Economic Indicators & Central Banks:

- Treasuries finished with losses on Wednesday, reversing Tuesday’s gains. The FOMC minutes did not provide any new information on the policy front, though did underscore what was already known, that peak rates have likely been achieved, but there is no rush to begin cutting rates.

- CME FedWatch Tool: Traders currently estimate a roughly 30% chance of the Fed beginning rate cuts in May, down from over 80% a month earlier.

- Nikkei (JPN225) share average reached a historic peak on Thursday, surpassing the bubble-era high of 1989, primarily driven by gains in chip-related stocks following Nvidia’s positive outlook.

- Today: Flash PMI data for the US, UK, and Eurozone are scheduled later in the day, offering insights into the performance of their manufacturing and service sectors.

Market Trends:

- Wall Street finished mixed after trading in the red most of the session amid anxiety ahead of key earnings from Nvidia.

- The S&P 500 finished under the 5000 level after hitting a new all-time peak of 5029.73 last Thursday.

- Nvidia announced mixed results after the bell, posting a solid revenue beat, strong demand for its AI-dominating chips and a positive sales forecast to help further underpin AI enthusiasm.

- The Nikkei rose 6% initially and closed up 2.19% at 39,098.68, breaking the previous all-time closing high. Further rally in the Nikkei, could hit 40,000 and 42,000 if momentum names continue to participate.

- Tokyo Electron and Advantest surged 6% and 7.5%, respectively, contributing significantly to the Nikkei’s gains.

- Japan’s benchmark has surged approximately 52% since its January 2023 low, fueled by a tech rally, corporate governance reforms, and increased profits for exporters due to a weakened Yen.

Financial Markets Performance:

- The USDIndex finished lower, but just barely hung on to the 104.000 level. Traders anticipate various business activity surveys to assess the economic condition of major economies and its potential impact on global interest rates.

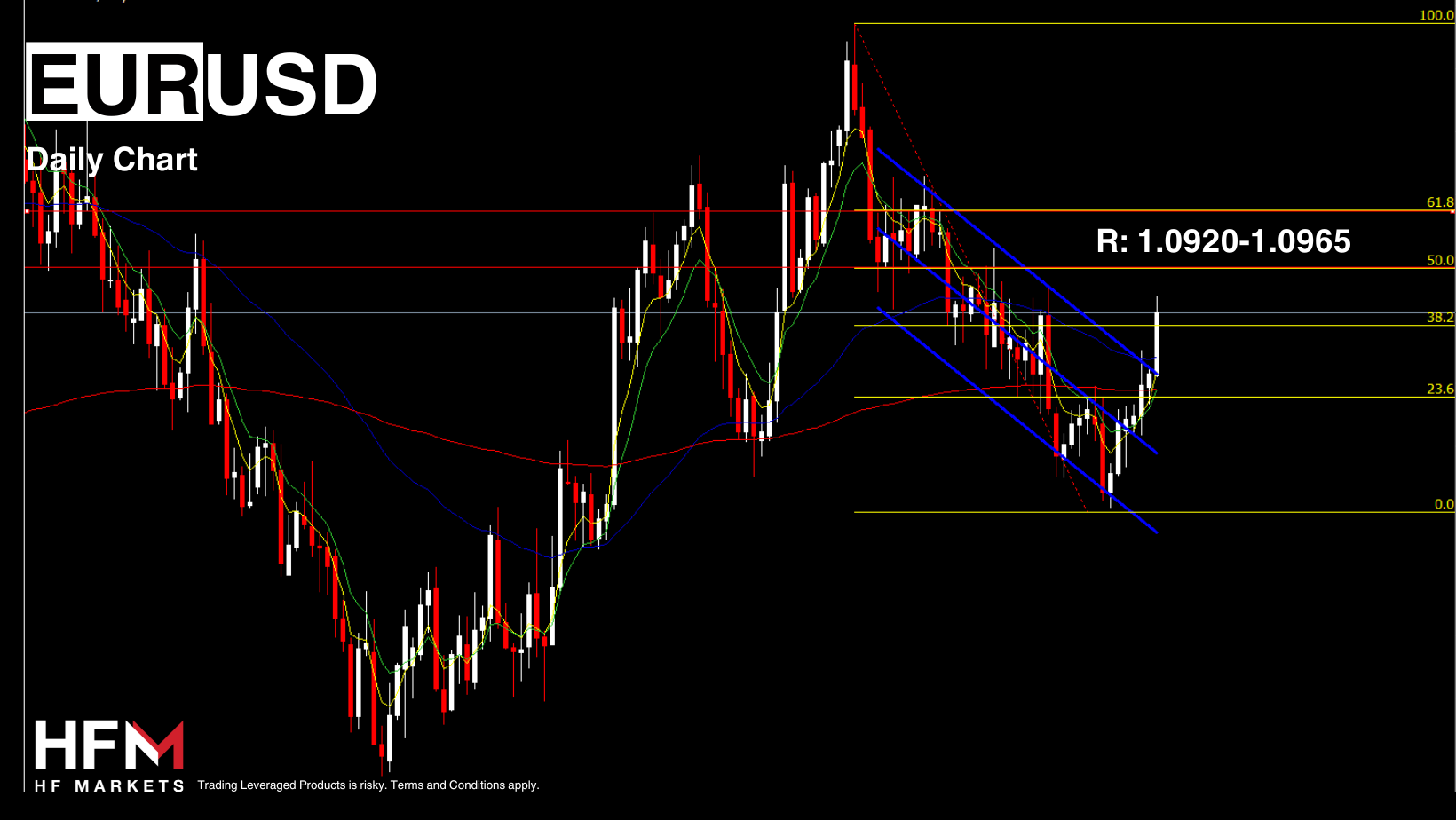

- The Euro strengthened by 0.14% to $1.0835, while the Pound increased by 0.08% to $1.2647. Conversely, the USDJPY slipped 0.04% to 150.23.

- NZDUSD reached a 1-month high of $0.6205. Expectations for the RBNZ to maintain its cash rate at 5.5% next week have led to some support for the kiwi, though there’s speculation of a potential hike.

- Gold was in the green, edging up fractionally to $2025.72 per ounce.

- USOil rose 1.22% to $77.98 per barrel.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.