The main theme so far today has been Yen weakness, which took hold during the European AM session.

This floated USDJPY to a 2-session high at 100.45, putting in a little more distance from the 6-week low that was seen yesterday at 109.70. AUDJPY and EURJPY, among other Yen crosses, have also risen, with the Japanese currency seeing some of its safe-haven premium unwind concurrently with a steadying in global stock markets, although sentiment remains palpably fragile as investors continue to fathom the recent sharp dive in US yields and yield curve inversions.

Meanwhile from Euro side, the above-forecast French business confidence and German Ifo survey outcomes, in data releases today and yesterday, respectively, have been tonic for markets, however the EURJPY remains about 90 pips net higher from levels prevailing of the foray of Bund yields into negative territory having offset the sharp drop in US yields.

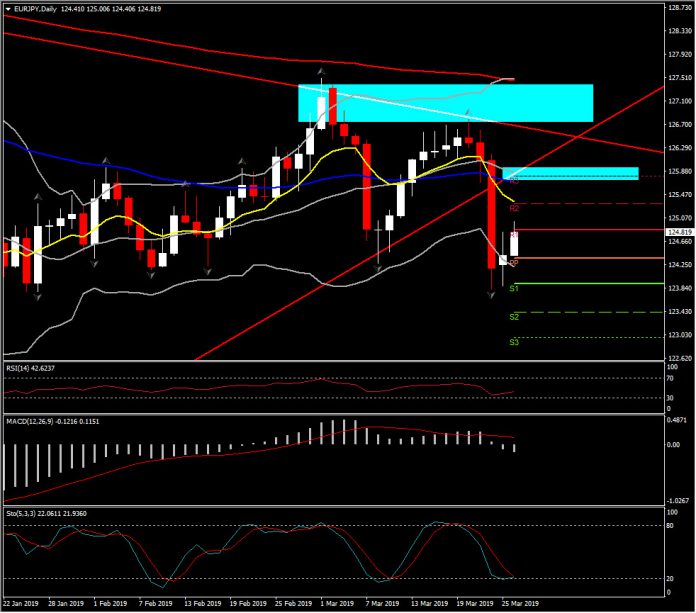

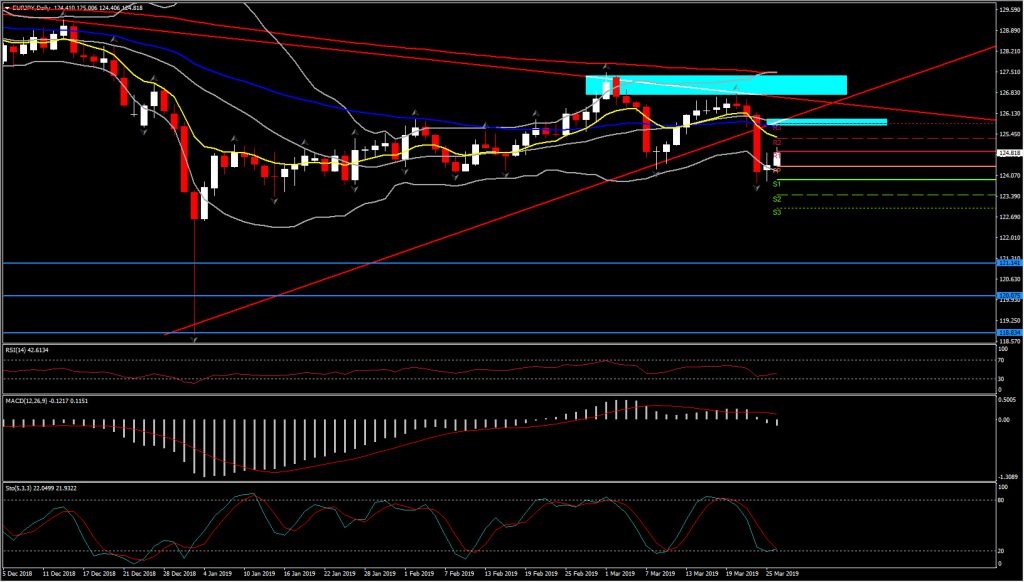

The 2-day rebound in US yields, which keep weighing on JPY, contradicts with the overall Euro weakness. Continuing to trade below the descending triangle set throughout Q4 2018, EURJPY sustains a negative outlook in the medium and long term. A breach of the January-March Support around 123.40 (also halfway of 2016-2018 rally), would re-open the 2017 low area which was also breached in 2019 open, at 118-80-122.00.

Such a drift to multi-year lows is not easy. A strong move on a closing basis needs to be confirmed at 123.40 level, as the momentum indicators are already negatively configured in the medium term.

This comes with further downside potential on the RSI which is in the high 40s, whilst the MACD and Stochastics lines are once more crossing lower in bearish configuration. Further pressure to the downside has been added on the bearish crossing of 50- and 200-week EMA.

For now, a swing higher could technically imply a “buying the deep” approach from the market participants, with limited gains to the upside though. Resistance comes at 125.65 and 125.95.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.