FX News Today

- Bond yields continue to recover from recent lows.

- Stock markets started the second quarter with renewed optimism.

- USA500 still posted the best quarter in a decade.

- Signs of progress in US-Sino trade talks helped to underpin sentiment and saw mainland China bourses outperforming amid a general move higher in Asian stock markets. Both sides said there was progress in talks.

- An unexpected jump in China’s Caixin manufacturing PMI to 50.8 revived hopes that government measures will boost the economy.

- The front end WTI future is trading at USD 60.58 per barrel amid sanctions and production cuts.

- USDJPY edged to an 8-day high at 111.17.

- EURUSD rebounded to 1.1240 overnight after printing 3-week low of 1.1207.

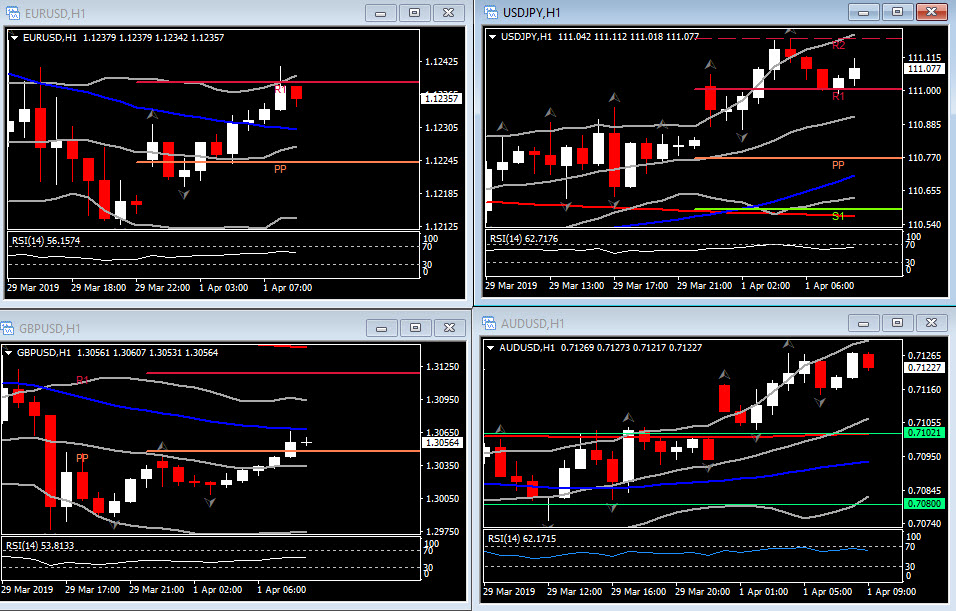

Charts of the Day

Technician’s Corner

- EURUSD rebounded, breaking through the 1.1240 R1 level. However, it appears to have reached the end of the hill for today as it is currently looking southwards with RSI sloping lower as well.

- GBPUSD keeps inclining so far today, but remains close to Pivot at 1.3048 as fears of no-deal Brexit continue.

- USDJPY printed an 11-day high at 111.18, as the safe haven premium of the Japanese currency unwind. USDJPY has support at 110.50-53, levels which encompasses the prevailing situation of the 100-day moving average.

- NZDUSD – Top gainer so far along with Aussie – jumped to 0.6836, from Thursday’s-Friday’s tweezer bottom. A confirmation of this formation and a move above the 20-day SMA at 0.6840, could turn the attention to last week’s highs at around 0.6900.

Main Macro Events Today

- Caixin Manufacturing PMI (CNY, GMT 01:45) – The Caixin manufacturing PMI is expected to remain unchanged at 49.5 in March.

- Consumer Price Index (EUR, GMT 09:00) – Prices are expected to be confirmed at 1.5%y/y in March, with core inflation holding at 1%.

- Retail Sales (USD, GMT 12:30) – February’s Retail Sales are expected to have grown by 0.3% m/m, from the 0.2% rise in January.

- ISM Manufacturing PMI (USD, GMT 14:00) – The US ISM Manufacturing PMI is expected to come out at 54.5 in March, compared to the 2-year low of 54.2 in February.

- BREXIT Vote on alternative plans.

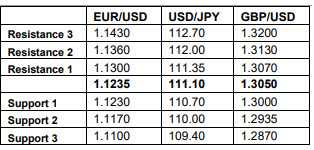

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.