Last week, the Tesla CEO – Elon Musk – announced the successful completion of $6 billion Series B financing (market valuation at $24 billion – about 1/3 of OpenAI’s current valuation) for his artificial intelligence startup xAI. Established in July 2023, xAI is primarily focused on the “development of advanced AI systems that are truthful, competent, and maximally beneficial for all of humanity”. The company has been continuously making progress on its Grok chatbot (which has been integrated into social media platform X), which is now claimed to be competitive with existing frontier multimodal models in a number of domains.

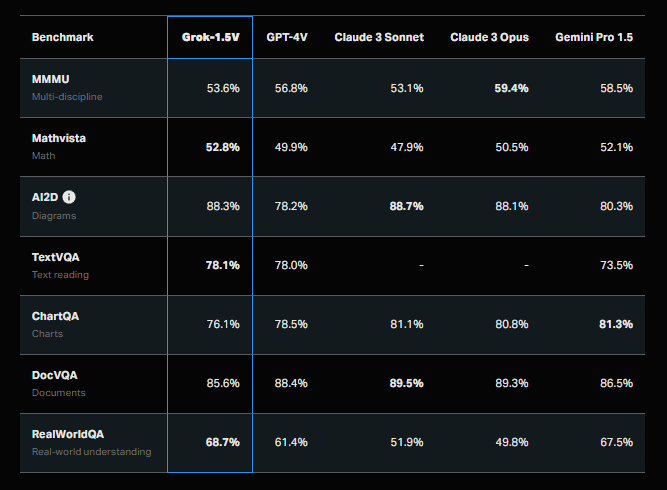

Grok and other Multimodal Models. Source: xAI

Musk’s ambition is way far beyond. It was reported that he is planning to integrate over 100,000 Nvidia H100 chips (which would be around 4 times the size of the current biggest GPU cluster) into the xAI supercomputer (the gigafactory of compute), which is set to propel xAI’s research and development efforts to new heights and to train more complex AI models. According to Musk, the proposed supercomputer is set to be running by the fall of 2025.

On Thursday 13th June, Tesla.Inc shall hold its 2024 annual stockholder meeting. A few topics are expected to be discussed, namely:

- Elon Musk’s $56 billion compensation package

- Approval on moving incorporation from Delaware to Texas

- Other voting proposals including the re-election of two board members

In general, Musk’s $56 billion compensation package which was granted back in 2018, has been voided recently by the Chancery Court in Delaware, citing a lack of fairness and negotiation on the part of Tesla’s board. As a result, this has prompted Musk’s proposal to move Tesla’s incorporation to Texas, where the latter offers a more relaxed legal framework, allowing greater flexibility in structuring pay packages. Also, such a move may foster a sense of unity and strategic coherence by aligning Tesla’s legal domicile with its operational headquarters. Nevertheless, there could be legal challenges ahead, especially if the decision is viewed as being driven by Musk’s personal interests instead of the broader interests of the company and its shareholders.

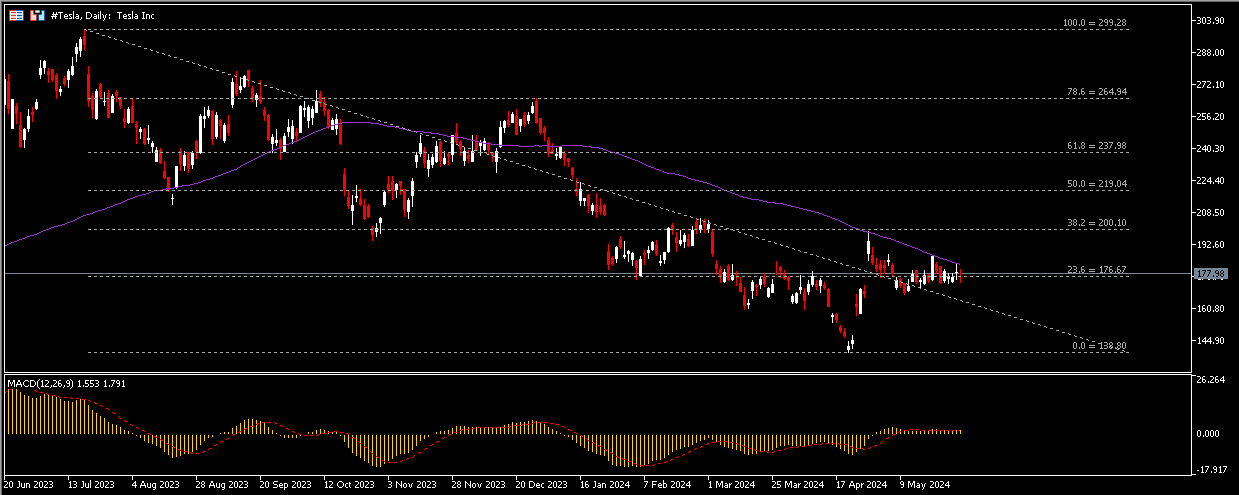

Technical Analysis:

#Tesla, Daily: The #Tesla share price remains consolidated with no clear direction, in line with the MACD indicator. The asset last closed slightly above $177 (FR 23.6% extended from the highs in July 2023 to the lows in April 2024). The 100-day SMA serves as the nearest dynamic resistance, followed by $200 (FR 38.2%) and $219 (FR 50.0%). On the other hand, $160.50 serves as minor support. A break below this level may suggest bearish continuation, towards the next target at the lows seen in April this year at $138.80.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.