FX News Today

- Stock markets traded mixed in Asia, with Chinese markets underperforming, ahead of key US jobs data today.

- Hopes that Mexico tariffs may be postponed helped Wall Street to close higher, but Vice President Pence said the US still plans to impose tariffs on Mexico next week ahead of further talks today.

- China’s central bank head sounded relaxed on the Yuan, but stressed that the PBOC still had lots of policy room if the trade war worsens.

- CSI and Shanghai Comp still lost -0.9% and -1.2% respectively and the tech heavy Shenzen Comp fell back more than 2% as Facebook announced that it will no longer preinstall its app on Huawei phones, spelling more trouble for the beleaguered tech company.

- US Stock futures around 0.1% higher and the WTI future continued to climb up from the lows seen in the wake of EIA data Wednesday and is now trading at $53.28 per barrel.

- Ahead of EU open, German trade surplus narrowed as exports slumped, while German industrial production corrected -1.9% m/m in April.

- European stock futures are moving higher, led by a 0.6% rise in the DAX futures, which also ignored the weak April numbers

Charts of the Day

Technician’s Corner

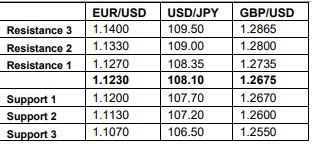

- EURUSD – has been consolidating in a narrow range in the mid 1.1200s, consolidating the steep losses from 1.1306 that were seen during the London PM/NY morning session yesterday. It is expected that the Dollar would likely hold up better than the Euro in the scenario that further sustained bouts of risk aversion is seen in global markets in the months ahead, with US Treasuries offering the highest risk-free return around, regardless of prevailing market discounting of Fed rate cuts. The pair remains in a bear trend which has been evolving since early 2018. This was reaffirmed by the new two-year low that was printed last month at 1.1107. Resistance comes in at 1.1300-06 and 1.1323-25.

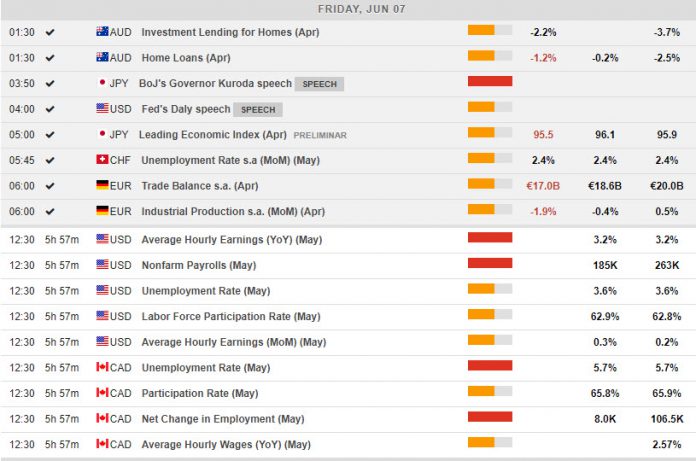

Main Macro Events Today

- Event of the Week – Non-Farm Payrolls (USD, GMT 12:30) – Along with Thursday’s employment data, payrolls are important in gauging how many people are employed in non-agricultural businesses. Jobs are expected to have increased in May, at 190k following a 263k increase in April. The unemployment rate should remain steady at 3.6% from April, while average hourly earnings should rise 0.3% m/m, for a y/y gain of 3.2%.

- Employment and Unemployment (CAD, GMT 12:30) – After the 106.5k surge in April employment, which notched a new all-time record 1-month gain, the Canadian unemployment rate is expected to have increased further in May.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leverage Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.