- US inflation fell to 3.3%, down from 3.4% and lower than most expectations.

- The NASDAQ trades 1.09% higher than the day’s open price and is now trading at an all-time high. The index has added 17.30% in 2024 so far.

- 88% of the NASDAQ components are trading higher after the latest inflation release as investors increase exposure to riskier assets.

- The US Dollar Index declines and is the day’s worst performing currency due to a more certain rate cut in September 2024.

USA100 – The NASDAQ Reaches New All-Time High After Low Inflation Reading!

The NASDAQ forms a 0.68% bullish price gap in the seconds after the US inflation data’s release. The bullish price movements are again triggering indications of upward price movement and a higher possibility of a rate cut. Why is inflation indicating lower rates?

On a monthly basis, price did not increase in value for the first time since November 2023 which brought inflation down to 3.3%. The inflation rate continues to remain higher than expectations but indicates a higher possibility of the rate falling in the next 2-3 months. Another positive factor is the Core Consumer Price Index which was also lower than expectations (0.02%). The Core Inflation Rate for the US is at 3.4%, the lowest seen since COVID-19 and the Ukraine-Russia conflict.

The inflation data, particularly the lowest Core CPI seen in more than 3 years, could potentially prompt the Federal Reserve to take a softer stance. As a result, consumer demand is likely to be protected and shares become more attractive for larger institutions. The best performing stock for the NASDAQ is Broadcom, which rose more than 2.50% before market open.

Investors will now turn their attention to the Federal Reserve’s Press Conference this afternoon. Investors will be keen to hear a more dovish tone from the Federal Reserve and comments on a potential cut in September 2024 or at least by the end of the year. If the press conference provides further clarity on this, stocks and the NASDAQ are again likely to gain.

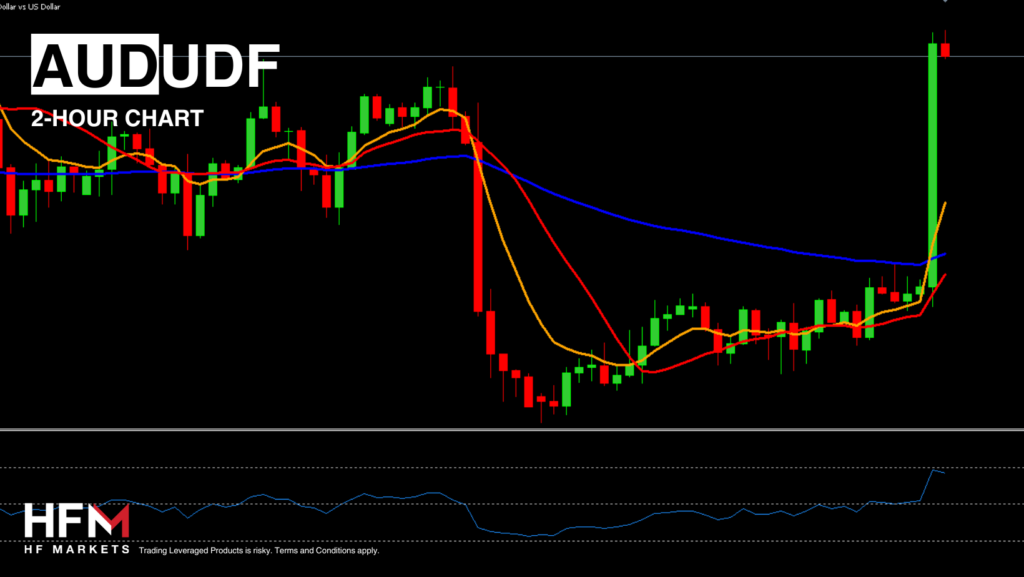

AUDUSD – Exchange Rate Rises 1.34%!

The day’s best performing currency is the Australian Dollar, hence the benefit of the AUDUSD while the US Dollar Index fell more than 0.80%. The decline is due to the higher chances of lower rates and also the higher risk appetite. Technical analysis also indicates potential downward price movement.

The AUDUSD now trades above the 75-bar EMA as well as other sentiment indications. On smaller timeframes, the exchange rate is also forming bullish crossovers and higher impulse waves. However, the only concern for investors is the price reaching the previous resistance point which has triggered a collapse on 5 occasions over the past 2 months. However, according to analysts, the price now has a driver to attempt a breakout.

For the Australian Dollar investors also need to note drivers from Australia. On Thursday, key data on the employment sector for May will be published. For the first time since the beginning of the year, analysts expect a decrease in the unemployment rate from 4.1% to 4.0% due to an increase in the full employment level by 30,000.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.