- The UK Chancellor looks to change Fiscal Policy in order to allow the UK to borrow 70 million GBP more.

- The IMF increases its forecast for the UK economy to recover this year from 0.7% to 1.1%. UK PMI data underachieved on Thursday.

- The NASDAQ increases 0.55% as Tesla’s latest earnings data increase shareholder sentiment.

- The US Dollar Index retraces after increasing in value for 4 consecutive weeks.

GBPUSD – UK To Change Fiscal Policy To Increase Debt Levels!

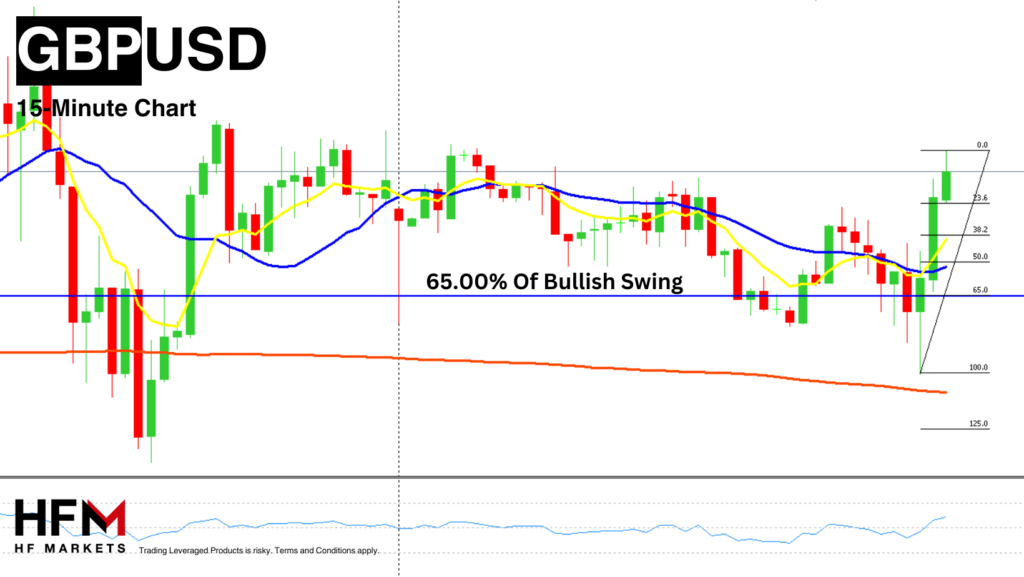

The GBPUSD exchange rate trades slightly lower during this morning’s asian session but looks to be regaining momentum. In addition to this, the GBPUSD continues to remain below most Moving Averages despite the upward price movement on Thursday. The downward price movement on Thursday was largely due to a decline in the US Dollar and not necessarily the Pound strengthening. For this week, the British Pound has fallen 0.65% against the currency market and traders will closely watch the Pound’s reaction to the UK’s Autumn budget.

The US Dollar is the best performing currency of the past 7 days and is the best performing of the day so far. The US Dollar continues to be supported by significant economic data. This includes the Weekly Unemployment Claims which fell to 227,000, New Home Sales rising to 738,000 and Flash PMI data reading slightly higher than previous expectations.

The Beige Book made public yesterday indicates that economic activity remained steady in September 2024. However, companies reported a modest uptick in hiring, a general easing of inflation pressures, and input costs rising faster than sales prices, which impacted business profitability. Lastly, the Federal Reserve continues to support the US Dollar as the market predicts a 0.25% rate cut.

The Bank of England on the other hand are likely to cut interest rates at the next meeting but it is not clear whether the BoE will cut 0.25% or 0.50%. Meanwhile, investors are watching the Autumn budget set for October 30th with a close eye. The UK Chancellor is looking to change Fiscal Policy in order to allow the UK to borrow 70 million GBP more. This could be a challenge and if global investors are not comfortable with the risk, this could pressure the Pound. This is something also previously seen under the Truss administration, but economists do not expect such a sharp nosedive. Lastly, yesterday’s UK PMI data for both the Services and Manufacturing sectors fell lower than the previous month and lower than current expectations.

However, if the price of the GBPUSD continues to decline, where does technical analysis point to a trigger point? As the price retraces back to the previous swing high, traders will look for the price to regain momentum before speculating a decline. The latest bullish swing measures 0.14%. Therefore if the price falls below 1.29618, investors will consider the momentum an opportunity. This will also push the price back below the 200-bar SMA on the 5-Minute Chart.

Click here to access our Webinar Schedule

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.