- Risk appetite rises as Donald Trump leads in the US election. All US indices increase more than 1% on Wednesday.

- Trump won 267 electoral votes after winning the key swing state Pennsylvania. Harris won 214 electoral votes.

- The US Dollar Index increases to an 18-week high as investors price in a Trump presidency and a less dovish Federal Reserve.

- The VIX falls more than 12.50% indicating a significant rise in risk appetite. Risk-based instruments including Bitcoin rise significantly. Bitcoin reaches all-time high!

- The SNP500 increases to an all-time high!

NASDAQ – All US Stocks Surge As The Global Risk Appetite Rises!

The NASDAQ jumps 1.72% on Wednesday as Presidential candidate Trump is only 3 electoral votes from officially being named president elect. As the price soars, the NASDAQ is now close to fully correcting last week’s 2-day decline. In addition to this, the NASDAQ is now less than 1.00% away from an all-time high.

Currently, of the NASDAQ 100 components, 85% have risen in value this morning and all of the top 15 most influential stocks are trading higher. In addition to this, the VIX index has fallen more than 12.50% indicating a significant rise in risk appetite. Both the performance of the components and the VIX index indicate that large institutions are increasing exposure to the US stock market. However, analysts have previously advised a Trump presidency could pressure global stocks.

Analysts have also predicted that the Federal Reserve will become more cautious on upcoming interest rate cuts. This could potentially pressure the US stock market. However, regardless of this, the Federal Reserve is also certain to cut interest rates by 0.25% tomorrow and a further 0.25% in December.

In terms of technical analysis, due to the bullish momentum, most momentum and trend style indicators are pointing towards an upward trend. The price is trading significantly higher than the VWAP and cumulative delta statistics indicate that buy orders outnumber the sell orders by a large margin. Investors also should note that the NASDAQ is the only US index which is not trading at an overbought price.

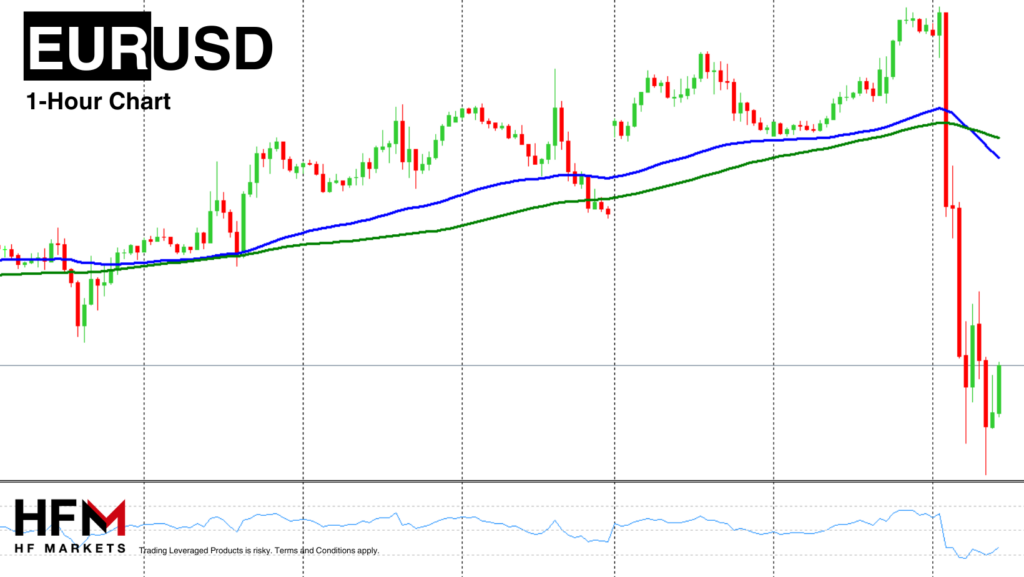

EURUSD – European Markets Fear High Trump Tariffs

As per analysts’ expectations, a Trump presidency is likely to support the US Dollar and the Federal Reserve is likely to be more cautious with hikes. The US Dollar is the best performing currency of the day by far. The US Dollar index trades 1.48% higher this morning, while the US Dollar against the global currencies is 1.59% higher.

The Euro on the other hand is the worst performing currency of the day trading 1.77% lower. This could be partially because Trump has previously had a shaky relationship with the EU over NATO, Geopolitical factors and European products being imported into the US such as European cars. Tariffs on imported goods may rise sharply, potentially prompting retaliatory actions by EU authorities and triggering a recession in the Eurozone. Additionally, a shift in the U.S. administration could hinder the European Central Bank’s (ECB) efforts to reach its inflation target. Last week, ECB President Christine Lagarde affirmed that consumer price growth is expected to reach the 2.0% target by 2025, though this will depend on the economy avoiding significant disruptions.

The US Dollar is generally responding positively to the almost certain president-elect, Donald Trump, as his party is anticipated to adopt tougher tariff policies toward China and the EU. This stance is likely to prompt the US Federal Reserve to slow down its rate-cutting process. However, during the upcoming meeting on Thursday, November 7, the Fed is still expected to adjust the interest rate by –25 basis points.

The EURUSD currently trades below the 75-Bar EMA and the 100-Bar SMA. In addition to this, the EURUSD is trading comfortably below the 50.00 level on the RSI and most oscillators. As a result, technical analysis indicates investors are increasing their exposure in the USD and away from the Euro.

Click here to access our Webinar Schedule

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.