Global growth increasingly appears to be resting on a one-legged stool, with Asia’s economies facing exports slowing/contracting through the turn of the year and the slowdown in Europe feeding the narrative, feeding concern that global growth will erode this year.

Indeed, softening growth in Asia, notably in China, should continue to underpin expectations that the G-7 central banks will hold policy steady this year or in some cases add accommodation.

Exports among Asia’s economies have contracted or slowed on an annual basis in recent months. An increase in tariffs and the slowing in China’s economy has weighed on the quantity of exports shipping out of the region. Hong Kong, Indonesia, the Philippines, South Korea, Taiwan and Thailand have experienced falling exports (y/y) in recent months. India and Malaysia have seen export growth slow so far this year.

The timing of the New Year holiday this year explains a portion of the sharp declines around the turn of the year, but US tariffs and diminished demand globally are taking a hefty bite out of China’s exports. China’s economy slowed through Q4 of 2018 to a 6.4% y/y pace that was the slowest since a matching 6.4% rate of expansion in Q1 of 2009. Further moderation is anticipated this year, with GDP easing to a 6.0% y/y clip by Q4 of 2019.

Generally, in the Asia region, inflation growth also slowed through the turn of the year, as softer growth and weaker energy prices impacted. China’s CPI moderated to a 1.5% y/y pace in February from 1.7% in January, leaving the tamest pace since the 1.7% y/y clip in November of 2017.

Meanwhile, Japan remains the standard bearer of low inflation/deflation among the G-7. The core CPI measures (excludes fresh food but includes energy) dipped to an 0.7% y/y rate of expansion in February from 0.8% in January.

The BoJ’s long held goal is to return this measure to 2.0%. It has been a long wait, with no end in sight.

Indeed, the “Summary of Opinions” from the Bank of Japan’s March meeting argued for “maintaining powerful monetary easing” in order to sustain momentum for hitting its price goals. The BoJ aimed to keep current policy intact, while watching economic developments and keeping an eye out for the side-effects of stimulus.

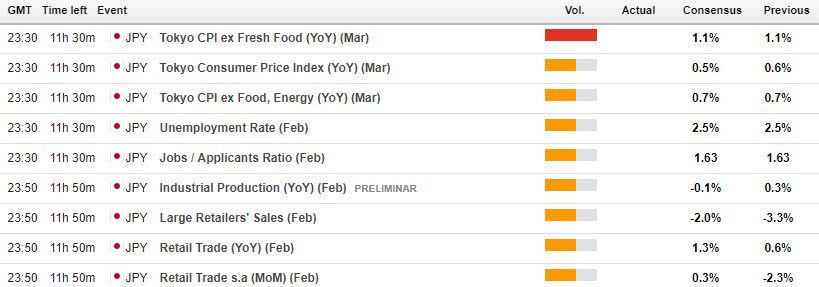

Hence tonight’s Tokyo CPI outcome along with Production data could give another indication to BoJ regarding its policy actions. Today’s data are also the last data to be announced before the start of the new fiscal year for Japan, as Japan’s fiscal year begins in April.

Tonight’s data: The country’s main leading indicator of inflation (Tokyo CPI) is expected to have remained at 1.1% y/y in March, at the same level as in February. Industrial Production is expected to have improved, growing by 1.4% m/m in February, compared to -3.4% m/m in January, while Retail Sales are expected to have increased by 0.9% y/y in February, compared to 0.6% in January.

PS: In January, BoJ reduced its inflation projections, with CPI for fiscal year (FY) 2018 now seen at 0.8% (was 0.9%), and FY 2019 at 0.9% (was 1.4%).

BoJ continues to view downside risks to Japan’s economy “clearly heightening,” amid increasing signs of Japan sliding into recession amid slowing global growth and the sales tax hike impact just ahead.

Hence although Tokyo CPI only comes from the single Japanese city, it acts as a fairly accurate bellwether of the national inflation figure, and therefore is by far the largest populous within Japan’s borders. Theoretically, the purchase power of JPY is dragged down by inflation. Therefore a high reading is seen as positive for the JPY, while a miss could undermine the currency.

Nevertheless, the broad trends in trade, CPI and GDP across the Asian economies are consistent with further slowing in export growth and regional growth through 2019.

Given Brexit chaos and diminishing EU growth prospects, Asia’s challenges add to the headwinds facing equity markets this year while providing support for fixed income markets.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.