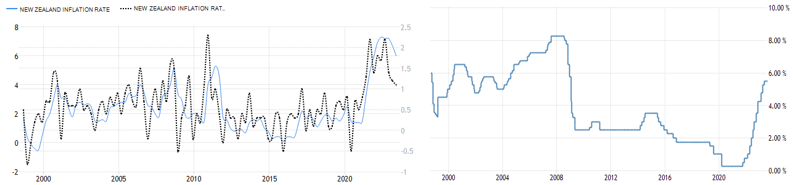

In today’s Asian trading session, the New Zealand Federal Reserve left the cash rate unchanged for the second consecutive month at 5.50% in its interest rate resolution. Regardless, the committee maintained a “moderately hawkish” stance, stating that interest rates will need to remain at restrictive levels for some time. They also hinted that rates would “move slightly higher” from the fourth quarter of this year to the last quarter of next year.

The statement also pointed to the risk of inflation indicators slowing down less than expected as inflation grew at an annualised rate of 6% in the second quarter of this year (6.7% previously), the lowest reading since the fourth quarter of 2021, but still the fastest rate of growth since the 1990s. In addition, as global growth weakens (including in China), commodity prices will also come under pressure and put pressure on New Zealand’s overall export earnings – the latest forecasts suggest that the New Zealand economy could fall into recession in the third quarter.

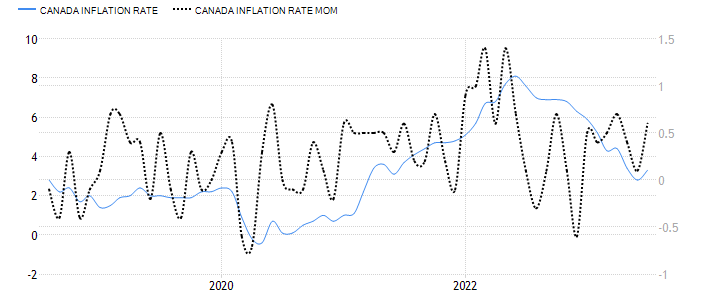

On the other hand, Canada’s July CPI, released yesterday, posted 3.3% y/y, beating market expectations of 3.0% and the previous 2.8%; driven by the peak travel month, the YoY reading of 0.6% from the previous month was also higher than the market’s expectation of 0.3%, the highest since April. Core CPI held steady at 3.2% year-on-year, ending a streak of declines over the past seven months; the figure rebounded sharply from the previous month to 0.5%, after -0.1%. The report showed that mortgage rate costs (up 30.6%) were the biggest contributor to higher inflation, followed by electricity prices (up 11.7%); grocery prices grew at the slowest pace since February last year; energy prices declined less (slipping -8.2% vs. slipping -14.6%); and other sub-data such as the cost of travel accommodations and airfares fell further.

The Bank of Canada predicted last month that inflation would hover at 3% until mid-2025 before falling to its 2% target level. The central bank will hold its interest rate resolution on 6 September, before which market participants will also be looking at Canada’s second-quarter GDP data, which will be released on 1 September.

Technical Analysis:

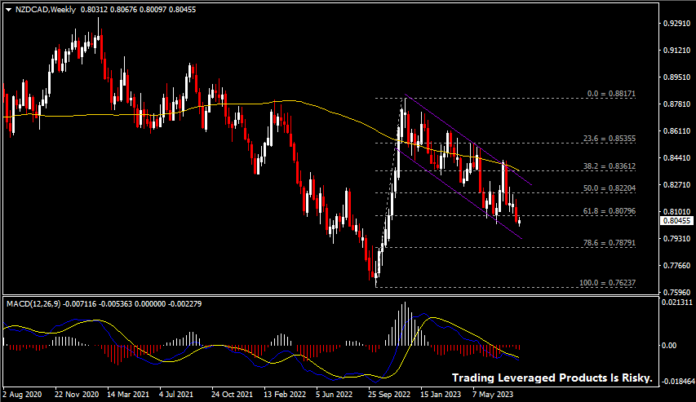

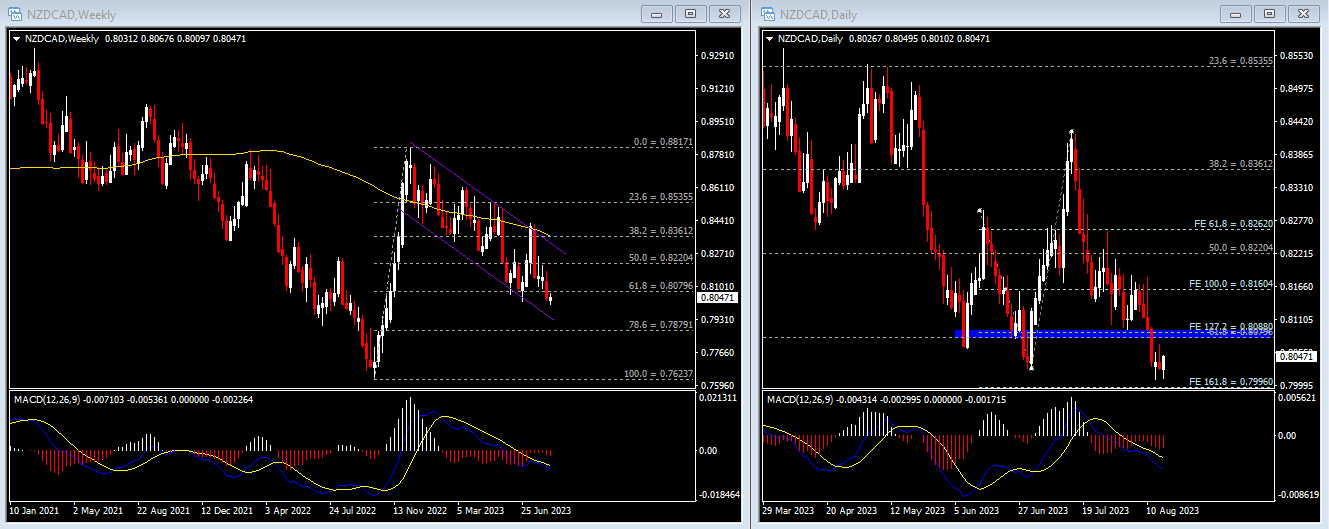

Overnight, the New Zealand Dollar retraced its intraday gains against the Canadian Dollar following the release of the Canadian CPI report, closing at 0.8027. The pair slipped nearly 5% from last month’s peak. Today, the pair was boosted by the New Zealand Federal Reserve’s “mild hawkishness” and is now back to testing the 0.80 mid level. The weekly chart shows a downward bias in the overall trend, with the pair trading in a descending channel. A short-term rally could test the 0.8080 area, then 0.8160, followed by 0.8220 (FR 50.0% from the lows seen in October last year to the highs in December), which meets the top line of the channel to form a key resistance. 0.7995 is the near-term support, followed by 0.7880. The MACD is still under pressure below the 0 line in a negative configuration.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.