GBPJPY remained heavy amid safe haven demand for the Yen but also amid a weak Pound on Brexit fatigue. The low reflected safe haven demand after Wall Street saw its worst day in 2 months, as markets continued to digest looming tariff hikes on imported Chinese goods to the US. Markets are anticipating the visit of Chinese vice-premier Liu to Washington, hoping for signs of a thawing in tensions in trade negotiations.

At the same time, the Pound ignored strong BRC retail sales and a rebound in house prices and fell sharply on Brexit-related news. Sterling is at fresh lows as ITV news reporting that talks between the government and the Labour Party are at “near collapse.”

The government had earlier confirmed that the UK would be taking part in the May 23 elections of the European parliament, although this had been widely expected. There had been a chance that the UK could have still left the EU ahead of this date had the government and Labour agreed on a compromise Brexit deal. The issue about whether the UK should remain a permanent member of EU’s customs union has been the main obstacle. EU parliamentary elections on May 23, which the UK is obliged to partake in, will provide an updated litmus test of UK public support, or lack thereof, for Brexit, with both pro- and anti-EU parties standing.

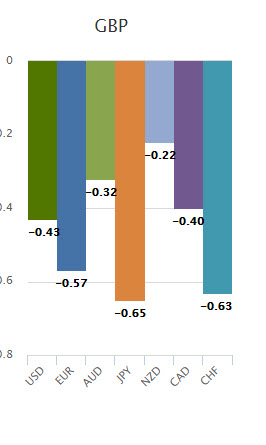

Overall, this week, Brexit fatigue has seen the Pound weaken against most currencies. The currency is presently showing a decline of just over 0.4%, on average, against majors, with the highest being against Yen, at 0.65%.

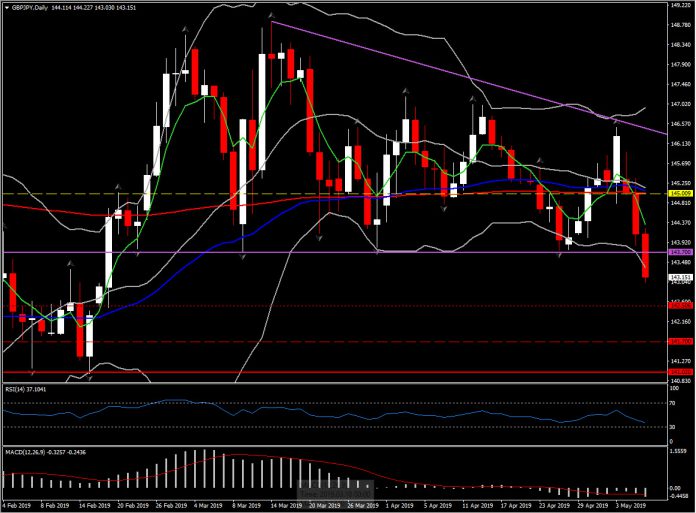

GBPJPY has concurrently tipped sharply to February’s lows, while EURGBP has risen to 5-day highs. In the meantime, the GBPJPY bias is expected to remain to the downside, based on the strong break of the 2-month Support which is reflected by the bottom of a descending triangle since March peak.

Further losses below this area bring into attention February’s low area, i.e. 141.00- 141.70. Immediate Support for the day comes at 141.50 and Resistance at 143.70.

Other than the above, technical analysis supports the negative outlook of the asset in the medium term as Daily Bollinger Bands extend southwards. RSI has been sloping towards oversold area since Friday, while MACD lines are also decelerating lower following a recent bear cross in the intraday basis but also in the daily basis.

Brexit, and the impact that the prolonged uncertainty is having on the UK economy, should keep the Pound on a softening tack.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.