FX News Today

- Treasuries sold off as risk appetite soured. Wall Street posted broad based and solid intraday gains of over 1% Thursday.

- There was good news on the data front, as well as stellar earnings news from Walmart to add to the bullish tone in equities.

- Bank of Japan governor Kuroda said the ultra-low rates may be maintained for a further period of well over a year. However, Kuroda warned against the idea of propping up the economy through unlimited money printing saying that “when a central bank monetises debt unlimitedly, it will most certainly trigger hyper-inflation and cause huge demand to the economy”.

- There were comments in China state media saying China may have no interest in continuing trade talks with the US for now.

- The Yuan fell past the psychologically important 6.9 per dollar level, something that previously had been speculated to eventually lead to the selling of Chinese Treasury holdings to prop up the currency.

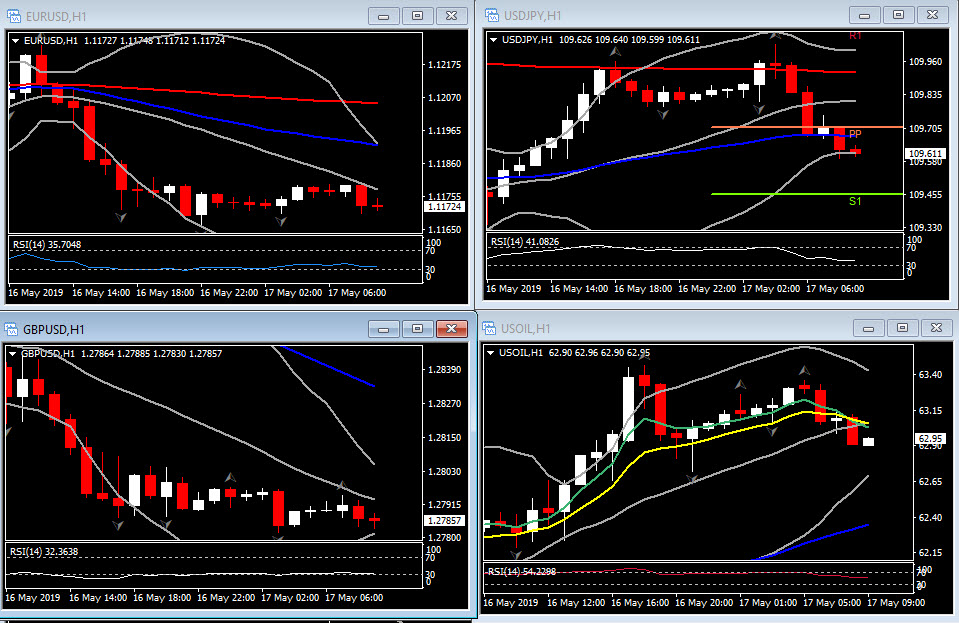

- The WTI future is trading at $62.98 per barrel. Geopolitical tensions in the Mideast continue to provide support, with the latest rally coming as Saudi Arabia blamed Iran and its proxies for attacks on Saudi oil infrastructure this week.

Charts of the Day

Technician’s Corner

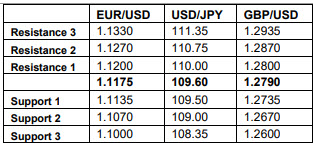

- EURUSD fell to 8-session lows of 1.1172 at mid-morning, slipping from opening highs near 1.1210. The early round of Dollar friendly US data saw the pairing start its decent, with selling picking up some pace on the break under the 20-day MA of 1.1197. The May 7 low of 1.1167 Support was reached , however the asset has managed to hold above it so far today. A break there could open the door for a test of the May 3 low of 1.1135.

- GBPUSD’s low is 1.2787 in what is now the fifth consecutive daily decline and the eighth down day out of the last nine trading days. Resistance comes in at 1.2875-78. Next Support holds at 1.2700.

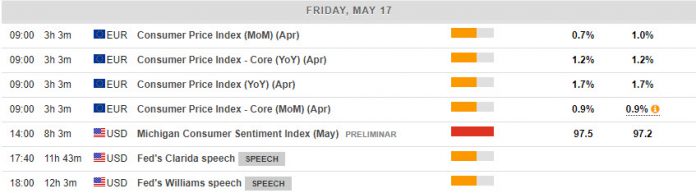

Main Macro Events Today

- Consumer Price Index (EUR, GMT 09:00) – The Euro Area CPI for April is expected to slow down slightly, at 0.7% from 1% last month. However, the overall picture remains largely unchanged, with headline inflation remaining modest, but underlying inflation starting to firm. No reason then for the ECB to add additional stimulus measures to an already very accommodative policy stance, and “low for longer” remains the message not just from the ECB.

- Michigan Consumer Sentiment Index (USD, GMT 14:00) – The preliminary May Michigan sentiment reading is forecast at 97.7, up from the final April sentiment at 97.2.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.