GBPUSD, H1, Daily

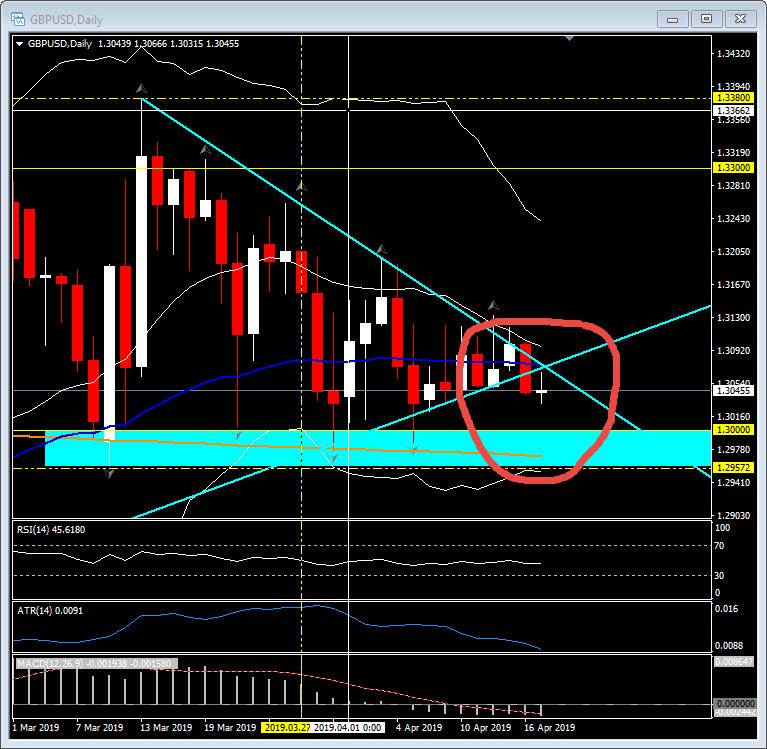

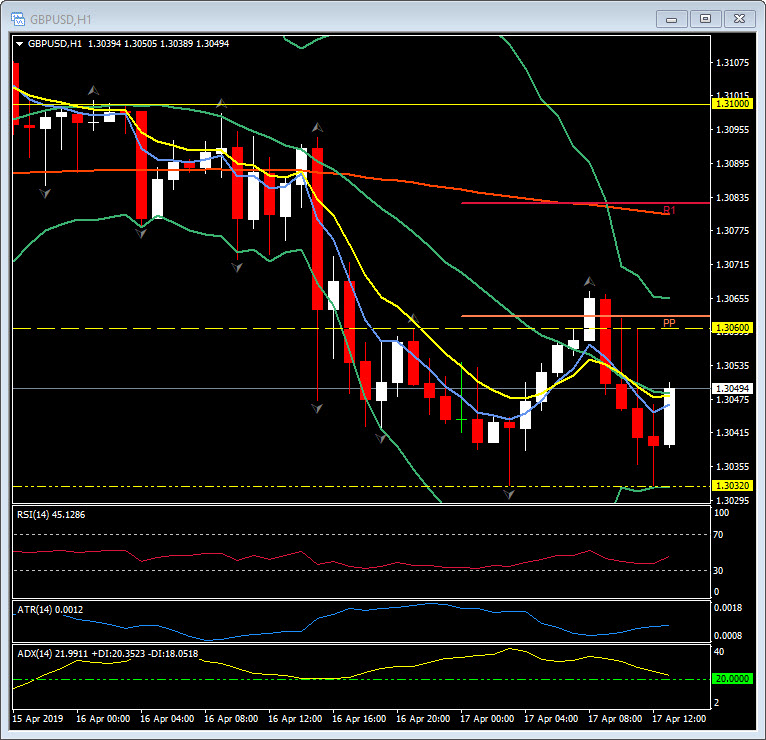

The Pound took a dip on sub-forecast UK CPI data, headline CPI coming in at a rate of 1.9% y/y, unchanged from February, but below the median forecast for 2.0% y/y. Core CPI also remained unchanged at 1.8% y/y, contrary to the market expectation for a tick higher to 1.9%. The BoE had been anticipating a tick higher in headline CPI, so today’s figures have painted a more benign near-term price picture than the central bank envisaged. Cable printed a low at 1.3032, so far today, retesting the the Asian session low. As for Brexit, while there has been some reprieve of related angst brought about by the delay in the process, the attention in market narratives has been turning the deleterious economic impact the associated uncertainty has been inflicting on the UK economy. In the mix is diminished expectations for the UK government and the Labour party, the principal opposition, coming together on Brexit following a Guardian report yesterday. Yesterday’s robust employment data was backward looking, with more timely March PMI surveys having already highlighted a reduction in employment in the UK’s dominant service sector, suggesting there has been a deterioration in employment conditions that is not yet being reflecting by official data. Recent range lows in Cable are contained within 1.2957 and key 1.3000, which mark out a reference support zone, including the key 200-day moving average. The pair have been below the 20-day moving average for 15 trading days, since March 27. The 20 MA now sits at 1.3095 and the first important resistance level. RSI (45) and MACD (below 0) are both biased to the downside.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.