- The NASDAQ reaches a 15-week high as JOLTS points to some weakness and Alphabet earnings are remarkably higher than expectations.

- Alphabet stocks rise 7.50% as earnings per share beat expectations by 14% and revenue by 2.00%.

- JOLTS Job Vacancies fall to the lowest level since early 2021. Shareholders were relieved to see some weakness after a streak of positive data.

- The market remains on tenterhooks as Microsoft and Meta release their quarterly earnings report today after market close.

NASDAQ – Weak Employment Data and Earnings Send The NASDAQ Close To Its All-Time High!

On Tuesday the NASDAQ rose 0.98% for 3 main reasons. The first is the general sentiment towards the stock market which has been on the rise and continues. The second is the JOLTS Job Openings which was made public in the afternoon. Typically, weak data can reduce risk appetite and pressure stocks; however, after a run of positive economic reports, investors were glad to see some negative figures. This negative data allows more pressure on the Federal Reserve to consider adjusting the Federal Fund Rate by 0.50% by the end of 2024, not only 0.25%. However, negative economic data can pressure the NASDAQ if it becomes a recurring trend.

The third reason is the one which is currently building the most momentum. Alphabet’s earnings per share beat expectations by 14.00% and the third quarter revenue by 2.00%. The company also saw its earnings per share rise from $1.89 in the second quarter to $2.12 in the third. Another positive factor is that Alphabet’s Cloud products skyrocketed 35.00% and got a significant boost from AI. Shareholders were keen to see that Alphabet is successfully able to monetize its AI products.

JOLTS Job Openings fell from 7.86 million to 7.44 million and the CB Consumer Confidence rose to 108.7, its highest level since January 2024. Both releases have had a positive impact on the NASDAQ and the stock market in general. This morning the VIX Index trades 0.85% lower and US Bond yields fall close to a 2-day low. Both these elements are known to have a positive effect on the NASDAQ. According to the CME FedWatch Tool, there is currently a 74% chance that the Federal Reserve will cut 0.50% by the end of the year.

The only negative factor of the day is the Advanced Micro Devices quarterly earnings report which did beat expectations but did not provide greater confidence regarding AI and the upcoming quarter. As a result, the stock fell more than 7.00% after the market closed. Due to this the stock has lost gains from the past 5 days. AMD is the 12th most influential company for the NASDAQ. Of the NASDAQ’s most influential stocks, 75% rose in value on Tuesday. The biggest gain during the US session came from Broadcom (+4.20%) and the largest decline was PepsiCo (-1.38%).

The NASDAQ On Wednesday 30th

Now investors will partially be looking towards the quarterly earnings reports from Microsoft and Meta. Both reports will be made public after the US trading session closes. Microsoft is the third most influential stock, holding a weight of 7.99% and Meta is the fifth holding a weight of 5.00%. Microsoft rose by 1.26% on Tuesday and a further 1.18% during this morning’s pre-open hours. Meta rose 2.62% on Tuesday and a further 2.30% thereafter. The increase in the stock price indicates that investors are expecting a positive earnings report similar to that of Alphabet. If earnings and revenue do beat expectations, the higher stock price can support the NASDAQ considerably.

Aside from the above quarterly earnings report, investors will also closely watch the US Gross Domestic Product and the ADP Non-Farm Employment Change. Analysts expect GDP to remain at 3.00% and the ADP Employment Change to fall to 110,000.

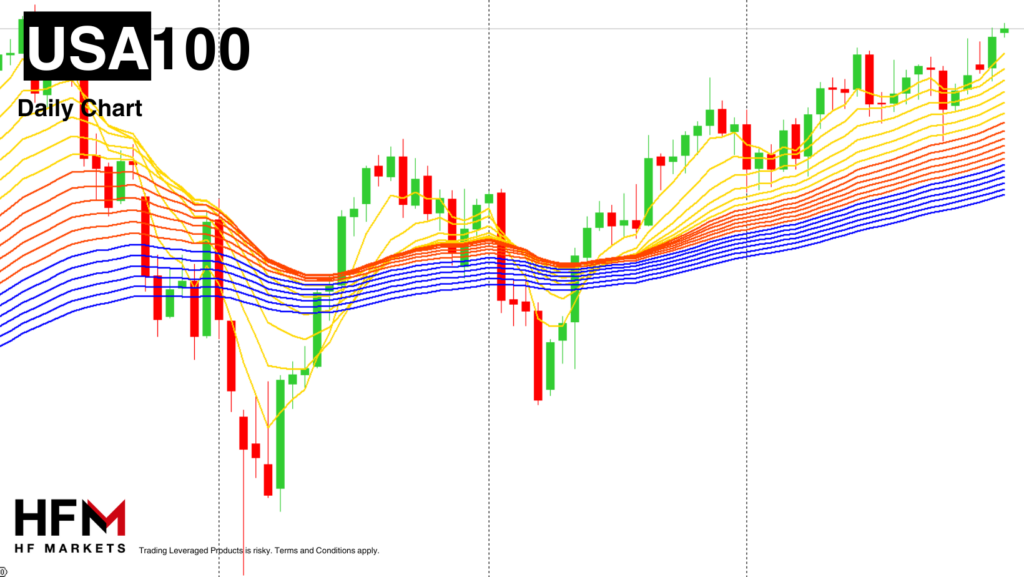

NASDAQ – Technical Analysis

Currently, the price is trading above the trend-line, major Moving Averages and above the VWAP. In addition to this, the NASDAQ is trading above the neutral level on the RSI and the Stochastic Oscillator. Due to the above indications, technical analysis currently paints a bullish bias. A price above $20,646.06 is likely to maintain an active buy signal. However, even with a retracement or correction, if news remains positive shareholders may buy at the lower price. Furthermore, investors should be cautious at the resistance level at $20,788.80 which is currently 0.80% higher than the current price.

Click here to access our Webinar Schedule

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.