The generative AI craze fuelled by the debut of ChatGPT a year ago has further enhanced Nvidia’s market position. New AI technologies require more intensive computing than standard processors can do. This presents an opportunity for Nvidia. The tech company was already the dominant graphics chip maker when new AI technologies started to emerge over the past decade. Nvidia’s powerful processors now run most of the data centres supporting the generative AI revolution.

Early last November, Nvidia introduced the H200 computing platform designed to train and deploy AI models that support the explosion of generative AI. The H200 is the first GPU to use an advanced memory technology called HBM3e. The event pushed Nvidia shares higher at that time. Cloud service providers Amazon Web Services, Microsoft Azure and Alphabet’s Google Cloud have developed their own AI processors that for now, work alongside Nvidia’s chips.

But challenges lie ahead, from competition to increasing questions and concerns about a rapidly growing yet controversial market that is still in its infancy. After all, no one likes to be tied down to a single vendor, giving rise to several options that might pose a threat to Nvidia’s market dominance and existence.

The uncertainty surrounding Nvidia’s AI future was underlined last week, when Nvidia shares fell despite an excellent earnings report that far exceeded expectations. All this is because Nvidia’s sales guidance missed the high end of estimates, or the unofficial estimates circulating in the market. The stakes will rise in the next fortnight when its main rivals AMD and Intel launch new AI products and initiatives.

AMD is officially scheduled to launch its family of data centre graphics processing units [GPUs], the Instinct MI300 on 6 December. AMD said it will discuss its growth momentum with AI hardware and software partners. And Intel on 14 December will launch its 5th Generation Intel Xeon processors for data centres and Intel Core Ultra processors for laptops.

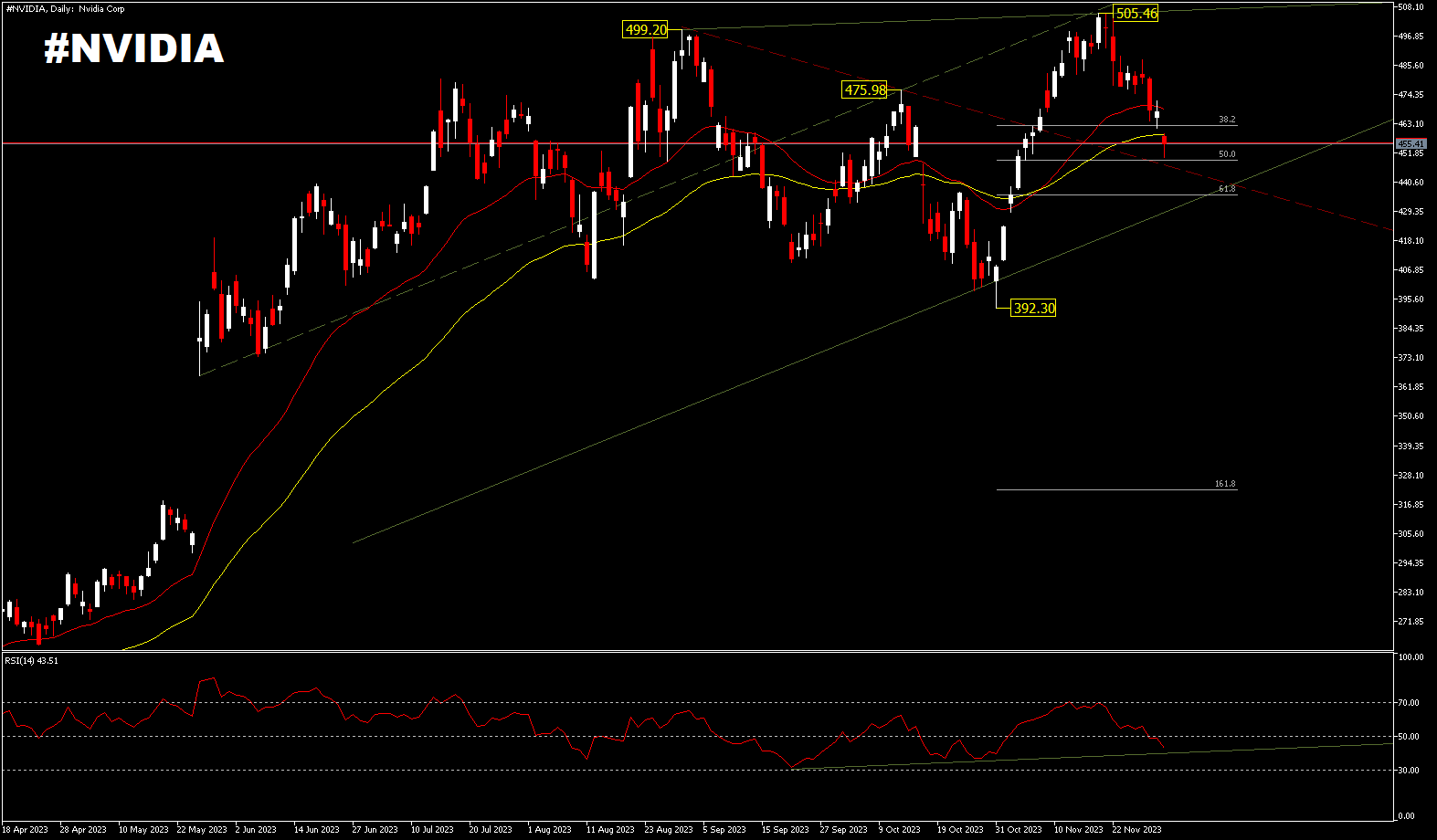

In the stock market, a surge in demand for chips for artificial intelligence infrastructure pushed #NVIDIA shares to a recent record high [$505.46]. In the company’s fiscal third quarter ended 29 October, Nvidia’s data centre sales jumped 279% from the year-earlier period to a record $14.51 billion. Its data centre business accounted for 80% of its total revenue.

Nvidia is a clear leader among AI stocks and semiconductor stocks. Technical analysis shows that the stock has corrected below $475.98 and the 26-day EMA. The stock retreated from the $505.46 peak on 20 November, as it was overweighted and looked overbought, so it corrected by 50% until Monday’s trading [04/12], slightly below the 52-day EMA. Further correction could test the 61.8%FR level around $435.00 with strong support seen at $392.30.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.