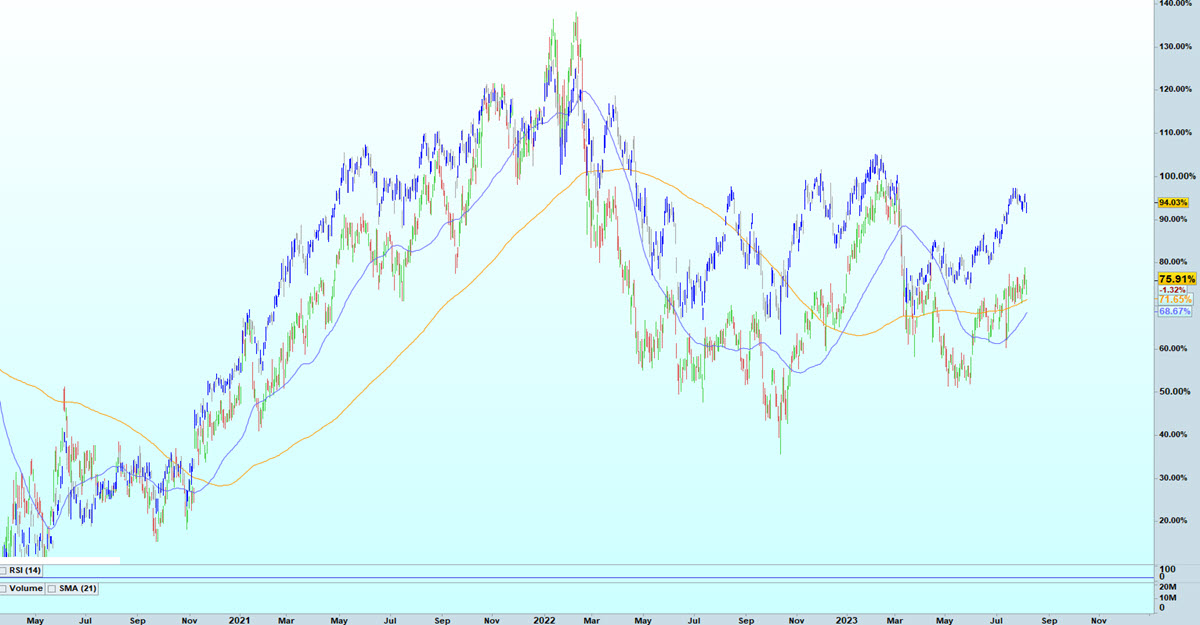

BNY has been underperforming the broader XLF, the Financial Select Sector SPDR Fund, for years now and the situation has not really improved: since the post Covid crisis bottom in late March 2020 the stock is +75.91% versus a sectorial fund performance of +94.03%.

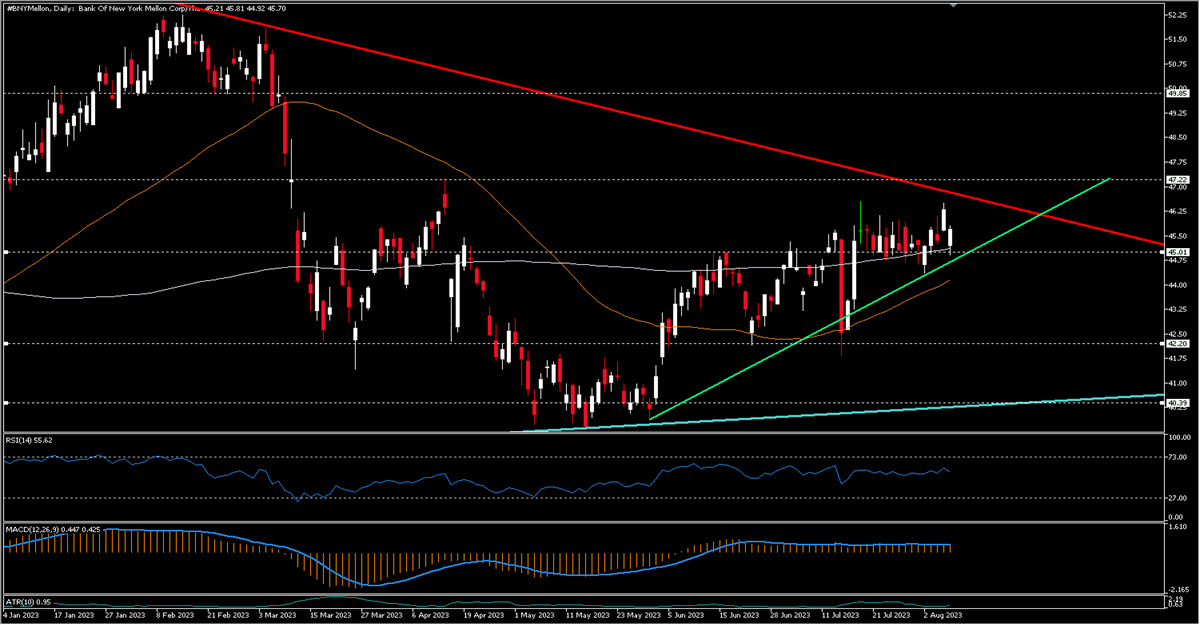

Right now the stock is in a rather interesting situation: first of all, we see that we have actually had ascending lows over the last three years. But what we want to pay more attention to is the fact that it has just tested the bearish trendline – also long-term – which is obtained by joining the highs of December 21 with those of February this year. The price is also just above the MA200 (and also the MA50) Neither the RSI nor MACD indicators give us much information, being essentially flat. What we will be observing over the next few days will be the holding of the two trendlines, i.e. around $46.54 upwards and $45 downwards: it is a very narrow range which, in the event of an upward break-out, would first lead toa test of $47.20 and then open up room for a lengthening up to around $49.80. A downward break of the more recent trend (light green) and of the two MAs should instead lead to a retest of the $42.20 area and perhaps even something lower, towards $40.40.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.