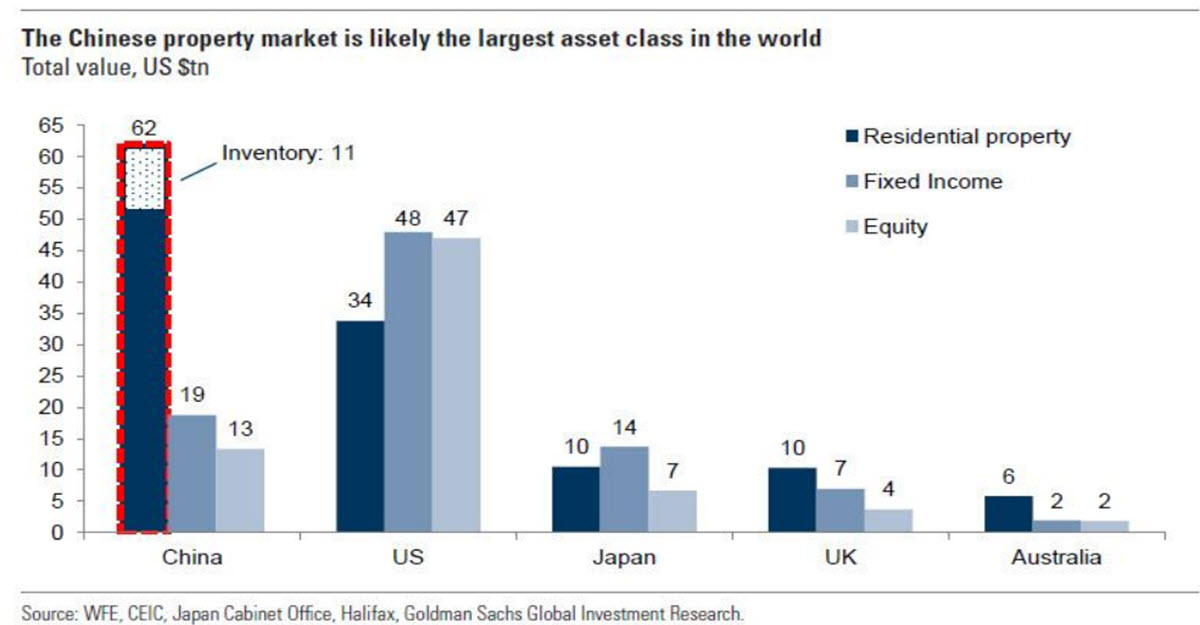

Let’s start with the data that just came out this morning: In the UK we had some nice surprises, with GDP (+0.2% q/q vs flat exp., +0.4% y/y vs +0.2% exp.), industrial and manufacturing production beating across the board. The Pound is up and the best performer among the majors, but the AUD isn’t doing too badly either, after RBA’s Governor Lowe reiterated his commitment to bring inflation to 3.25% by the end of 2024. Yesterday’s CPI data sent the markets on a rollercoaster ride: big daily swings in the indices which, after rising around 1%, closed at the day’s lows. The USD recovered heavy losses and above all the crushing performance against the JPY helped it recover 90 cents after falling as low as 101.62 (USDX). The Japanese currency is at the lows of the year and close to what in the past has been an intervention zone. More trouble from Asia where it is rumoured that the developer giant Country Garden will ask for a debt restructuring in the coming weeks, making it the biggest crisis since the not so distant days of Evergrande. The central government is said to shift $139 bln of troubled debt to provinces. CHINA50 -1.88%.

- FX – USDIndex little changed this morning at 102.35, USDJPY 144.78, less than 30 pips away from this year’s highs. CABLE up above 1.27 after the data, EURUSD shy of 1.10.

- Stocks – US indices closed the day flat after rising as much as 1% earlier. Futures are flat. US500 and US100 are set for the 2nd week of losses in a row. GER40 failed to stay above 16k, CAC above 7.4k. CHINA50 – 2.88%.

- Commodities – Some profit taking on USOil after it almost touched $85, back at $82.4 now. Copper down roughly -7% in AUG, $373.25 now.

- Gold – Down close to July’s lows, trading at $1916.25, XAG -4.34% so far this week.

Today: US PPI and Michigan Consumer Confidence.

GBPUSD, H1

Interesting FX Mover: GBPUSD (+0.29%) spiked 40 pips after the GDP data, consolidating above 1.27 now, 1.2711 last. Holding above the 1.2675 support zone, below the short term trendline.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.