The ECB turned all out dovish at the March meeting, after the central bank pushed out the timing of the first rate hike and announced another round of TLTRO loans just a month ago. Expectations are for a pretty balanced statement tomorrow (April 10 – 11:45 GMT) and at the following Press Conference (12:30). The details of the new round of targeted long term loans still have to be hammered out and officials are also debating measures to tackle the negative side effects of a deposit rate that will remain in negative territory for longer than expected. As the last round of TLTRO loans also tied lending rates to either the repo rate or the deposit rate, depending on actual lending performances at individual banks, both issues are actually related and details are expected at the June meeting, when the next round of forecasts are going to be released and the outlook on the Brexit front may have become a bit clearer.

Tomorrow’s meeting, will, however, give an opportunity to finalise contingency plans for a no-deal scenario should the Emergency EU Council summit tomorrow not bring an extension, or if things go wrong in London, where May is still under pressure from hardcore Brexiteers within her own party. Looking further ahead, the balance of risks remains tilted to the downside as geopolitical trade tensions continue to cloud over the outlook and at the moment the chances are that the guidance on rates will be pushed out further. The ECB is also keeping the option of restarting QE purchases open in case the economic situation worsens further.

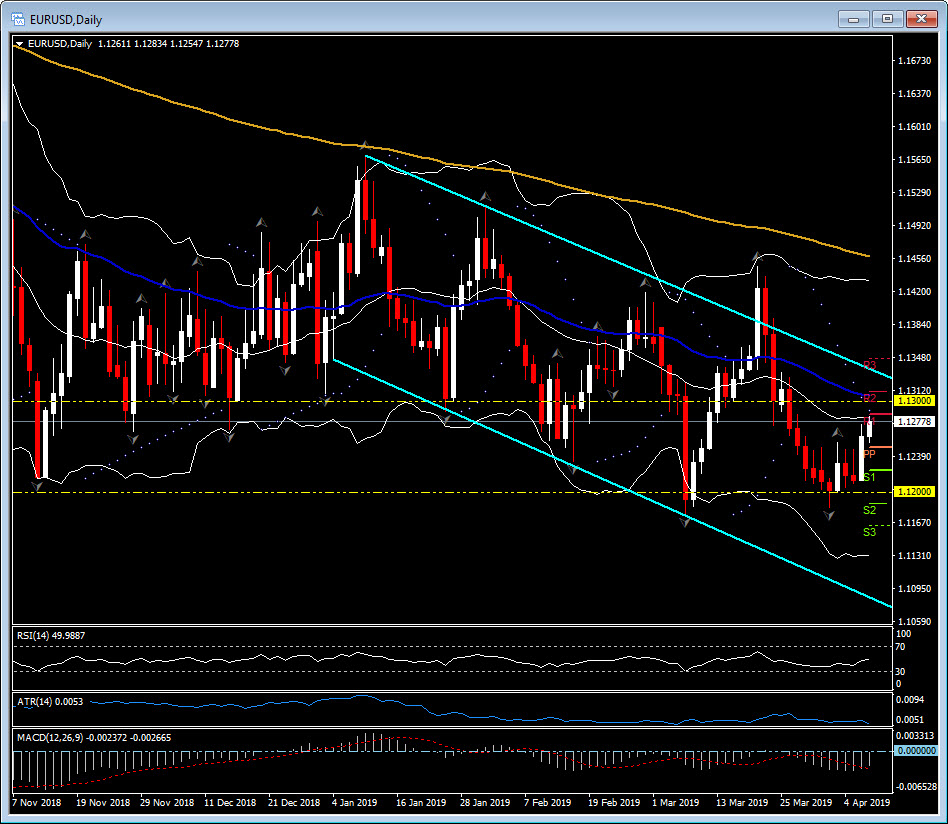

Technically EURUSD remains biased to the downside with key support at 1.1200, 1.1130 and 1.1075. Resistance sits at 1.1300, 1.1325-50 and 1.1400.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.