Profit-taking on overbought conditions was the general rational after bond bulls overzealously brought forward Fed rate cuts to the spring, and aggressively priced in 50 bps in easing by mid-year. The mixed signals from the data on retail sales, PPI, and the Empire State did not provide much direction. Treasuries gave back about half of Tuesday’s CPI-inspired rally as yields climbed about 7 bps across the curve.

Meanwhile, President Biden and Chinese leader Xi Jinping adopted a less contentious tone at their summit, though deep US-China disagreements remain.

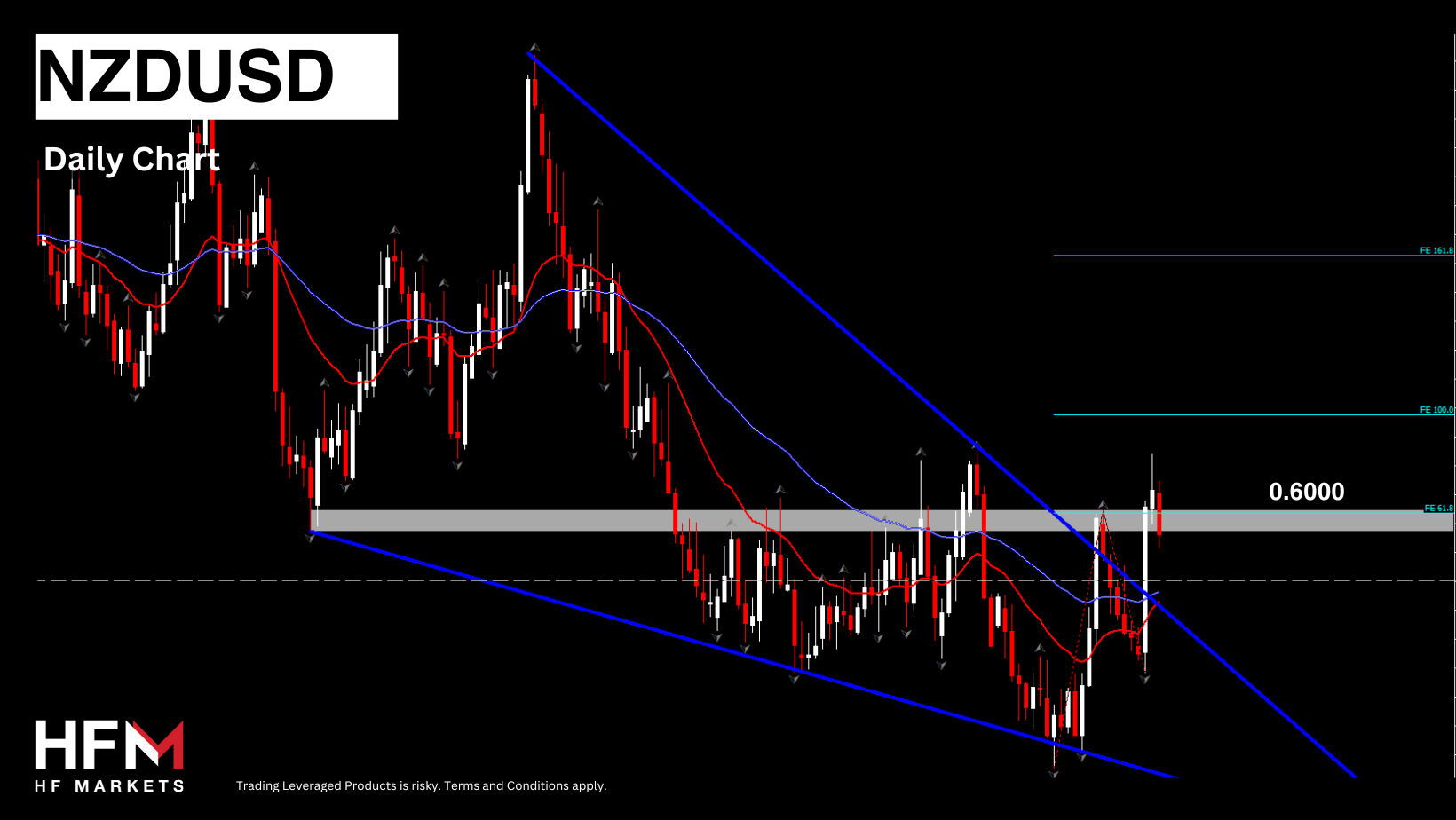

Interesting Mover: NZDUSD (-0.74%) holds ground above 4-months descending channel. Key support at 0.5940 and Key Resistance at 0.6000.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.