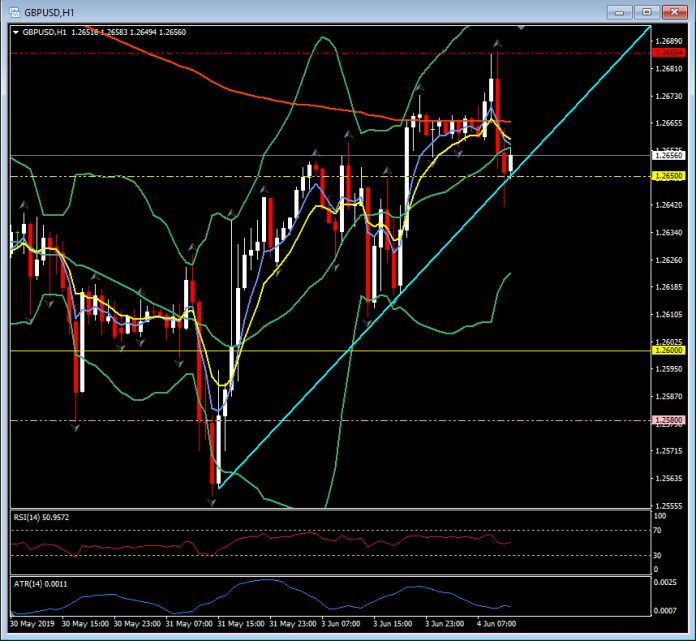

GBPUSD, H1 & Daily

UK May construction PMI came in much weaker than expected with a headline reading of 48.6, dropping sharply from April’s 50.5. The median expectation had been for an unchanged 50.5 outcome. The indicator is at 48.6, the weakest since snow-disrupted conditions of March 2018. The construction PMI has been at sub-50.0 readings, indicating contraction in the sector, in three of the past four months. The details of the report showed the biggest drop in construction employment since November 2012. Weakness in civil engineering and commercial activity more than offset a modest rise in house building. New orders were weak while input price inflation eased to its lowest since June 2016. As in the PMI survey for manufacturing, released yesterday, Brexit-related political uncertainty was blamed by respondents for at least some of the downturn in activity and new orders. With both the construction and manufacturing PMI reports having disappointed, focus will turn to tomorrow’s release of the May services PMI survey. Sterling has been little impacted by the release today, which despite wrong-footing the consensus of economists, was not much of a surprise to Brexit-wary and weary market participants.

Cable has been in a stronger down trend, for 18 trading days, since breaching the key 20, 50 and 200-day moving averages on May 8th at 1.3000. Some support formed on Thursday (30th) and Friday (31st) as end of month profit-taking ensued and buyers appeared as the pair touched 1.2580. Despite rising for two consecutive days for the first time since April 30-May 1, given the risk of a disorderly no-deal Brexit scenario, the odds for which have increased following the resignation announcement of Prime Minister May and the success of the Brexit Party at the recent European Parliament elections, the Pound is likely to remain in the column of underperforming currencies for some while yet, especially in the context of a broader risk-off theme in global markets.

Today, Sterling took a turn lower since the London open, with Cable running into good selling interest after earlier reaching a one-week high at 1.2686 in pre-Europe trading. The pair dropped back to 1.2650 support following the poor construction PMI data.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.