Adobe, Inc., an American software company founded in December 1982, is best known for its multimedia and creativity software products. It operates via three segments, namely Digital Media (creative cloud services which allow members to download and install products such as Adobe Photoshop, Adobe Illustrator, Adobe InDesign, etc), Digital Experience (which provides solutions, including analytics, social marketing, targeting, media optimization, digital experience management, cross-channel campaign management, premium video delivery and monetization) and Publishing and Advertising (legacy products and services for eLearning solutions, technical document publishing, web application development and high-end printing).

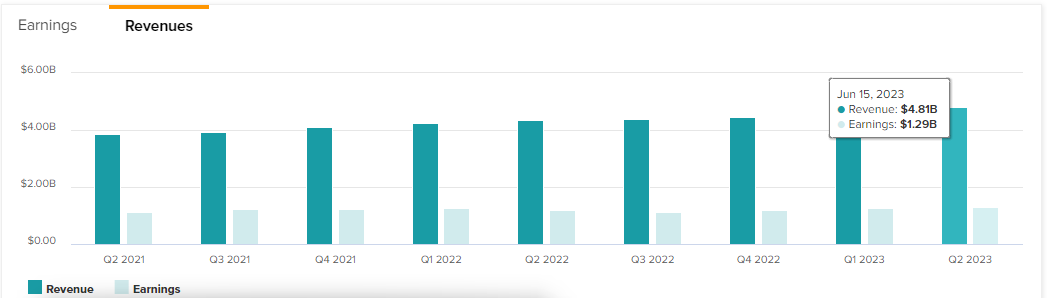

Adobe: Revenues & Earnings (After Deduction of Tax and Expenses). Source: Tipranks

The company will release its Q3 2023 earnings report on 14th September (Thursday), after market close. In the previous quarter, the company made $4.81B in sales revenue, up 3.66% from the previous quarter, and up 10.57% from the same period last year. Non-GAAP operating income and net income were reported at $2.18B and $1.79B, respectively.

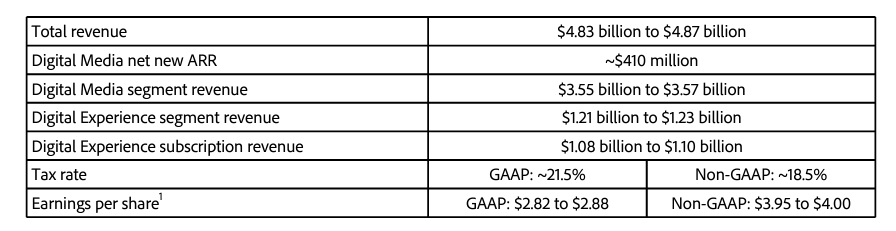

Adobe’s Q3 2023 Projection. Source: Adobe Investor Relation

The management team held positive guidance for the coming earnings result. Sales revenue is expected to be in the range between $4.83B to $4.87B. All segments’ revenue have been revised upward. Non-GAAP EPS is expected to be around $3.95 to $4.00 (versus $3.91 in Q2 2023).

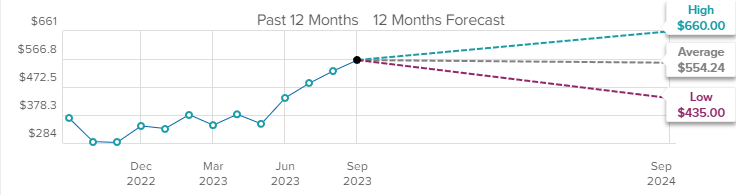

Analysts Price Target for Adobe. Source: Tipranks

In fact, Adobe’s proactive approach in defending its dominant position in the market for creative software by rolling out new generative AI tools (text-to-image generation application, AI-based photo editing, “Firefly” for enterprises, etc) has driven its stocks higher in 2023. Based on the analyst forecasts displayed above, the average price target for the next 12 months stood at $554.24, while its high and low are estimated at $660 and $435, respectively.

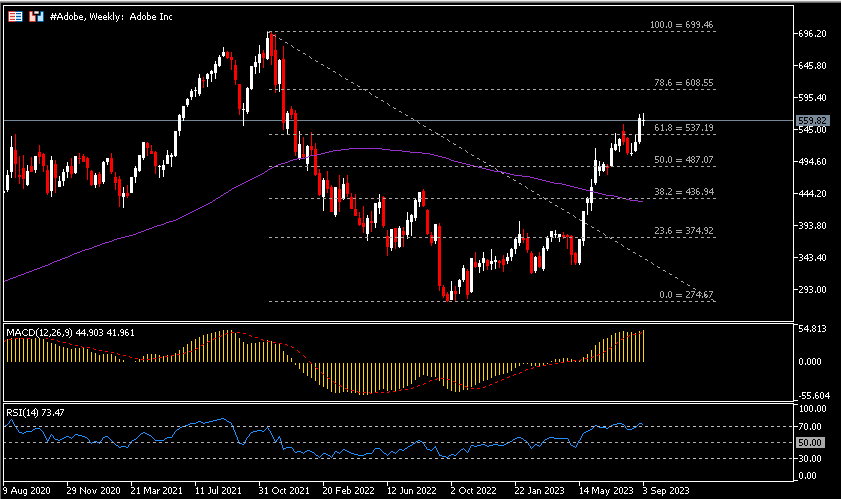

Technical Analysis:

YTD gains for #Adobe shares are over 75%. So far in 2023, there have been only two negative months (February and April). To date, it closed at $559.82, slightly below the high in January 2022 ($574.11), which also serves as the nearest resistance. A successful break above this level shall encourage the bulls to continue testing $608.55, followed by the ATH $699.46. Otherwise, $537 serves as the nearest support, followed by $487 and 437. The MACD indicator is in positive configuration, whereas RSI is at the overbought zone.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.