GBPUSD, Daily

Sterling has come under pressure in the London session, and is presently showing a 0.3% decline versus both the Dollar and Euro. News that the press officer for Northern Ireland’s DUP has reaffirmed that his party will be voting against Prime Minister May’s Withdrawal Agreement later today has put the Pound under the cosh. This should not be too surprising as May has tabled her deal without the future arrangements part, which, although a deliberately vague political declaration (to be worked on later), was sure to cement final opposition of the DUP as this was the one part of the deal that provided assurances on the Irish backstop issue. The DUP — a fiercely pro-Union party — had in any case been on a course to vote against May, given the potential for the Irish backstop to separate Northern Ireland from the rest of the UK by a customs border down the Irish Sea.

Cable dove over 60 pips to an eight-day low of 1.3010 while EURGBP spiked by about 40 pips to levels around 0.8620-25. Markets are pricing in the end of May’s deal and a significant further weakening in her authority, which will almost certainly lead to her resignation. The Economist this morning also reported that “Theresa May’s successor will be selected by a Tory membership who are whiter, older and keener on a hard Brexit than the rest of the country.”

Assuming that May’s Brexit is indeed voted down, Parliament would then have until April 12 to come up with an alternative plan to avoid the legal default no-deal scenario from happening. It is expected that Parliament — which has in several non-binding votes since January clearly indicated it will not countenance a no-deal option — will come up with a new way forward, whether by way of an alternative Brexit plan or a new referendum. The odds for a general election have also increased.

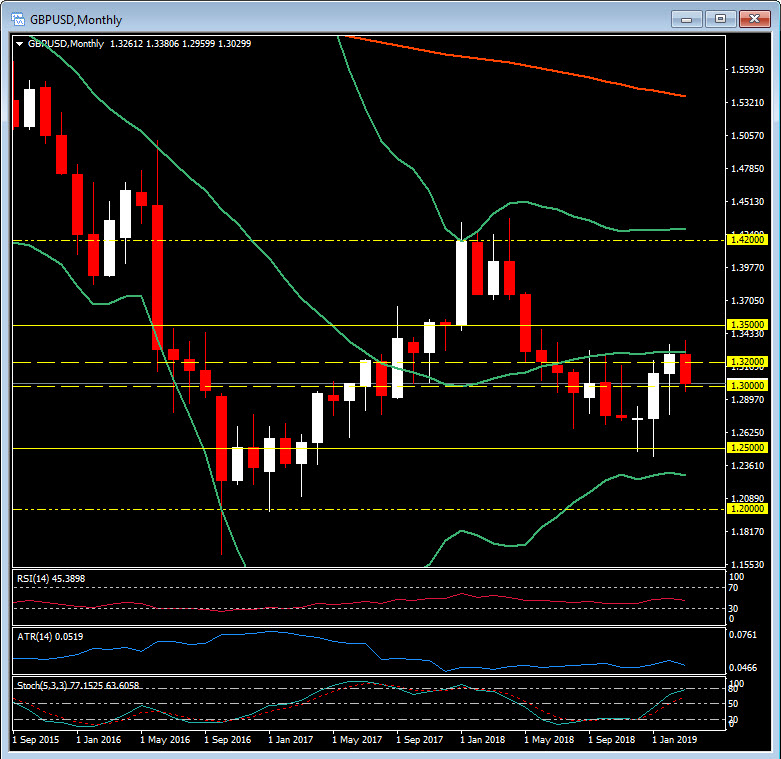

Where does all of this leave Sterling? In the short-term cable appears on its way to be testing 1.3000 (it closed below the key 200-day EMA yesterday, while Stochastics and RSI remain negative). A breach and break of this key psychological level will see a test of the February low below 1.2800. However, with volatility increasing throughout March and the rise of the ATR to 157 pips yesterday, 1.3000 becomes even more significant. The daily pivot at 1.3100 and first resistance at 1.3200 would need to be breached for a break of this 200 pip range.

The higher time-frames have ranges extending to 1.2500 and 1.2000 (in the now unlikely event of a No-Deal Brexit, a Corbyn premiership and the BOE acting to cut interest rates). Options to the upside are 1.3500 and even 1.4200 should the Brexit benefit play out, the UK economy grow significantly and the BOE act to increase interest rates.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.