FX News Today

- 10-year Treasury yields are down -1.4 bp at 2.486% as JGB yields fell back -0.4 bp to -0.063%.

- The IMF’s growth downgrade has rekindled concerns about the outlook for the world economy and the US threat of new tariffs on imports from Europe has reminded markets that geopolitical trade tensions are far from resolved and put a stop to the rally in recovery in stock markets seen over the past week.

- China’s bond yield rose to the highest this year as risk aversion flared up and the focus increasingly turns to China’s still large number of non-performing loans.

- Markets are also looking to Europe today, where the EU has to make a decision on yet another Brexit extension. The IMF named Brexit as one of the risks to world growth.

- Wall Street closed in the red and Asian markets also headed south, with Topix and Nikkei down -0.73% and -0.66%. The Hang Seng lost -0.34% so far and CSI 300 and Shanghai Comp are down -0.10% and -0.14%.

- US stock futures, however, are posting marginal gains, after yesterday’s correction on Wall Street.

- The front end WTI future meanwhile continues to hold above USD 64 per barrel.

Charts of the Day

Technician’s Corner

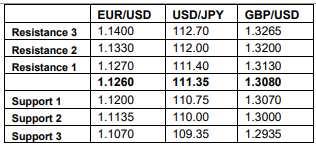

- EURUSD started moving upwards on early Wednesday, following the Brexit positive news, with both Stochastics and the MACD showing support for this movement.

- GBPUSD has been fluctuating in the 1.3026-1.3067 range for the past hours, also bounded by the 200HMA at 1.3082. Stochastics and the MACD support an upwards movement.

- USDJPY broke through the 200HMA, now at 111.31 early yesterday, but has been moving in a slight upwards trend after the worse than expected machinery orders for February. Indicators support the movement.

- XAUUSD broke through the 1300 mark but is still bounded by the 1304 Resistance, with indicators appearing indecisive regarding the future trend in the pair.

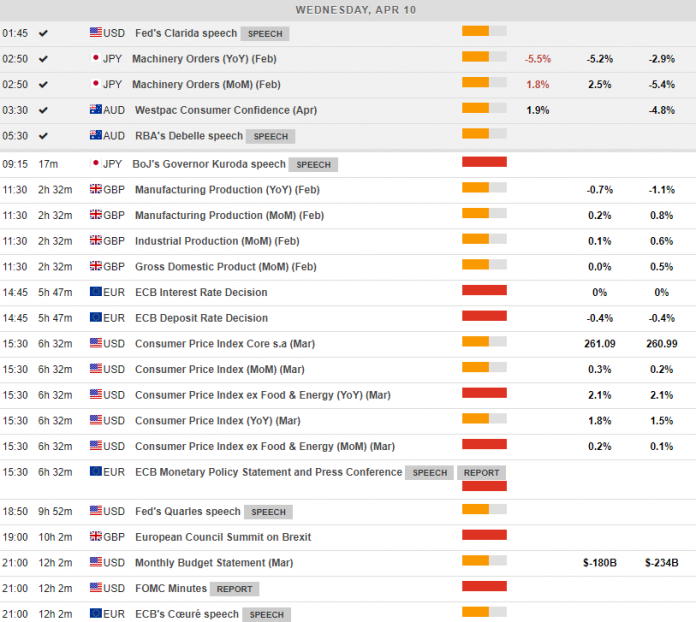

Main Macro Events Today

- UK Manufacturing and Industrial Production and GDP (GBP, GMT 08:30) – Manufacturing production is expected to have declined by 0.7% y/y on February, compared to -1.1% in January. Industrial Production is expected to have eased to 0.1% m/m compared to 0.6% m/m last month, while UK GDP for February is forecast to register zero growth m/m, down from 0.5% m/m in January.

- ECB Interest Rate Decision (EUR, GMT 11:45) – No changes are expected in the ECB policy rate, even though some policy guidance should be offered, especially with regards to future rate hikes.

- US CPI Inflation (USD, GMT 12:30) – Core CPI is expected to have remained at 2.1% y/y, close to the Fed’s 2% target. The overall index is forecast to rise to 1.8% compared to 1.5% in March.

- European Council Summit on Brexit (EUR-GBP, GMT 16:00) – The future of Brexit is expected to be discussed in the summit, with the EU said to offer a “flextension” until either December 2019 or March 2020, even providing the UK with the opportunity to withdraw its application for leaving the EU.

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.