A few days ago, the US500 futures, after having fallen -6.55% in 13 trading sessions and having corrected -8.48% from the highs reached at the end of July (4607), came to test the psychological level of 4200 as well as its MA200: now, five trading sessions later (at the time of writing) it is at 4343, about 3.36% higher. It was not the only international index that was testing important psychological levels: the US30 was testing 33k, the German GER40 was at 15k, and the French FRA40 was around the 7k level.

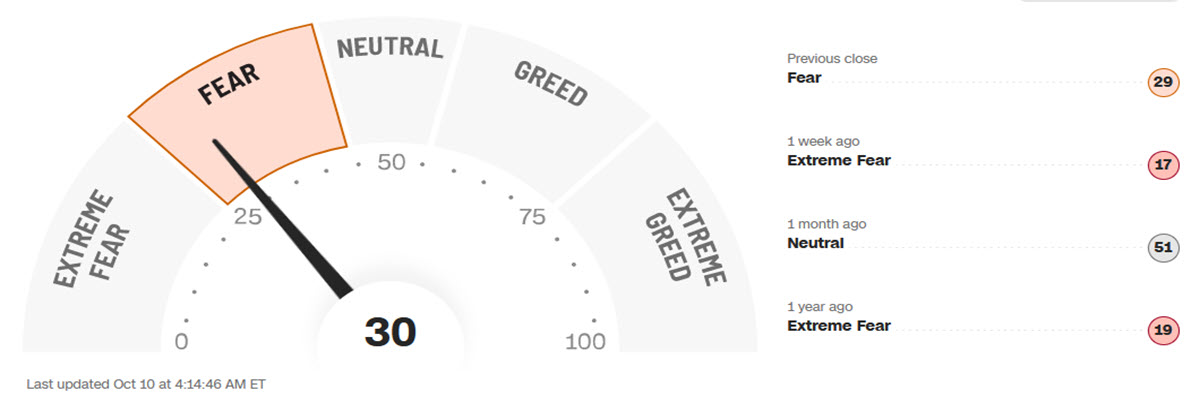

Before delving into the technical analysis of the benchmark index of global equity risk appetite in more detail, let’s take a look at two relevant factors: the Greed and Fear index and the Put Call Ratio.

The first is a very easy to read synthetic index produced not by a financial institution but by CNN Business. It is a compilation of seven different indicators that measure some aspect of stock market behavior: they are market momentum, stock price strength, stock price breadth, put and call options, junk bond demand, market volatility, and safe haven demand. As Warren Buffett has repeatedly stated, ”it is a good idea to buy when others are selling” and a reading close to fear in such an index is used by some as a buying signal. It certainly worked this time, because on 3 October it had reached the ‘extreme fear’ level at 17 (now it has lowered to 30), and did so the day before the current short-term bottom.

The other, the Put Call Ratio, is a measure of activity on put and call options on a specific day: the higher the ratio, the more activity there is on put options. It is often considered a contrarian indicator and on 5 October it had reached its second highest level of the year at 1.42. Several analysts have pointed out that the returns after such levels are usually positive, implying that this could be a bullish signal. In reality, although this is true over the longer time horizon of about 15 years, characterised by a secular bull market, the signal was very weak in 2023. In any case, as you already know, the return on the SP500 at 1W is definitely positive.

The other, the Put Call Ratio, is a measure of activity on put and call options on a specific day: the higher the ratio, the more activity there is on put options. It is often considered a contrarian indicator and on 5 October it had reached its second highest level of the year at 1.42. Several analysts have pointed out that the returns after such levels are usually positive, implying that this could be a bullish signal. In reality, although this is true over the longer time horizon of about 15 years, characterised by a secular bull market, the signal was very weak in 2023. In any case, as you already know, the return on the SP500 at 1W is definitely positive.

Put/Call Ratio (above) and US500 (Below), 2023

Returning to a more traditional technical analysis perspective, the US500 on 4 October was testing its MA200, had closed the previous day just below the bullish channel from October 2022 and was in the proximity of the important support in the 4190-4200 area; the RSI was close to oversold levels and the price was testing the lower part of a recent bearish channel inside which it seems to have been moving since mid-July 2023. A rebound was probably due: but now come resistance zones, first in the current 4340-4360 area, floor of the whole last summer period – and then the 4400 area where both a negatively inclined 50MA and the upper part of the bearish channel await. These are two important obstacles and who knows if the index will have the strength to break them in the current confused macroeconomic situation.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.