FX News Today

- 10-year Treasury yields are up 1.3 bp at 2.528%, JGB yields down -0.7 bp at -0.0585 amid subdued trade on Asian stock markets.

- China was closed for a holiday and elsewhere markets traded mixed, with Topix and Nikkei managing gains of 0.23% and 0.28% respectively, while the ASX closed with a loss of 0.83%, although the latter was an exception, with most markets managing slight gains.

- There were some optimistic comments on the progress of the US-Sino trade deal from China, with Trump tweeting that he expects a deal “within 4 weeks” but after the recent run higher in equities traders will want to see more than words before pushing valuations higher.

- Markets will also be holding back ahead of key US payroll data today amid lingering concerns about the outlook for world growth. US futures are posting slight gains ahead of the key release, with the Dow Jones mini up 0.133%.

- GBP picked up (back over 1.3100) on a Brexit “Flexi-Extension” offer from the EU which suggests an extension of up to 12 months, but Britain could leave at any time if they signed an agreement.

- The front end WTI future meanwhile is trading at USD 62.16 per barrel.

Charts of the Day

Technician’s Corner

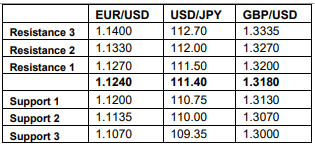

- GBPUSD reacted positively to “Flexi-Brexit”, showing upwards potential with Resistance at the 200HMA at 1.3126, and a stronger one at 1.3184, while Support stands at 1.3067.

- EURUSD moved up and down yesterday, with MAs showing an upwards movement with Resistance at its 200HMA at 1.1238, with both the MACD and Stochastics showing upwards signs.

- USDJPY continued its rise, breaking through the 110.68 level and trading around that level as of this morning. Both the MACD and the Stochastics indicators are suggesting a downturn. Support and Resistance remain at 110.95 and 111.80.

- XAUUSD has been trading in the 1285-1294 band, with indicators giving out mixed signals. Support and Resistance are marked as the channel bounds.

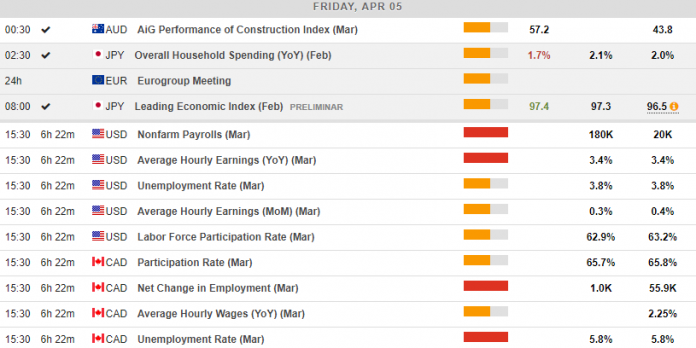

Main Macro Events Today

- NonFarm Payrolls, Earnings, Unemployment (USD, GMT 12:30) – The most important piece of news this week, NFPs are expected to have grown by 180K, compared to 20K in the previous month, while earnings and unemployment are expected to have remained at the same levels.

- Canada Labour Market Data (CAD, GMT 12:30) – Canadian Participation Rate is expected to have declined to 65.7% compared to 65.8% last month, while the net change in employment is expected to have been just 1K compared to 55.9K last month. Unemployment is not expected to have changed.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.