Nike, Inc., an American multinational corporation founded in 1964 which specializes in the design, development, marketing and sale of athletic footwear, apparel, accessories, equipment and services, shall release its earnings report for fiscal quarter ending August 2024 on 1st October (Tuesday), after market close.

According to Statista, Nike is ranked second (after Louis Vuitton) among the top 50 athletic apparel companies in terms of brand value, at 29.87B. As of the latest data recorded, the company’s retail stores has ended its five years consecutive drop, to 1045. There are a total of 377 stores in the U.S., while non-U.S. retail stores amounted to 668.

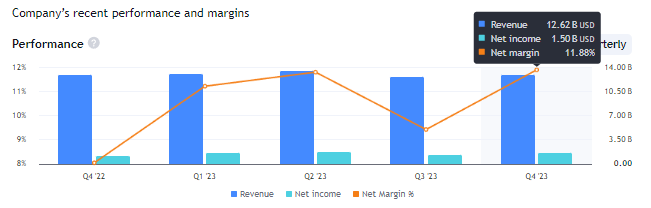

Nike: Revenue, Net Income and Net Margin. Source: TradingView

In the previous quarter, Nike.Inc reported sales revenue at $12.62B, up slightly over 1% from the previous quarter, but down -1.5% from the same period last year. Full year revenue was reported at $51.39B, up $0.2B from the previous year.

By segment, NIKE Brand reported sales revenue down -1% (y/y), to $12.1B; Wholesale revenues up 5% (y/y) to $7.1B; NIKE Direct revenues down -8% (y/y) to $5.1B; Converse was negatively impacted the most, with sales revenue reported at $480 million, down -18% from prior year period.

The company also reported an improvement in gross margin by 110 b.p. to 44.7%, boosted by strategic pricing actions, lower ocean freight rates and logistics costs, as well as lower warehousing, but partially offset by lower margin in NIKE Direct and unfavourable changes in net forex rate.

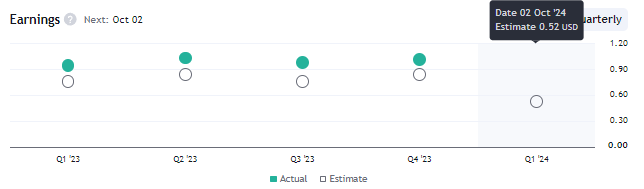

Nike: EPS. Source: TradingView

Despite being the world’s leading athletic apparel company, prospects for Nike Inc. remain gloomy and uncertain. In addition to poor management and dreadful execution, the company has been undergoing intensive competitive pressure, which has led to the company losing a fraction of its market share to several fast-growing rivals. Consequently, we can see that revenue growth for the company remains flat. Moreover, dragged by concerning financial problems, dividend was raised by only 8.8% in FY 2023, as compared to an annualized 12% in its shareholder distribution over the decade.

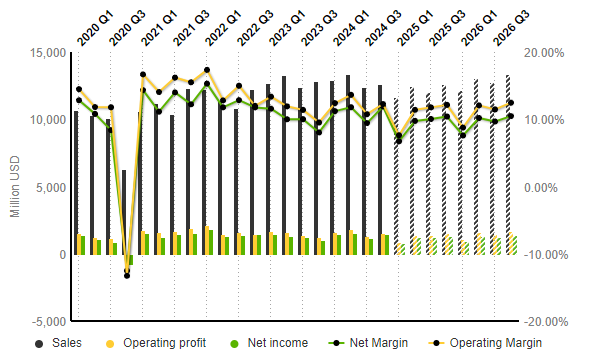

Nike: Income Statement Evolution (Quarterly Data). Source: Market Screener

According to projections by S&P Global Market Intelligence, sales revenue is expected to reach $11.6B in the coming quarter, down -7.6% from the previous quarter, and down -10% from the same period last year. Operating profits are projected to hit $887 million, while net income is also expected to fall towards $783 million, both were $1.5B in the previous quarter. Operating margin is expected to edge lower towards 7.62%, previously 12.26%; Net margin, on the other hand, is expected to be down towards 6.72%, previously 11.90%.

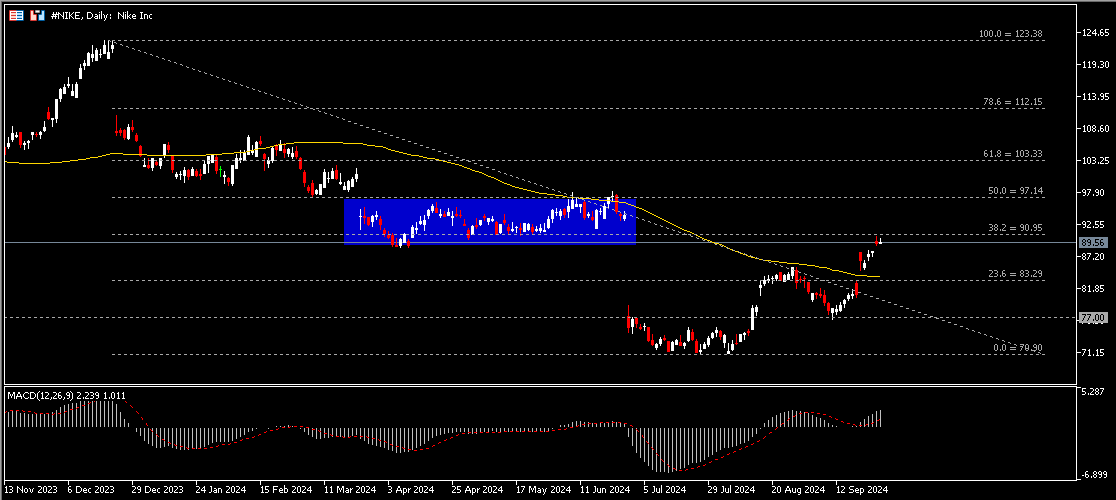

Technical Analysis:

#NIKE, Daily: The company share price last closed slightly below resistance $91 (FR 38.2% extended from the highs in December 2023 to the lows in July 2024). The asset hit its YTD low in July this year as a result of weak sales forecasts, falling digital revenue as well as inventory issues. As the asset regained its footing and rebounded throughout the third quarter, it has almost recovered its prior losses. A break above the said resistance shall lead the bulls to continue testing $97 (FR 50.0%), followed by $103 (FR 61.8%). Otherwise, a price retrace shall lead focus onto the nearest support $83 (FR 23.6%), a level that intersects with 100-day SMA. The next support lies at $77.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.